- Stellar year for US stock markets, fueled by ‘soft landing’ hopes

- Can the rally persist in 2024, despite high valuations and election uncertainty?

- European valuations are much cheaper, partly reflecting recession concerns

US stocks race higher, but tougher environment ahead

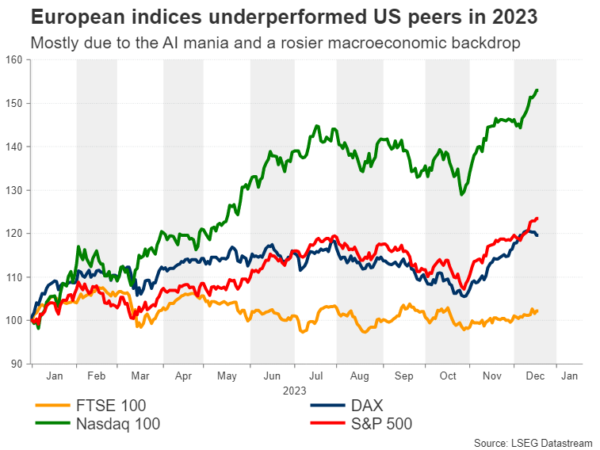

It’s been a sensational year for US equity markets. The S&P 500 has risen more than 23% while the tech-heavy Nasdaq 100 has gained a stunning 52% so far, with both indices coming within breathing distance of their record highs. Fears about a recession have melted away and investors are increasingly confident the US economy can achieve its elusive soft landing.

Bets that the Fed and other central banks will slash interest rates next year have also served as jet fuel for this rally, alongside the hype surrounding artificial intelligence and the prospect that it could usher in an era of rising productivity.

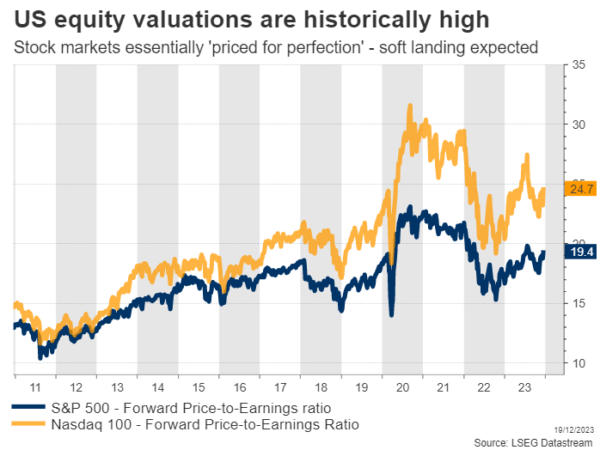

That said, there are some red flags as we head into next year. For starters, equity valuations are expensive. The S&P 500 is currently trading at over 19 times what analysts expect earnings to be over the coming year, which is a historically high valuation multiple.

Outside of the pandemic years, the last time the market traded at similar valuations was back in 2001, as the ‘dot com’ bubble was bursting. Such a high multiple would make more sense if interest rates were extremely low and investors had no real alternative to stocks, or if corporate earnings were growing at an impressive pace. Neither is the case today.

Indeed, earnings assumptions by analysts seem overly optimistic. For 2024, analysts expect S&P 500 companies to generate earnings growth of over 11%, which would be a tremendous acceleration from the 3% growth the market is on track to achieve this year. The question is whether such a profit boom is a realistic prospect, particularly as we are heading into a global economic slowdown.

Even though the US economy has been resilient, with an enormous government deficit shielding economic growth, it’s questionable whether this strength will persist. Business optimism is subdued and several retailers including Walmart have recently warned consumption is losing power, especially at lower income levels.

Looking outside the US, the situation is even worse. Europe is probably in a mild technical recession already, while China is dealing with the painful deleveraging of its housing sector. It’s difficult to square this gloomy picture with the cheerful earnings projections, considering that S&P 500 companies derive 40% of their revenue from overseas.

In other words, the soft landing narrative has been fully priced into equity markets, but it is not necessarily supported by the macroeconomic landscape. Even if the US ultimately dodges a recession, a weaker environment globally could still impact corporate earnings, preventing them from racing higher as anticipated.

