Robust risk-on sentiment was seen in the US markets overnight, with DOW extending its record-breaking run. S&P 500 is also approaching its historical peak, now just 50 points shy, and appears poised to challenge this high. The bullish momentum is underpinned by messages from Fed officials, suggesting that while an immediate rate cut is not anticipated, policy easing should be on the horizon for the second half of next year. This scenario hinges on the continued cooling of inflation as a trend as per current expectations.

In Asia, market responses are more varied. Nikkei in Japan is having over 1.5% rise, largely benefiting from BoJ’s continued dovish stance, which also drags down 10-year JGB yield notably. However, this positive sentiment is not uniformly reflected across all Asian markets. Hong Kong stocks are seeing a rebound, while markets in China and Singapore are showing signs of weakness.

In the currency markets, New Zealand Dollar and the Australian Dollar are leading as the strongest currencies for the week, with Swiss Franc also showing strength. In contrast, Japanese Yen is the weakest performer, followed by Dollar and Canadian. Euro and British Sterling are positioned in the middle, with mixed performances. Sterling’s next move, particularly against Euro and Swiss Franc, is likely to be influenced by today’s UK CPI data.

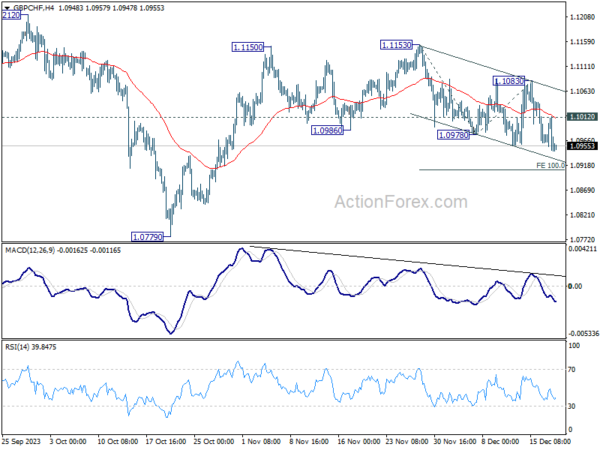

Technically, GBP/CHF’s fall from 1.1153 is in still in progress. This decline is currently seen as a corrective move. Thus, downside should be contained by 100% projection of 1.1153 to 1.0978 from 1.1083 at 1.0910 to bring rebound. Break of 1.1012 minor resistance will bring stronger rise to 1.1083. However, decisive break of 1.0910 will argue that whole rise from 1.0779 has already completed and bring retest of this low instead.

In Asia, at the time of writing, Nikkei is up 1.60%. Hong Kong HSI is up 1.10%. China Shanghai SSE is down -0.42%. Singapore Strait Times is down -0.02%. Japan 10-year JGB yield is down -0.0745. Overnight, DOW rose 0.68%. S&P 500 rose 0.59%. NASDAQ rose 0.66%. 10-year yield fell -0.032 to 3.922.

Fed’s Bostic: No rush to cut rates, eyes second half of 2024 for easing

Atlanta Fed President Raphael Bostic emphasized a lack of urgency in cutting interest rates, projecting potential rate reductions only in the second half of 2024.

In an event overnight, Bostic expressed his view that inflation is likely to decrease gradually over the next six months. This outlook underpins his stance that there is no immediate need to deviate from the current restrictive monetary policy.

“For me, I’m thinking inflation is going to come down relatively slowly in the next six months, which means there’s not going to be urgency for us to pull off our restrictive stance,” he stated.

Bostic anticipates that Fed might implement two rate cuts in the latter half of 2024. However, he clarified, “It is not like there has been an active discussion on this.”

Highlighting the prevailing economic uncertainties, Bostic advocated for a “cautious but resolute” approach. This strategy involves a resistance to reacting hastily to individual data points and instead focuses on making sure “the trends are really trends.”

Fed’s Barkin seeks consistency and breath in disinflation for policy decisions

Richmond Fed President Thomas Barkin, in an interview with Yahoo Finance, acknowledged that the Fed is making “good progress” in its efforts to bring down inflation.

