The forex markets have entered a quieter phase in Asian session, likely influenced by the holiday season, leading to reduced market activity. This calm follows an overnight sell-off of Dollar, driven by renewed risk-on sentiment as seen in the stock markets. Despite this shift, the Dollar has not experienced further selling pressure in Asia. Market participants are now closely monitoring key upcoming economic data from US, including PCE inflation and durable goods orders. However, the likelihood of a significant or sustained move in the greenback appears limited for the time being.

Japanese Yen, which had been showing signs of recovery, is now seeing its momentum wane following release of Japan’s inflation data, which came in line with market expectations. Minutes from BoJ’s October meeting revealed a diversity of opinions among policymakers about the timing for exiting negative interest rates, with a notable emphasis on preparing market communications for such a transition. For the time being, Yen is expected to remain in a consolidation phase, with more range-bound trading likely in the near term.

GBP/CAD is a pair that’s worth some attention today, given releases of UK retail sales and Canadian GDP data. Technically, fall from 1.7270 short term top is seen as the third leg of the consolidation pattern from 1.7332. Deeper decline is expected as long as 1.7051 minor resistance holds, to 61.8% retracement of 1.6335 to 1.7270 at 1.6705 and below. But stronger support should emerge at around 1.6355 to complete the decline.

In Asia, at the time of writing, Nikkei is up 0.11%. Hong Kong HSI is down -1.27%. China Shanghai SSE is up 0.17%. Singapore Strait Times is up 1.01%. Japan 10-year JGB yield is up 0.0361 at 0.628. Overnight, DOW rose 0.87%. S&P 500 rose 1.03%. NASDAQ rose 1.26%. 10-year yield rose 0.017 to 3.894.

Japan’s CPI core slows to 2.5% yoy, but services inflation hit three-decade high

Japan’s core CPI, which excludes fresh food, decreased from 2.9% yoy to 2.5% yoy in November, marking the lowest level since July 2022. Despite this deceleration, inflation remains above BoJ’s target of 2% for the twentieth consecutive month, indicating persistent inflationary pressures.

All-items CPI also experienced a slowdown, dropping from 3.3% yoy to 2.8% yoy. Additionally, core-core CPI, which excludes both fresh food and energy, showed a slight decrease from 4.0% yoy to 3.8% yoy.

Notably, goods inflation saw a significant reduction, declining from 4.4% yoy to 3.3% yoy. In contrast, service inflation showed an acceleration, rising from 2.1% yoy to 2.3% yoy. This increase in service inflation is the sharpest in three decades, dating back to October 1993, if the effects of past consumption tax hikes are excluded.

Energy prices, a key factor in inflation calculations, dropped by -10.1% yoy. Japanese government’s subsidies to reduce fuel costs played a role in tempering inflation rates. Without these subsidies, core CPI would have seen an increase of around 3%, according to the ministry.

Looking ahead

UK retail sales and Q3 GDP final are the main features in European session. Later in the data, Canada GDP is a focus. Also, US will release personal income and spending with PCE inflation, as well as durable goods orders.

EUR/USD Daily Outlook

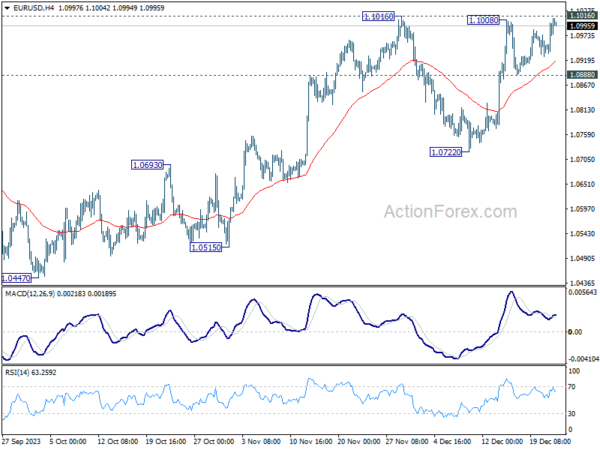

Daily Pivots: (S1) 1.0960; (P) 1.0986; (R1) 1.1038; More…

EUR/USD breached 1.1008 but stays below 1.1016 resistance. Intraday bias remains neutral for the moment. On the upside, decisive break of 1.1016 will resume the whole rise from 1.0447 to retest 1.1274 high. However, break of 1.0888 support will turn bias to the downside, to extend the pattern from 1.1016 with another falling leg.

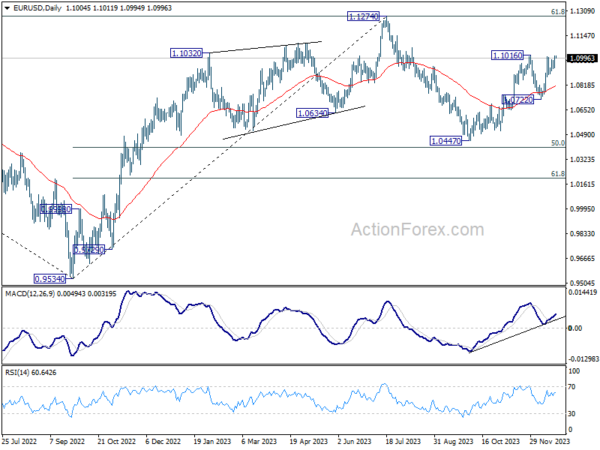

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0722 support will argue that the third leg has already started for 1.0447 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | National CPI Y/Y Nov | 2.80% | 3.30% | ||

| 23:30 | JPY | National CPI ex Fresh Food Y/Y Nov | 2.50% | 2.50% | 2.90% | |

| 23:30 | JPY | National CPI ex Food & Energy Y/Y Nov | 3.80% | 4.00% | ||

| 23:50 | JPY | BoJ Minutes | ||||

| 07:00 | GBP | Retail Sales M/M Nov | 0.40% | -0.30% | ||

| 07:00 | GBP | GDP Q/Q Q3 F | 0.00% | 0.00% | ||

| 07:00 | GBP | Current Account (GBP) Q3 | -13.1B | -25.3B | ||

| 13:30 | CAD | GDP M/M Oct | 0.20% | 0.10% | ||

| 13:30 | USD | Personal Income M/M Nov | 0.40% | 0.20% | ||

| 13:30 | USD | Personal Spending Nov | 0.30% | 0.20% | ||

| 13:30 | USD | PCE Price Index M/M Nov | 0.10% | 0.00% | ||

| 13:30 | USD | PCE Price Index Y/Y Nov | 2.90% | 3.00% | ||

| 13:30 | USD | Core PCE Price Index M/M Nov | 0.20% | 0.20% | ||

| 13:30 | USD | Core PCE Price Index Y/Y Nov | 3.40% | 3.50% | ||

| 13:30 | USD | Durable Goods Orders Nov | 2.70% | -5.40% | ||

| 13:30 | USD | Durable Goods Orders ex Transport Nov | 0.20% | 0.00% | ||

| 15:00 | USD | Michigan Consumer Sentiment Index Dec F | 69.4 | 69.4 | ||

| 15:00 | USD | New Home Sales Nov | 0.690M | 0.679M |