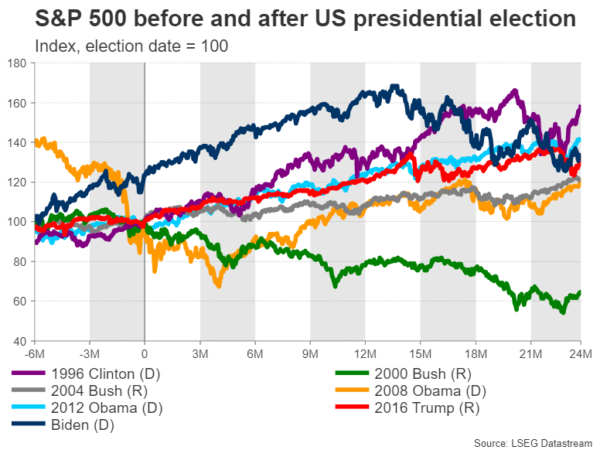

Another element is the US presidential election next year. Historically speaking, equity markets tend to underperform in election years, ahead of the vote in November. This phenomenon reflects uncertainty around the outcome, which pushes investors to hedge some of their risk exposure. That said, the market often rallies once the election has passed, almost irrespective of who wins.

Therefore, the risk-to-reward profile for US equities does not seem very attractive heading into next year. Stocks are already priced for perfection, which leaves scope for turbulence in case reality does not match the market’s rosy expectations.

Now to be clear, all this does not imply some apocalyptic crash is imminent. It simply means that the upside appears limited with valuations already stretched, especially if earnings growth undershoots.

Sluggish growth baked in European equities

The Euro area and UK have been suffering from subdued economic growth this year, leading markets to price in a higher probability of a recession.

Europe’s economic engine – Germany – is on the brink of a technical recession due to the malaise in global manufacturing and its reliance on slowing Chinese demand. Meanwhile in the UK, things are not looking great either as inflation remains elevated, fueling concerns about a period of stagflation next year.

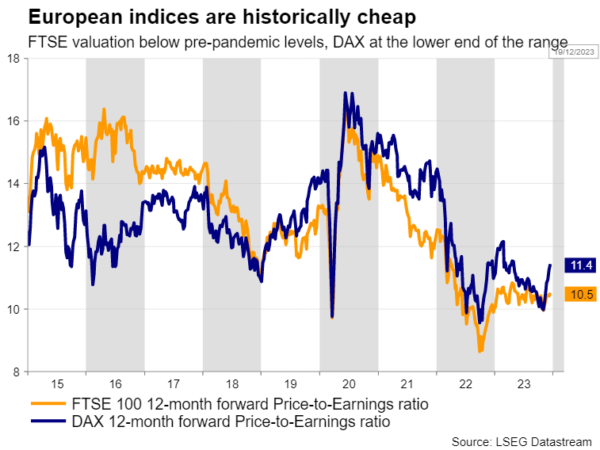

Although there are storm clouds hanging over Europe, pessimistic forecasts are already priced into European stocks. Forward earnings estimates have come down to reflect recessionary risks, at a time when a soft landing and corporate earnings accelerating is the baseline scenario in the US. Therefore, European stocks seem better positioned to weather the impact of earnings downgrades, especially if central banks fail to cut rates at the right pace, inflicting unnecessary damage on the economy.

From a chart perspective, the FTSE 100 and DAX 40 are currently trading around 5% and 2% below their all-time highs, respectively. Combining the bleak earnings forecasts with the historically high prices, someone would expect stock valuations in Europe to be inflated. Surprisingly, the leading European indices are trading at a discount both historically and against the US markets.

Even if the discount can be attributed to a more value-oriented composition, the historically low valuations are clearly limiting the downside in case of a deeper-than-expected recession. Speaking about structural differences, interest rate cuts in a growing economy could bolster the tech-heavy US equity markets, but the defensive nature of European indices could attract more interest in a severe economic downturn.

Elections are another common risk factor for these economies in 2024. In June, markets will brace for the European Parliament elections, as the next European Commission needs to implement tighter fiscal reforms after a three-year period of ultra-loose policies.

Turning to the UK general election, the Labour Party has a massive lead against the incumbent Conservative Party in opinion polls. That’s a risk for British equities, considering that Labour governments are often associated with higher taxes, especially on corporations.

In a nutshell, the future of stock markets in the Euro area lies heavily on China’s economic performance next year, while for the UK, risks mostly stem from the government’s fiscal stance. But even if the worst-case scenario strikes, European shares are in a better position to absorb any shocks compared to their US counterparts, as much of the pessimism is already baked in.