Today’s Asian session saw broad decline in Australian Dollar, along with New Zealand and Canadian Dollars. This pattern suggests a shift towards risk aversion among investors, a sentiment echoed by the performance of major Asian stock indexes. Hong Kong stocks, in particular, continued their recent down trend, reaching new lows due to disappointing earnings results from some large Chinese companies. Japan’s Nikkei index also hit a three-week low, largely impacted by falling chipmaker stocks.

RBA’s decision to maintain its interest rate unchanged was in line with market expectations. Despite this, the statement was interpreted as less hawkish than some market analysts anticipated. However, prior to the meeting, it was largely understood that RBA would await Q4 inflation data, scheduled for release in January, before contemplating its next move in February. Thus, RBA’s stance of data-dependency and openness to future rate hikes was not an entirely new revelation. Nonetheless, the Australian Dollar is currently underperforming even compared to other commodity-linked currencies.

In other areas of the currency markets, Dollar, Euro, and Japanese Yen are showing relative strength. But Yen’s progress is somewhat tempered by lower-than-expected inflation figure from Tokyo. Dollar is also facing challenges in sustaining its near-term rebound. Market focus is now shifting towards the upcoming US ISM Services PMI, which is expected to introduce some volatility. However, traders may hold off on larger bets until Friday’s non-farm payroll report.

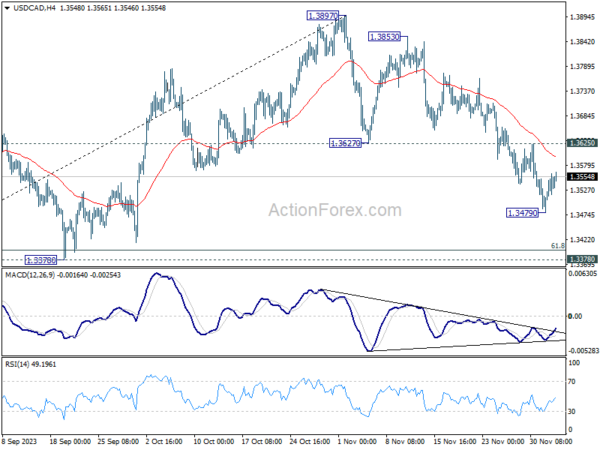

Technically, USD/CAD is recovering mildly after edging lower to 1.3479 yesterday. Fall from 1.3897 is seen as a corrective move only. While another fall cannot be ruled out yet, bullish convergence condition in 4H MACD suggest that downside should be contained by 1.3378 support, at least on first attempt. Meanwhile, break of 1.3625 resistance will argue that the correction has completed and bring stronger rebound. With key economic events like ISM services data, BoC’s rate decision, and US non-farm payroll report on the horizon, the direction of USD/CAD is likely to become clearer very soon.

In Asia, at the time of writing, Nikkei is down -1.20%. Hong Kong HSI is down -1.44%. China Shanghai SSE is down -0.67%. Singapore Strait Times is down -0.28%. Japan 10-year JGB yield is down -0.0040 at 0.687. Overnight, DOW fell -0.11%. S&P 500 fell -0.54%. NASDAQ fell -0.85%. 10-year yield rose 0.062 to 4.288.

RBA holds rates following sparse information since last meeting

RBA kept its cash rate target unchanged at 4.35%, aligning with market expectations. The central bank’s latest statement indicates continued openness to further rate hikes, but emphasizes that any such decision “will depend upon the data and the evolving assessment of risks.” This stance reflects a careful approach, as RBA awaits more comprehensive data, particularly the Q4 inflation figures due in January, before its next meeting in early February.

In its review of the “limited information” available since November meeting, RBA acknowledged that the data were “broadly in line with expectations.” The October monthly CPI update suggested continued moderation in inflation, but did not provide substantial insights into services inflation. While wage growth accelerated in Q3, it is “not expected to increase much further”. The labor market conditions are seen as “continuing to ease gradually,” though they remain tight.

RBA also highlighted “still significant uncertainties” regarding the economic outlook. It pointed out the potential for persistent services inflation in Australia. Domestically, the uncertainties include the lag effects of monetary policy and household consumption patterns. On a global scale, the ongoing uncertainty around Chinese economy’s trajectory and the broader implications of international conflicts were noted as significant factors influencing Australia’s economic environment.

Japan’s Tokyo CPI core slows to 2.3% yoy in Nov, core-core still stick at 3.6% yoy

November’s inflation data in Japan’s capital Tokyo shows a notable slowdown. CPI core, which excludes fresh food, dropped from 2.7% yoy to 2.3% yoy, falling slightly below the expected 2.4%. This decline brings the reading further towards BoJ target of 2%.

Headline CPI also experienced a decrease, falling back to 2.6% yoy. This reduction comes after an unexpected rise from 2.8% yoy in September to 3.2% yoy in October.

Furthermore, CPI core-core, which excludes both food and energy, showed some progress. It declined from 3.8% yoy to 3.6% yoy, a reduction from its peak of 4.0% seen in July and August. However, the still relatively high CPI core-core reading indicates that underlying inflationary pressures remain persistent within the economy, despite the overall slowdown.

Japan’s PMI services finalized at 50.8, weakening in a year of strong growth

Japan’s PMI Services for November was finalized at 50.8, down from October’s 51.6, marking the weakest reading since November 2022. PMI Composite also fell to 49.6, down from 50.5 in the previous month, indicating the first contraction since December 2022.

