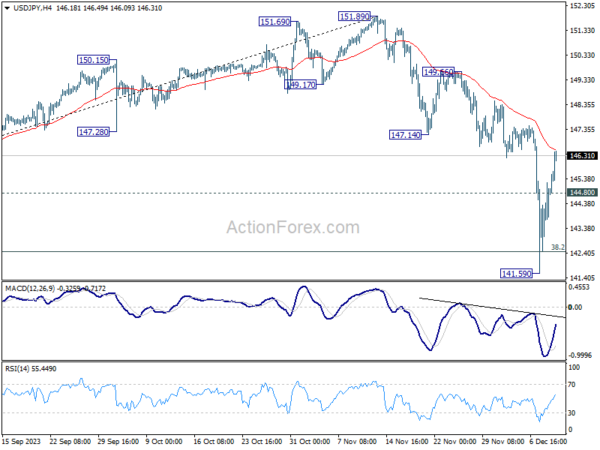

Yen’s near-term pullback has notably accelerated today. Some reports surfaced suggesting that the BoJ is not poised to abandon its negative rate policy anytime soon, with the earliest potential shift expected no sooner than April meeting. This stance isn’t fundamentally new, as BoJ has consistently indicated that it requires time to assess Spring’s wage negotiations before considering any policy changes. Additionally, the timing of the new economic projections aligns with April meeting, making it an opportune moment for the bank to explain any significant policy shifts. Despite this, the resilience seen in 10-year JGB yields indicates that traders are still hopeful for a minor policy adjustment, particularly concerning the yield curve control, later this month.

In other developments, British Pound is currently leading as the strongest currency for the day, followed by Canadian Dollar and then US Dollar. The Pound faces several critical economic releases, including tomorrow’s UK job data and Wednesday’s GDP figures, before BoE rate decision on Thursday. Meanwhile, Dollar is gearing up for tomorrow’s CPI release, followed by FOMC rate decision and new economic projections on Wednesday. These upcoming releases suggest a significant week ahead for these currencies, with potential for notable market movements.

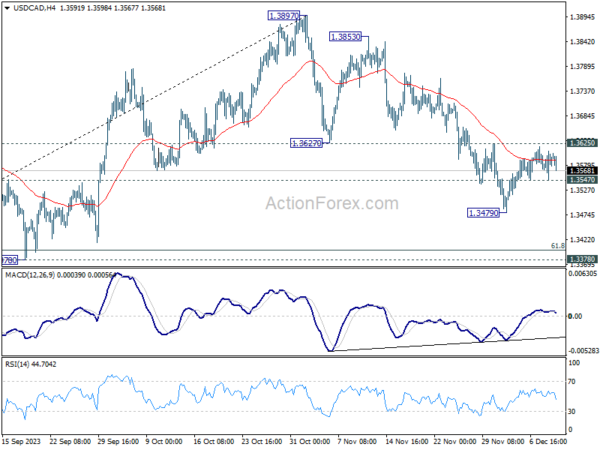

Technically, USD/CAD continued to lose upside momentum just ahead of 1.3625 support. Focus could be back to 1.3547 minor support in the next 24 hours. Break there will indicate rejection by 1.3625 resistance, and the fall from 1.3897 is in progress for another leg through 1.3479 towards 1.3378 support. Let’s see how it goes.

In Europe, at the time of writing, FTSE is down -0.50%. DAX is up 0.10%. CAC is up 0.39%. Germany 10-year yield is down -0.016 at 2.264. UK 10-year yield is up 0.025 at 4.066. Earlier in Asia, Nikkei rose 1.50%. Hong Kong HSI fell -0.81%. China Shanghai SSE rose 0.74%. Singapore Strait Times fell -0.66%. Japan 10-year JGB yield rose 0.0052 to 0.779.

Q3 next year marked for SNB’s first rate cut, economists predict

SNB is widely anticipated to maintain its key policy rate at 1.75%. However, the focus of market analysts and economists has shifted to speculating the timing of potential policy loosening. Recent polls conducted by Reuters and Bloomberg revealed a consensus among economists that SNB would only start cutting interest rates in Q3 next year.

The Reuters poll, conducted between December 5-11, gathered responses from 31 economists, all of whom unanimously agreed that SNB would hold the rate at 1.75% in the upcoming meeting. A substantial majority, approximately 70% (or 21 out of 31), predicted that SNB would maintain this rate until at least the third quarter of next year. Furthermore, a notable minority of 45% (or 13 out of 29) economists foresee the first rate cut by being pushed back to December 2024 or even later.

In comparison, a separate Reuters poll last week focusing on ECB revealed that around 57% of economists expect the ECB to implement at least one rate cut by the end of June. This comparison highlights expectations that SNB could starting cutting rates after ECB.

Additionally, a Bloomberg poll conducted from December 1-7 forecasts SNB initiate an interest rate cut in September next year. This would be followed by two more reductions of 25 bps each, anticipated in December 2024 and March 2025.

