Gold and Bitcoin are leading the charge in Asian markets today, with Gold breaking to a new record high and Bitcoin surpassing the 40000 mark. This surge contrasts with the mixed performance of Asian equity markets, where indices like Japan’s Nikkei and Hong Kong’s HSI experienced some pressure. The varied market reactions come at a time when traders are bracing themselves for a week packed with high-profile economic events, including key central bank decisions from RBA and BoC, along with pivotal US non-farm payrolls data. Such anticipation is prompting a more cautious approach among traders, who are likely weighing the potential outcomes and their impacts on various asset classes.

In the realm of currency markets, Japanese Yen trading broadly higher, largely riding on the back of a global dip in benchmark yields, coupled with growing expectations that the BoJ would exit its negative rate policy next year. The forthcoming Tokyo CPI and Japan’s wage growth data are set to offer critical inputs for BoJ’s policy deliberations, potentially influencing the Yen’s path further. Dollar and Euro are both showing signs of recovery, attempting to pare back some of the significant losses witnessed last week. Despite this rebound, there remains a lack of clear indicators signaling a long-lasting shift in the fortunes of Dollar and Euro yet.

On the other hand, Australian Dollar showing mild weakness as the market anticipates upcoming RBA rate decision and Australian GDP data release later in the week. British Pound and New Zealand Dollar are also dipping, while Canadian Dollar and Swiss Franc are showing mixed performances. These movements in the currency markets are reflective of the overall cautious sentiment that seems to be prevailing among investors at the moment.

Technically, AUD/NZD is a pair to watch this week. Fall from 1.0942 is in progress and break of last week’s low at 1.0700 will resume the decline to 1.0620 support. Decisive break there will argue that consolidation pattern from 1.0469 has completed, and the down trend from 1.1489 is ready to resume. In case of a bounce on RBA or Australia GDP, sustained break of 55 D EMA (now at 1.0814) is need to confirm that fall from 1.0942 has finished. Otherwise, outlook will stay bearish.

In Asia, Nikkei closed down -0.60%. Hong Kong HSI is down -0.47%. China Shanghai SSE is down -0.17%. Singapore Strait Times is up 0.38%. Japan 10-year JGB yield fell -0.0080 to 0.692.

Bitcoin shatters 40K barrier, path to 50K now open?

Bitcoin’s surged over the weekend, breaking the 40K barrier for the first time since May 2022, has brought a fresh wave of optimism and focus in the cryptocurrency market. The immediate attention is now on the key level of 41259, a significant Fibonacci projection level. Decisive break through this level could set the stage for a climb through 50K handle.

The surge is largely driven by growing optimism surrounding the approval of Bitcoin ETF by the SEC. Bloomberg’s expectation of a batch of such funds gaining SEC approval by January adds to this sentiment. This development signifies a major shift towards mainstream acceptance of Bitcoin, fulfilling a long-awaited milestone for many investors and traders.

Another contributing factor is the anticipated Bitcoin halving event scheduled for May next year. Historically, Bitcoin halvings, which occur every four years, have been associated with bullish market trends. Market participants are eyeing a potential bull run post-halving, with some traders positioning themselves early in anticipation of both the halving and the ETF approval.

Technically, D MACD suggests that Bitcoin is now in a re-acceleration phase. Immediate focus is on 100% projection of 15452 to 31815 from 24896 at 41259. Decisive break there will pave the way to 161.8% projection at 51371 next.

There might be some initial resistance from 41259 to limit upside at the first attempt. Break of 37485 support will bring consolidations in Bitcoin first. But pull back should be contained by 31815 resistance turned support to bring another rally.

Surging to new record, can gold maintain momentum towards 2500?

Gold prices reached a new record high today, surpassing 2,110, before experiencing a slight pullback. This surge represents an extension of the recent two-month rally, initially sparked by the Israel-Hamas conflict,which heightened global geopolitical tensions and triggered a flight to safety among investors, bolstering demand for Gold.