Trevor Balchin, Economics Director at S&P Global Market Intelligence, contextualized these numbers, stating, “November data signalled a further loss of momentum in the services sector, but this should be viewed in the context of a year of strong growth.” He highlighted that Business Activity Index for 2023 is trending at 53.7, the highest annual reading since the survey’s inception in 2007.

Balchin also pointed out several positive aspects in the latest survey. The rise in new business, sustained employment growth, and the increase in outstanding work indicate ongoing economic activity. Furthermore, the 12-month outlook for activity improved and was “among the strongest on record”. Despite these optimistic signs, price pressures in November eased but remained above long-term trends.

China’s PMI services rose to 51.5 in Nov, composite rose to 51.6

China’s Caixin PMI Services rose from 50.4 to 51.5 in November, above expectation of 50.8. PMI Composite rose from 50.0 to 51.6.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Overall, the macroeconomy showed signs of a positive recovery, with steady growth in consumer spending, solid progress in industrial production and improved market expectations.

“However, due to various unfavorable factors, both domestic and external demand still face challenges and employment pressures remain relatively high. The foundation for economic recovery needs to be further consolidated.”

Looking ahead

France industrial production, Eurozone PMI services final and PPI, UK PMI services final will be released in European session. Later in the day, US ISM services is the main focus.

AUD/USD Daily Report

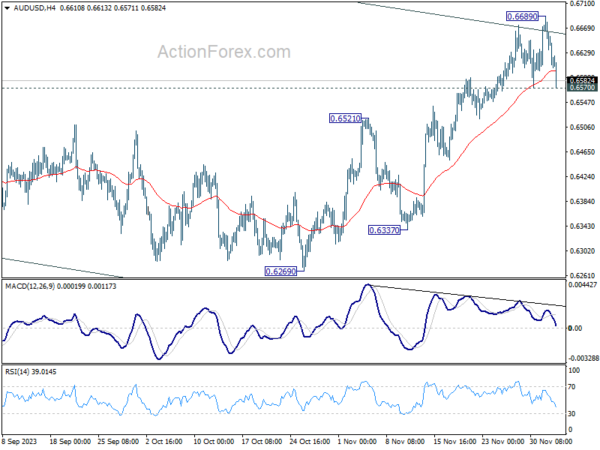

Daily Pivots: (S1) 0.6586; (P) 0.6639; (R1) 0.6672; More…

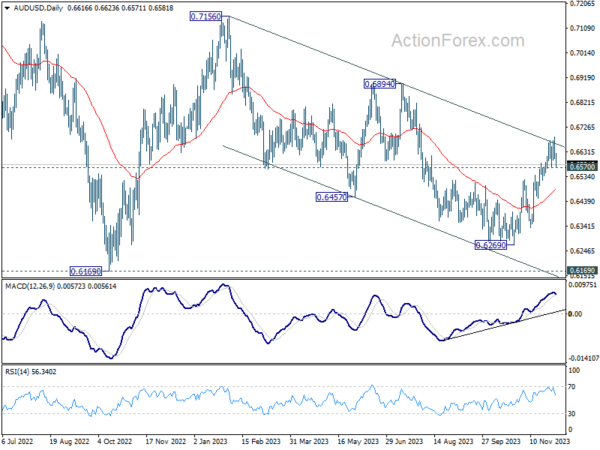

AUD/USD dips notably today but stays above 0.6570 support so far. Intraday bias remains neutral first. On the upside, sustained break of channel resistance (now at 0.6651) will argue that whole decline from 0.7156 has completed with three waves down to 0.6269. Further rally should then be seen to 0.6894 resistance for confirmation. However, break of 0.6570 support will indicate rejection by the channel and turn bias back to the downside for 55 D EMA (now at 0.6482) instead.

In the bigger picture, there is no confirmation that down trend from 0.8006 (2021 high) has completed. price actions from 0.6169 (2022 low) could be just a medium term corrective pattern, with rise from 0.6269 as the third leg. For now, range trading should be seen between 0.6169 and 0.7156 (2023 high), until further developments.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Y/Y Nov | 2.60% | 3.30% | 3.20% | |

| 23:30 | JPY | Tokyo CPI ex Fresh Food Y/Y Nov | 2.30% | 2.40% | 2.70% | |

| 23:30 | JPY | Tokyo CPI ex Food Energy Y/Y Nov | 3.60% | 3.80% | ||

| 00:30 | AUD | Current Account (AUD) Q3 | -0.2B | 3.5B | 7.7B | 7.8B |

| 01:45 | CNY | Caixin Services PMI Nov | 51.5 | 50.8 | 50.4 | |

| 03:30 | AUD | RBA Interest Rate Decision | 4.35% | 4.35% | 4.35% | |

| 07:45 | EUR | France Industrial Output M/M Oct | -0.20% | -0.50% | ||

| 08:45 | EUR | Italy Services PMI Nov | 48.2 | 47.7 | ||

| 08:50 | EUR | France Services PMI Nov F | 45.3 | 45.3 | ||

| 08:55 | EUR | Germany Services PMI Nov F | 48.7 | 48.7 | ||

| 09:00 | EUR | Eurozone Services PMI Nov F | 48.2 | 48.2 | ||

| 09:30 | GBP | Services PMI Nov F | 50.5 | 50.5 | ||

| 10:00 | EUR | Eurozone PPI M/M Oct | 0.20% | 0.50% | ||

| 10:00 | EUR | Eurozone PPI Y/Y Oct | -9.40% | -12.40% | ||

| 14:45 | USD | Services PMI Nov F | 50.8 | 50.8 | ||

| 15:00 | USD | ISM Services PMI Nov | 52.6 | 51.8 |