Canadian Dollar jumps against US Dollar in early US session. The move is primarily attributed to Canada’s CPI data, which came in stronger than anticipated, signaling persistent inflationary pressures. Despite this uptick, CAD is not leading the pack, as it faces stiff competition from others, including the buoyant Sterling. Pound’s significant rise can be traced back to hawkish statements made by the new deputy governor of BoE. These comments have infused upward momentum into the currency, leading to its appreciation not just against Euro and Swiss Franc as well.

Concurrently, Japanese Yen’s selloff intensified following BoJ Governor Kazuo Ueda’s post-meeting press conference, which reaffirmed the central bank’s dovish stance, and lacked any indications of a shift towards exit of ultra-loose monetary policy. Dollar finds itself as the second-worst performer, succumbing to a wave of selling pressure across various fronts. While Euro has managed to gain against the weaker Yen and Dollar, it still ranks as the third-worst performer of the day.

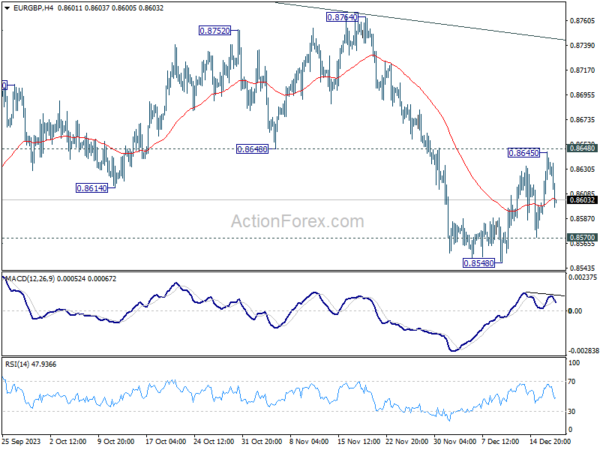

Technically, EUR/GBP’s dip today raises the chance that recovery from 0.8548 has completed at 0.8645, after rejection by 0.8648 support turned resistance. Focus is back on 0.8570 minor support. Firm break there should push EUR/GBP through 0.8548 to resume the larger down trend. UK CPI data scheduled for tomorrow could be the trigger.

In Europe, at the time of writing, FTSE is up 0.06%. DAX is up 0.44%. CAC is down -0.02%. Germany 10-year yield is down -0.063 at 2.017. UK 10-year yield is down -0.032 at 3.664. Earlier in Asia, Nikkei rose 1.41%. Hong Kong HSI fell -0.75%. China Shanghai SSE rose 0.05%. Singapore Strait Times rose 0.11%. Japan 10-year JGB yield fell -0.0353 to 0.634.

Canada CPI unchanged at 3.1% yoy in Nov, vs exp 2.9% yoy

Canada CPI was unchanged at 3.1% yoy in November, above expectation of 2.9% yoy. Higher prices for travel tours put upward pressure on CPI. Offsetting the upward pressure was slower price growth for food alongside lower prices for cellular services and fuel oil. Excluding food and energy, CPI accelerated from 3.4% yoy to 3.5% yoy.

CPI median was unchanged at 3.% yoy, above expectation of 3.3% yoy. CPI trimmed was unchanged at 3.5% yoy, above expectation of 3.4% yoy. CPI common slowed from 4.2% yoy to 3.9% yoy, below expectation of 4.0% yoy.

BoE’s Breeden focuses on inflationary persistence for future policy

BoE Deputy Governor Sarah Breeden acknowledged in a speech that the UK economy is making strides towards bringing inflation back to the BoE’s 2% target, but emphasized that “our job isn’t done.”

Breeden expressed a focused concern on the persistence of inflationary pressures, highlighting a key area of the BoE’s attention: “The question I am focused on is whether there is evidence of more persistent inflationary pressures which means we may need to tighten further.”

Emphasizing the need for a sustained restrictive monetary policy, Breeden stated, “Regardless, monetary policy still needs to be restrictive for an extended period of time to keep pushing down on inflation and to return it sustainably to target.”

Breeden also highlighted the importance of utilizing a diverse range of data sources to gauge the economy’s trajectory. She mentioned using “soft data, such as surveys, as well as real-world conversations with businesses and others,” to inform her assessment of economic trends.