The upsurge in gold’s value is further fueled by growing expectations of monetary easing by key global central banks. Fed, along some other major global central banks like ECB are anticipated to implement interest rate cuts in the coming year. This speculation is a critical factor in the current Gold price dynamics, as lower interest rates typically decrease the opportunity cost of holding non-yielding assets like Gold, making it more attractive to investors.

Technically, initial resistance is seen at 100% projection of 1810.26 to 2009.26 from 1931.39 at 2130.39. Some consolidations might be seen first, and volatility could be high due to near term profit taking around prior record high of 2074.

Nevertheless, outlook will stay bullish as long as 2009.26 resistance turned support holds, and further rally is expected. Sustained break above 2130.39 will pave the way to 161.8% projection at 2253.37.

However, the broader picture for Gold’s long-term trend revolves around whether it can maintain enough buying momentum to reach 100% projection of 1160.17 to 2704.84 from 1614.60 at 2529.27, surpassing 2500 mark. The potential to achieve this ambitious target hinges on whether there will be a global loosening of monetary policy next year and if geopolitical tensions persist or escalate further.

BoJ’s Noguchi: Just only beginning to envision inflation target achievement

BoJ board member Asahi Noguchi emphasized the need for continuing ultra-loose monetary policy in Japan.

Noguchi acknowledged on Saturday the impact of global inflation on Japan, stating, “It’s true the impact of elevated global inflation is reaching Japan’s economy with consumer inflation exceeding the BOJ’s 2% target since the spring of 2022.”

However, Noguchi differentiated the nature of Japan’s inflation from that of the West, pointing out that, “the rise is mostly due to cost-push factors amid higher import prices,” contrasting with the wage-driven price increases in US and Europe. This distinction is crucial in understanding BoJ’s monetary policy approach.

To effectively meet the BoJ’s inflation target, Noguchi emphasized “we must see price rises backed by sustained wage increases.”

Despite significant wage hikes in this year’s spring wage negotiations, Noguchi believes that Japan is only at the beginning of its journey to reach its inflation target, stating, “we’ve only just reached a stage where the possibility of achieving our target has come into sight.”

The week ahead in Forex: RBA & BoC, US NFP as pivotal drivers

Attention is squarely focused on the upcoming meetings of two major central banks: RBA and BoC, as well as heavy weight economic data from the US including ISM services and non-farm payroll employment.

RBA is widely expected to hold interest rate unchanged at 4.35%. November meeting minutes hinted at the possibility of one to two rate hikes in the forthcoming quarters. With one hike already executed, the market is rife with speculation about another one increase in February. Although recent CPI data did not meet expectations, the missing key components in this data make the set less important. It is anticipated that RBA will hold off on any significant policy announcements or indications until Q4 data is assessed, rendering the upcoming meeting more of a procedural event than a groundbreaking one.

The BoC, on the other hand, is widely believed to have concluded its tightening cycle, especially in light of Governor Tiff Macklem’s recent remarks suggesting that the current interest rates might be sufficiently restrictive. The key question now is whether BoC is prepared to signal a shift towards easing. While there is chatter about a potential rate cut in Q2, it seems premature for BoC to make a pronounced shift in tone at this juncture. However, even a slight dovish tilt in the statement could stir significant reactions in the Canadian Dollar.

Parallel to these developments, the U.S. economic indicators, notably the ISM services data and non-farm payrolls, are also key factors influencing market sentiment. Fed is closely monitoring these indicators for signs of cooling in the services sector and loosening in the employment market, which are prerequisites for any softening in their stance on further rate hikes. Conversely, investors are seeking a delicate balance in the data – a “goldilock” scenario where the economy shows signs of slowing but not alarmingly so. The market’s response to data falling outside this ideal range remains unpredictable, potentially leading to heightened volatility.

Here are some highlight for the week:

- Monday: Japan monetary base; Australia MI inflation gauge; Germany trade balance; Swiss CPI; Eurozone Sentix investor confidence; US factory orders.

- Tuesday: Japan Tokyo CPI; China Caixin PMI services; RBA rate decision; Eurozone PMI services final, PPI; UK PMI services final; US ISM services.

