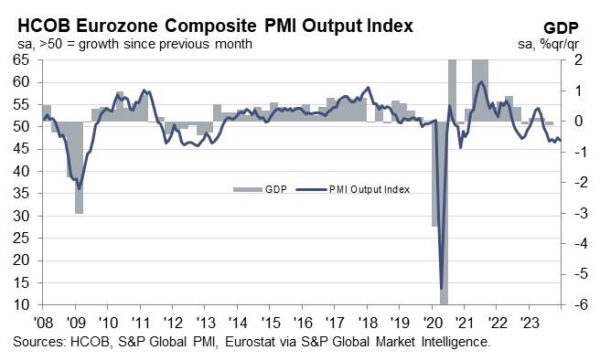

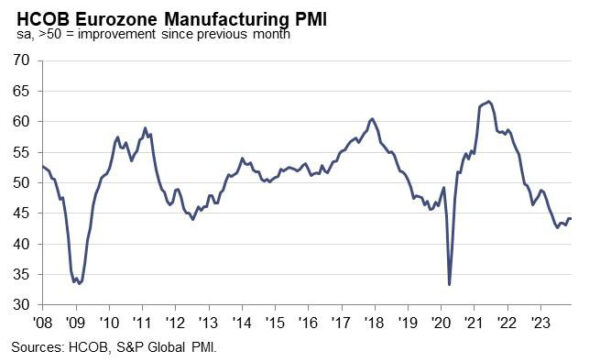

Eurozone PMI Manufacturing remained unchanged at 44.2 in December, falling short of anticipated 44.5. PMI Services index also declined from 48.7 to 48.1, below expected 49.0. Consequently, PMI Composite index decreased from 47.6 to 47.0.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, provided a critical analysis of these figures. He noted, “Once again, the figures paint a disheartening picture as the Eurozone economy fails to display any distinct signs of recovery. On the contrary, it has contracted for six straight months.”

This ongoing contraction underscores the challenges facing the Eurozone economy, with a high likelihood that it has been in a recession since the third quarter.

De la Rubia also observed, “A closer look at the top two economies in the Eurozone reveals a positive comparison for Germany in relation to France, particularly within the service sector.” Germany is experiencing a slower contraction in services compared to the more pronounced downturn in France. The manufacturing sector exhibits similar trends, with France facing a faster pace of output decline than Germany.

However, De la Rubia cautioned against any sense of satisfaction from Germany’s comparatively better performance, emphasizing, “Obviously, there’s no room for ‘Schadenfreude’ on the German side… the positive comparison does not change the fact that Germany’s economy is in a bad shape, in absolute terms.”

Also released, France PMI Manufacturing fell from 42.9 to 42.0 in December, a 43-month low. PMI Services fell from 45.4 to 44.3, a 37-month low. PMI Composite fell from 44.6 to 43.7, also a 37-month low. Germany PMI Manufacutring rose from 42.6 to 43.1, a 7-month. PMI Services fell from 49.6 to 48.4. PMI Composite fell from 47.8 to 46.7.