Eurozone CPI finalized at 2.4%, core at 3.6%

Eurozone CPI was finalized at 2.4% yoy in November, down from October’s 2.9% yoy. CPI core (excluding energy, food, alcohol & tobacco) was finalized at 3.6% yoy , down from prior month’s 4.2% yoy. The highest contribution came from services (+1.69 percentage points, pp), followed by food, alcohol & tobacco (+1.37 pp), non-energy industrial goods (+0.75 pp) and energy (-1.41 pp).

EU CPI was finalized at 3.1% yoy, down from prior month’s 3.6% yoy. The lowest annual rates were registered in Belgium (-0.8%), Denmark (0.3%) and Italy (0.6%). The highest annual rates were recorded in Czechia (8.0%), Hungary (7.7%), Slovakia and Romania (both 6.9%). Compared with October, annual inflation fell in twenty-one Member States, remained stable in three and rose in three.

BoJ holds steady despite speculation for tweaks

BoJ decided to maintain its monetary policy unchanged, a move that has come as a disappointment to some observers who anticipated minor policy changes or at least some alterations in the statement.

Under the Yield Curve Control framework, short-term policy interest rate remains at -0.1%. BoJ has also maintains its target for the 10-year JGB yield at approximately 0%, allowing for a cap of 1% for yield fluctuations. This decision was reached unanimously.

In addition, BoJ reiterated its commitment to an easing bias, stating it “will not hesitate to take additional easing measures if necessary.”

Regarding Japan’s economic outlook, BoJ expects a moderate ongoing recovery in the near term. However, it acknowledges downward pressures, primarily due to a slowdown in the recovery pace of overseas economies. Looking ahead, the central bank projects that as a positive cycle from income to spending strengthens, Japan’s economy will continue to grow at a rate above its potential growth rate.

In terms of inflation, BoJ anticipates CPI core to remain above 2% through fiscal 2024. Underlying inflation is expected to “increase gradually toward achieving the price stability target.”

BoJ Ueda’s dovish press conference

Japanese Yen’s decline gained momentum following dovish comments by BoJ Governor Kazuo Ueda in the post-meeting press conference. Ueda reaffirmed the central bank’s readiness to take “additional easing steps if necessary,” highlighting the “extremely high” level of uncertainty surrounding the economy.

Addressing the possibility of a policy adjustment in January meeting, Ueda downplayed the likelihood of an abrupt rate hike, stating, “I don’t think the chance is high for us to say abruptly that we will hike rates at a subsequent meeting.” He also mentioned that “we won’t see much new data” to come before the meeting, except branch managers’ meeting which will provide insights into regional economies.

Ueda spoke about various policy scenarios under consideration, recognizing the high degree of uncertainty in current economic forecasts. He noted the difficulty in outlining a clear exit strategy from the ultra-loose monetary policy due to the unpredictability of achieving sustainable and stable inflation at the target level. Ueda assured that once the BoJ foresees conditions aligning with their targets, more information will be disclosed.

RBA considered hike and hold, Dec minutes show

Minutes of RBA’s December 5 meeting revealed that both a 25bps hike and maintaining the status quo were considered. Ultimately, they opted to keep the interest rate unchanged at 4.35%. The rationale behind this decision was the perceived value in “waiting for further data to assess how the balance of risks was evolving and how best to balance these risks when setting policy.”

The board members concurred that the need for additional monetary tightening to ensure inflation returns to the target within a reasonable timeframe would be contingent on how incoming data influences the economic outlook and the assessment of risks.

The RBA emphasized its commitment to closely monitoring various economic indicators in its future policy decisions. This includes developments in the global economy, trends in domestic demand, and the outlook for inflation and the labor market.

NZ ANZ business confidence improved to 33.2, with mixed inflation signals

New Zealand’s ANZ Business Confidence climbed from 30.8 to 33.2 in December. Looking into the specifics, own activity outlook improved from 26.3 to 29.3, indicating positive sentiment about future business conditions. However, investment intentions dropped from 4.5 to 2.7, suggesting some hesitancy in capital expenditures. Employment intentions rose from 5.4 to 7.0, reflecting moderately stronger inclination towards hiring.