- Wednesday: Australia GDP; Germany factory orders; UK PMI construction; Eurozone retail sales; US ADP employment, trade balance; Canada BoC rate decision, trade balance, Ivey PMI.

- Thursday: Australia trade balance; China trade balance; Swiss unemployment rate, foreign currency reserves; Germany industrial production; Eurozone GDP revision; Canada building permits; US jobless claims.

- Friday: New Zealand manufacturing sales; Japan average cash earnings, household spending, current account, GDP final; Canada capacity utilization; US non-farm payrolls, U of Michigan consumer sentiment.

USD/JPY Daily Outlook

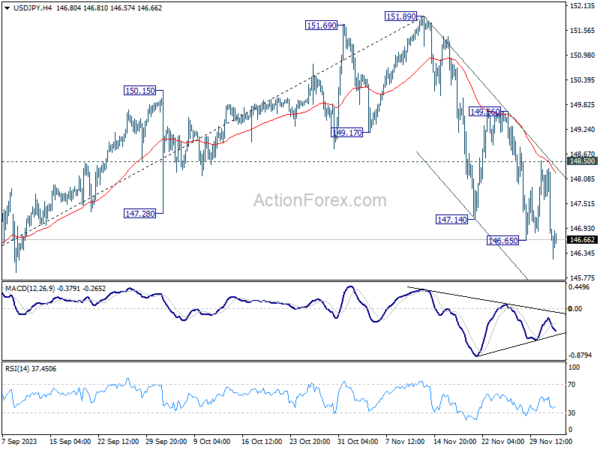

Daily Pivots: (S1) 146.20; (P) 147.27; (R1) 147.88; More…

Intraday bias in USD/JPY is back on the downside with break of 146.65 temporary low. Fall from 151.89 is in progress and should target 145.06 key support level. On the upside, break of 148.50 resistance is needed to indicate short term bottoming. Otherwise, further decline with remain in favor in case of recovery.

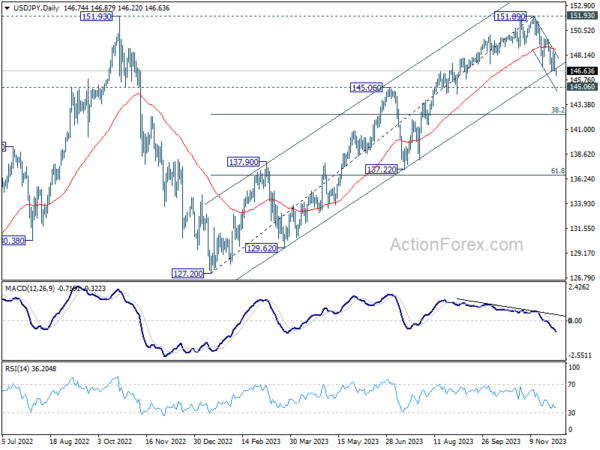

In the bigger picture, rise from 127.20 (2023 low) is seen as the second leg of the pattern from 151.93 (2022 high). Decisive break of 145.06 resistance turned support will confirm that this second leg has completed, after rejection by 151.93. Deeper fall would be seen through 38.2% retracement of 127.20 to 151.89 at 142.45 to 61.8% retracement at 136.63. Nevertheless strong bounce from 145.06 will retain medium term bullishness for another test on 151.93 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Terms of Trade Index Q3 | -0.60% | -2.10% | 0.40% | 0.30% |

| 23:50 | JPY | Monetary Base Y/Y Nov | 8.90% | 9.50% | 9.00% | |

| 00:00 | AUD | TD Securities Inflation M/M Nov | 0.30% | -0.10% | ||

| 07:00 | EUR | Germany Trade Balance (EUR) Oct | 17.0B | 16.5B | ||

| 07:30 | CHF | CPI M/M Nov | -0.10% | 0.10% | ||

| 07:30 | CHF | CPI Y/Y Nov | 1.60% | 1.70% | ||

| 09:30 | EUR | Eurozone Sentix Investor Confidence Dec | -16 | -18.6 | ||

| 15:00 | USD | Factory Orders M/M Oct | -2.50% | 2.80% |