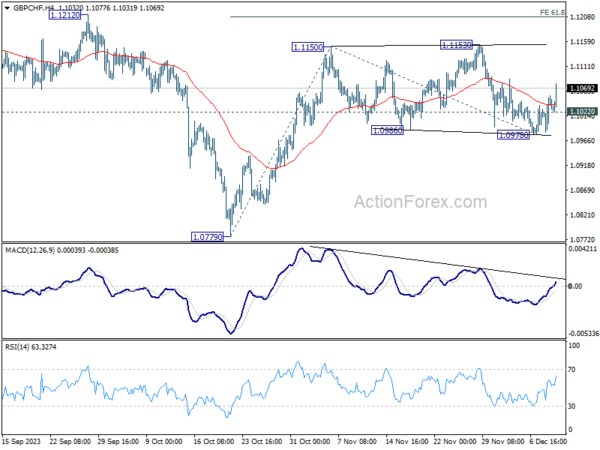

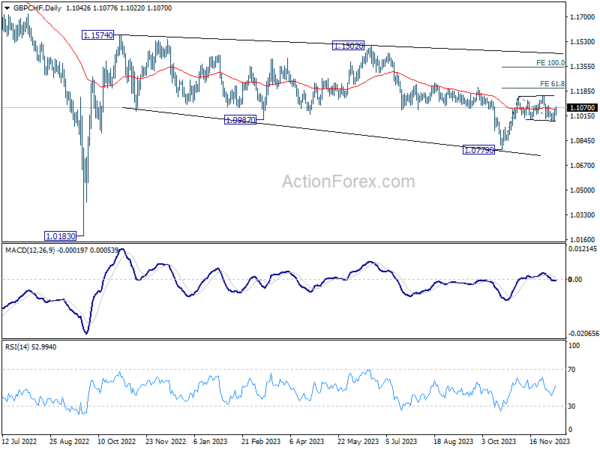

GBP/CHF rebounds, eyes 1.115 resistance

GBP/CHF stands as one of the focuses this week, particularly in light of the upcoming monetary policy decisions by both BoE and SNB. Market consensus widely anticipates that both central banks will maintain their current interest rates.

GBP/CHF’s rebound from 1.0978 extends higher today. The development suggests that fall from 1.1153 has completed at 1.0978 already. More importantly, corrective pattern from 1.1150 might has completed with three waves down to 1.0978 too.

Further rise is now in favor as long as 1.1022 minor support hold. Decisive break of 1.1153 resistance will confirm resumption of whole rise from 1.0779. GBP/CHF should then target 61.8% projection of 1.0779 to 1.1150 from 1.0978 at 1.1199, or even further to 100% projection at 1.1341.

USD/JPY Mid-Day Outlook

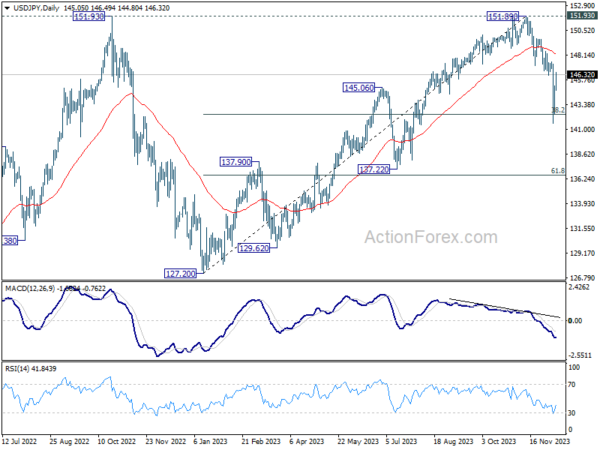

Daily Pivots: (S1) 143.18; (P) 144.20; (R1) 145.89; More…

While USD/JPY’s rebound from 141.59 is strong, outlook is unchanged for the moment. Upside should be limited be 147.14 support turned resistance. On the downside, below 144.80 minor support will turn bias to the downside for retesting 141.59. Break of 141.59 and sustained trading below 142.45 fibonacci level will pave the way to next fibonacci level at 136.63. However, firm break 147.14 will dampen the bearish view, and bring stronger rally to 149.56 resistance and above.

In the bigger picture, current fall from 151.89 is seen as the third leg of the corrective pattern from 151.93 (2022 high). Deeper decline would be seen through 38.2% retracement of 127.20 to 151.89 at 142.45 to 61.8% retracement at 136.63. This will now remain the favored as long as 147.14 support turned resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BSI Large Manufacturing Index Q4 | 5.7 | 5.6 | 5.4 | |

| 23:50 | JPY | Money Supply M2+CD Y/Y Nov | 2.30% | 2.50% | 2.40% | |

| 06:00 | JPY | Machine Tool Orders Y/Y Nov P | -13.60% | -20.60% |