In terms of pricing, there was a noticeable increase, with pricing intentions moving from 46.8 to 50.2. This rise implies that more businesses are planning to increase their prices, which could contribute to inflationary pressures. Similarly, cost expectations saw an upward movement from 73.9 to 76.2, indicating rising costs for businesses. On the other hand, inflation expectations showed a decline from 4.79% to 4.61%.

ANZ commented on the mixed nature of the inflation indicators, as they do not present an encouraging outlook for inflation. With more data expected before RBNZ’s February decision, this survey’s results might not be among the most favorable. While recent GDP data showed RBNZ’s measures gaining more traction than previously understood, the extent of economic downturn required to bring inflation down to the 2% target remains an unresolved question.

New Zealand’s trade deficit narrows to NZD -1.2B, led by decreased trade with china

New Zealand’s goods trade deficit narrowed from NZD 1.7B to NZD 1.2B in November, aligning largely with market expectations. Exports fell by NZD 337m, representing -5.3% yoy decline, settling at NZD 6.0B. Meanwhile, imports saw a more substantial reduction of NZD 1.3B, -15% yoy decrease, totaling NZD 7.2B.

A key factor in these changes is reduced trade volume with China, which led contraction in both imports and exports. Exports to China decreased by NZD 183m, -9.7% yoy fall. Imports from China also saw a substantial reduction of NZD 347m, marking -17% yoy decrease.

Other key trading partners also showed varied trends. Exports to Australia and EU declined by NZD 35m (-4.5% yoy) and NZD 27m (-9.1% yoy), respectively. Conversely, exports to US increased by NZD 110m, a significant 18% yoy rise. Exports to Japan experienced a sharp decline of NZD 99m, -27% yoy drop.

In the realm of imports, alongside China, EU, Australia, US, and South Korea all registered declines. Imports from the EU decreased by NZD 164m (-14% yoy), from Australia by NZD 219m (-23% yoy), from the US by NZD 68m (-11% yoy), and from South Korea by NZD 231m (-32% yoy).

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.3363; (P) 1.3386; (R1) 1.3422; More…

USD/CAD’s decline is resuming by breaking 1.3348 temporary low. Intraday bias is back on the downside. Sustained trading below 1.3378 will extend the fall from 1.3897 to retest 1.3091 support next. On the upside above 1.3408 minor resistance will turn intraday bias neutral again. But risk will stay on the downside as long as 1.3479 support turned resistance holds.

In the bigger picture, outlook is mixed up by deeper then expected fall from 1.3897. But after all, price actions from 1.3976 (2022 high) are viewed as a corrective pattern that’s in progress. Larger up trend from 1.2005 (2021 low) is still expected to resume at a later stage as long as 1.2947 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Nov | -1234M | -1200M | -1709M | -1730M |

| 00:00 | NZD | ANZ Business Confidence Dec | 33.2 | 30.8 | ||

| 00:30 | AUD | RBA Meeting Minutes | ||||

| 02:49 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 07:00 | CHF | Trade Balance (CHF) Nov | 3.71B | 3.50B | 4.60B | 4.71B |

| 10:00 | EUR | Eurozone CPI Y/Y Nov F | 2.40% | 2.40% | 2.40% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Nov F | 3.60% | 3.60% | 3.60% | |

| 13:30 | USD | Housing Starts Nov | 1.56M | 1.360M | 1.372M | 1.36M |

| 13:30 | USD | Building Permits Nov | 1.46M | 1.470M | 1.498M | 1.50M |

| 13:30 | CAD | Industrial Product Price M/M Nov | -0.40% | -0.70% | -1.00% | -0.90% |

| 13:30 | CAD | Raw Material Price Index Nov | -4.20% | -3.50% | -2.50% | -2.60% |

| 13:30 | CAD | CPI M/M Nov | 0.10% | -0.10% | 0.10% | |

| 13:30 | CAD | CPI Y/Y Nov | 3.10% | 2.90% | 3.10% | |

| 13:30 | CAD | CPI Median Y/Y Nov | 3.40% | 3.30% | 3.60% | 3.40% |

| 13:30 | CAD | CPI Trimmed Y/Y Nov | 3.50% | 3.40% | 3.50% | |

| 13:30 | CAD | CPI Common Y/Y Nov | 3.90% | 4.00% | 4.20% |