However, he pointed out that the economic data has been somewhat erratic, emphasizing his desire for “consistency” and “breadth” in the inflation metrics. He explained that he is looking for “consistency around our target and a broad-based disinflationary set of results.”

On the topic of interest rate cuts, Barkin’s stance was cautious and data-dependent. He suggested that a response from Fed would be appropriate if inflation trends downwards as hoped. However, he stressed the unpredictability of economic data

“If you’re going to assume that inflation comes down nicely, then, of course, we’d respond appropriately. You know, I don’t assume what the data is going to do. We’ll see what happens,” he said.

Fed’s Goolsbee cautions against market euphoria on rate cuts

Chicago Fed President Austan Goolsbee, in an interview with Fox News overnight, said that investors might be “a little ahead of themselves” with their “euphoria” as stock markets surged to record highs following Fed’s announcement last week.

Goolsbee did acknowledge that if inflation continues its downward trend towards target, Fed might reassess its restrictive stance. “If inflation continues to come down to target, then the Fed can reconsider how restrictive it wants to be,” he stated.

However, Goolsbee was clear in emphasizing Fed’s independence, asserting that the central bank will not be “bullied” by market pressures.

Japan’s divergent export trend: 26 months of US growth, 12 months of China decline

Japan’s trade statistics for November were marked by a slight decline in exports and a more significant drop in imports. Exports fell marginally by -0.2% yoy, totaling JPY 8829B, marking the first drop in three months.

A closer look at export destinations shows contrasting trends. Exports to US continued to grow, marking a 5.3% increase and extending the expansion streak to 26 months. In contrast, exports to China fell by -2.2%, continuing a downward trend for the 12th consecutive month. One of the most notable declines was in food shipments, which plummeted by -60.3%, significantly impacted by China’s ban on Japanese seafood imports.

On the import side, Japan saw a more pronounced decline of -11.9% yoy, with total imports amounting to JPY 9597B. This reduction in imports contributed to a trade deficit of JPY -777B for the month.

When adjusted for seasonal variations, exports dropped by -1.8% mom to JPY 8567B, and imports decreased by -2.7% mom to JPY 8976B. Consequently, trade deficit narrowed from JPY -501B to JPY -409B.

Australia’s Westpac leading index climbs to 0.3%, signaling stabilization, not an upturn

Westpac Leading Index in Australia showed an encouraging rise from -0.39% to 0.30% in November, marking the first positive, above-trend reading since mid-2022. However, Westpac cautioned that this uptick might be influenced by temporary factors. Also, the shift in underlying momentum, as RBA’s tightening begins to slow, is seen more as a stabilization rather than the start of an upturn.

Further, Westpac highlighted weaker conditions in the domestic sphere, particularly impacting the household sector. This weakness is expected to continue into the first half of next year. Hence, Westpac anticipates that barring a “truly disastrous” December quarter CPI update, RBA is likely to maintain its current policy in the upcoming February meeting.

RBNZ’s Orr highlights struggle with core inflation and migration impact

RBNZ Governor Adrian Orr, in his address to a parliament select committee today, emphasized there is “still a long way to go” to curb inflation. He added, “it’s core inflation that’s going to be our challenge ahead”.

Orr also noted the complexity of this challenge, pointing out that much of the core inflation factors are entrenched within central and local government influences, including rates and taxes. He cautioned that tackling these elements in the “last five yards on the inflation battle is going to be tough.”

Adding to the economic challenges, Orr highlighted the current record-high levels of net inward migration in New Zealand. This surge in migration has surpassed RBNZ’s expectations and presents additional complexities for monetary policy, housing demand, asset prices, and the general inflation outlook.

Regarding the country’s economic growth, Orr mentioned that GDP was “surprisingly subdued,” with a contraction of -0.3% in Q3. He indicated that RBNZ is internalizing this complex situation and will provide more detailed insights in their monetary policy statement due in February.

