Dollar’s rally extends in early US session after stronger than expected data. GDP grew a solid 3.0% annualized in Q3, beating expectation of 2.6%. More importantly, taking into consideration of the impacts of the hurricanes, growth was just 0.1% below prior quarter’s 3.1% annualized. That’s very impressive. Meanwhile, GDP price index rose 2.2%, much higher than prior quarter’s 1.0% and expectation of 1.8%. barring any disastrous developments ahead, a December rate hike now seems more likely than ever. And indeed, based on yesterday’s pricing, fed fund futures were already indicating 95.2% chance of another 25bps hike in federal funds rate to 1.25-1.50%.

Technically, Dollar is set to end as the strongest major currency for the week. EUR/USD’s break of 1.1669 support yesterday should now extend the fall from 1.2091 high to next key fibonacci level at 1.1510. USD/JPY could now take on 114.49 key resistance today. Firm break there will be a strong indication of medium term rise resumption for 118.65 and above. Euro has been soft since yesterday’s post ECB decline. But still, the common currency is trading up against Swiss Franc and commodity currencies for the week, not too bad.

Elsewhere, German import price rose 0.9% mom in September. Japan national CPI core was unchanged at 0.70% yoy in September, in line with consensus. Tokyo CPI core rose to 0.6% yoy in October, above expectation of 0.5% yoy. Australia PPI rose 0.2% qoq, 1.6% yoy in Q3.

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9909; (P) 0.9944; (R1) 1.0012; More….

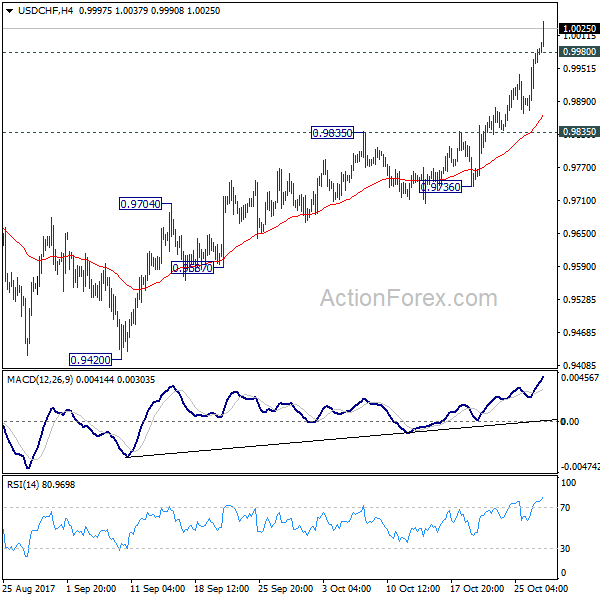

USD/CHF’s rally accelerates to as high as 1.0037 so far today. 61.8% retracement of 1.0342 to 0.9420 at 0.9990 is firmly taken out. Intraday bias remains on the upside for 1.0099 resistance first. Break will pave the way to 1.0342 key resistance level next. On the downside, below 0.9980 minor support will turn intraday bias neutral first. But retreat should be contained by 0.9835 resistance turned support and bring another rally.

In the bigger picture, current development suggests that USD/CHF has defended 0.9443 (2016 low) key support level again. Rise from 0.9420 could develop into a medium term move and target a test on 1.0342 high. This represents the upper end of a long term range that started back in 2015. On the downside, break of 0.9736 support is now needed to indicate completion of the rise from 0.9420. Otherwise, further rally will remain in favor in medium term.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | National CPI Core Y/Y Sep | 0.70% | 0.70% | 0.70% | |

| 23:30 | JPY | Tokyo CPI Core Y/Y Oct | 0.60% | 0.50% | 0.50% | |

| 00:30 | AUD | PPI Q/Q Q3 | 0.20% | 0.40% | 0.50% | |

| 00:30 | AUD | PPI Y/Y Q3 | 1.60% | 1.70% | ||

| 06:00 | EUR | German Import Price Index M/M Sep | 0.90% | 0.50% | 0.00% | |

| 12:30 | USD | GDP (Annualized) Q3 A | 3.00% | 2.60% | 3.10% | |

| 12:30 | USD | GDP Price Index Q3 A | 2.20% | 1.80% | 1.00% | |

| 14:00 | USD | U. of Michigan Confidence Oct F | 101 | 101.1 |