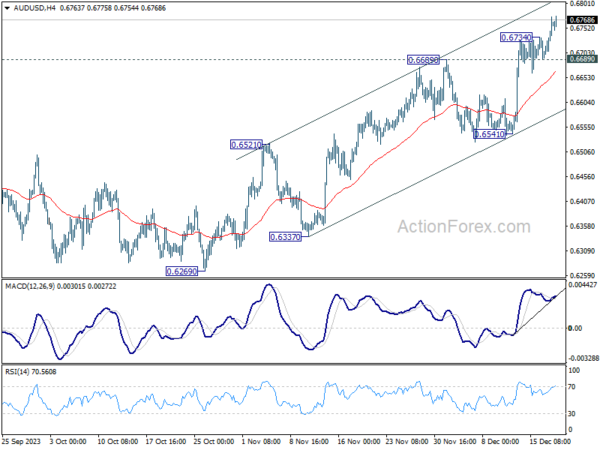

AUD/USD Daily Report

Daily Pivots: (S1) 0.6718; (P) 0.6746; (R1) 0.6792; More…

AUD/USD’s rally resumed after brief retreat and intraday bias is back on the upside. As noted before, fall from 0.7156 could have completed with three waves down to 0.6269. Further rise should be seen to 0.6894 resistance first. Sustained break there will target 0.7156 next. On the downside, below 0.6689 minor support will turn intraday bias neutral for consolidations again. But outlook will remain mildly bullish as long as 0.6541 support holds, in case of retreat.

In the bigger picture, there is no confirmation that down trend from 0.8006 (2021 high) has completed. Price actions from 0.6169 (2022 low) could be just a medium term corrective pattern. Rise from 0.6269 is seen as the third leg of the pattern. For now, range trading should be seen between 0.6169 and 0.7156 (2023 high), until further developments.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Trade Balance (JPY) Nov | -0.41T | -0.75T | -0.46T | -0.50T |

| 00:00 | AUD | Westpac Leading Index M/M Nov | 0.10% | 0.00% | ||

| 07:00 | EUR | Germany Gfk Consumer Climate Jan | -27 | -27.8 | ||

| 07:00 | EUR | Germany PPI M/M Nov | -0.40% | -0.10% | ||

| 07:00 | EUR | Germany PPI Y/Y Nov | -7.50% | -11% | ||

| 07:00 | GBP | CPI M/M Nov | 0.20% | 0.00% | ||

| 07:00 | GBP | CPI Y/Y Nov | 4.30% | 4.60% | ||

| 07:00 | GBP | Core CPI Y/Y Nov | 5.50% | 5.70% | ||

| 07:00 | GBP | RPI M/M Nov | 0.30% | -0.20% | ||

| 07:00 | GBP | RPI Y/Y Nov | 5.80% | 6.10% | ||

| 07:00 | GBP | PPI Input M/M Nov | -0.60% | 0.40% | ||

| 07:00 | GBP | PPI Input Y/Y Nov | -3.30% | -2.60% | ||

| 07:00 | GBP | PPI Output M/M Nov | -0.10% | 0.10% | ||

| 07:00 | GBP | PPI Output Y/Y Nov | -0.50% | -0.60% | ||

| 07:00 | GBP | PPI Core Output M/M Nov | 0.10% | |||

| 07:00 | GBP | PPI Core Output Y/Y Nov | 0.20% | |||

| 09:00 | EUR | Eurozone Current Account (EUR) Oct | 27.0B | 31.2B | ||

| 13:30 | USD | Current Account (USD) Q3 | -197B | -212B | ||

| 15:00 | USD | Existing Home Sales Nov | 3.78M | 3.79M | ||

| 15:00 | USD | Consumer Confidence Dec | 103.9 | 102 | ||

| 15:00 | EUR | Eurozone Consumer Confidence Dec P | -16.5 | -16.9 | ||

| 15:30 | USD | Crude Oil Inventories | -4.3M | |||

| 18:30 | CAD | BoC Summary of Deliberations |