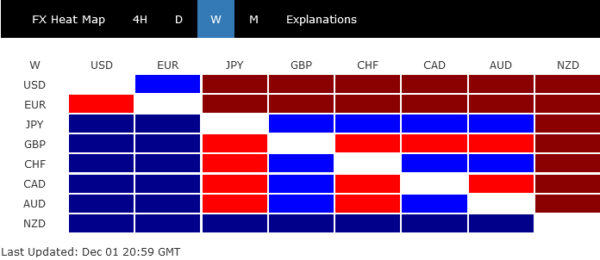

Financial markets were dominated by themes of cooling inflation, a slowing economy, and increasing expectations of policy easing by both ECB and Fed last week. This convergence of factors ignited a full risk-on mode among investors, propelling major US stock indexes and Germany’s DAX to sharp gains. In tandem, benchmark treasury yields in both Europe and US experienced significant declines. Consequently, Euro and Dollar emerged as the week’s worst performers, largely overwhelmed by these market movements.

Looking ahead, this risk-on sentiment is expected to persist, likely keeping Dollar under pressure generally, with the notable exception of its pairing with Euro. Technical developments in various Euro crosses suggest that the selling pressure on the Euro would persist for some time.

Conversely, New Zealand Dollar stood out as the strongest currency, largely due to the RBNZ’s unexpectedly hawkish stance on interest rates. RBNZ’s new economic projections hinted at the possibility of further rate hike next year. Additionally, Deputy Governor Christian Hawkesby highlighted the unforeseen impact of record net migration on boosting demand and inflating prices.

Other currencies displayed mixed performance. Yen ranked as the second strongest, buoyed by expectations of BoJ’s exit from negative interest rates next year. However, Yen’s gains were primarily against Dollar and Euro, failing to break through prior week’s highs against others. Swiss Franc ranked third in strength, largely driven by buying against Euro.

On the other hand, Sterling was was comparatively weaker, and Canadian Dollar showed mixed performance despite strong job data. Australian Dollar also lacked clear direction, a lower-than-expected monthly CPI reading lessened the need of further interest rate hikes by RBA next year.

A trio of factors leads investors to embrace strong risk-on sentiment

Strong risk-on sentiment prevailed among investors in the US markets last week, fueling significant gains across major stock indices and treasuries. DOW surged to a new 2023 high, marking its fifth consecutive week of gains and bringing its total increase for the year to nearly 9.4%. Similarly, S&P 500 index closed at its highest level since March 2022, further underlining the bullish trend in the equity markets. NASDAQ Composite, while showing gains, lagged behind the other indices and remained capped below its July high. In the bond market, 10-year Treasury yield dropped significantly, breaking through an important support level around 4.33% to reach its lowest point since September.

This positive market development was fueled by a combination of factors related to inflation trends, Fed expectations, and the overall pace of economic cooling.

Inflation Trends: October’s inflation data showed slowing in both the headline and core PCE price index, aligning with investor expectations. This easing of inflationary pressures is a welcome sign for the markets, as it affirms that the aggressive price increases experienced over the past year continues to abate.

Fed Policy Shift: The market is increasingly anticipating a shift in Fed’s monetary policy. Fed fund futures market now indicates over 90% probability of a full percentage point rate cut in 2024. This expectation of a more dovish stance from Fed, moving from tightening to loosening policy, is buoying investor sentiment.

Goldilocks Cooling: The gradual cooling of the US economy, perceived as neither too rapid nor too slow, is being welcomed by the markets. This “Goldilocks” cooling phase is seen as ideal for mitigating inflation without triggering a significant economic downturn, creating a favorable environment for investment.

Meanwhile, some market participants interpreted Fed Chair Jerome Powell’s comments last Friday as veering towards a dovish stance, Powell was actually quite balanced. He emphasized the premature nature of concluding that current monetary policy is “sufficiently restrictive” or speculating about policy easing. He also stated Fed’s preparedness to tighten policy further if needed. However, markets seemed to focus more on Powell’s acknowledgment that the risks of under- and over-tightening are becoming more balanced and the Fed’s intention to proceed carefully. Stocks managed to extend gains and closed on a high note after Fed anyway.

Technically, DOW powered through 35679.13 resistance to resume whole rise from 28660.94 last week. Near term outlook will stay bullish as long as last week’s low at 25280.57 holds. Next target is 36952.65 high.

In the bigger picture, there are still various interpretations on the price actions from 28660.94. The most bullish one is that it’s already resuming long term up trend. More importantly, price actions from 34712.28 to 32327.20 are a three wave consolidation pattern that’s skewed upwards.

In this bullish case, 100% projection of 28660.94 to 34712.28 from 32327.20 at 38378.54 is a minium target, with prospect of even shooting through 40k handle.

10-year yield extended the decline from 4.997 to close at 4.226, breaking through 38.2% retracement of 3.253 to 4.997 at 4.330. Near term outlook will stay bearish as long as 55 D EMA (now at 4.498) holds. Next target is 61.8% retracement at 3.919. As 55 W EMA is in proximity (now at 3.942), there could be some notable support between 3.9 and 4.0 psychological to contain downside on first attempt.

One important perspective is that 10-year yield has possibly completed a five-wave impulsive rally from 0.398 (2020 low already), on bearish divergence condition in W MACD. If that’s the case, it’s now in a medium correction to this up trend, and fall from 4.997 could eventually extend to 3.253 cluster support (38.2.% retracement of 0.398 to 4.997 at 3.240. With this in mind, TNX breaking through 4% in the medium term is indeed not a fantasy.

DAX eyes historical high on inflation slowdown and prospects of ECB rate cuts

In the Eurozone, investors have positively responded to faster-than-expected slowdown in inflation, leading to increased speculation about rate cuts by ECB. November a significant decline in Eurozone CPI, decreasing from 2.9% to 2.4%, bringing it closer to ECB’s symmetric 2% target. Core CPI also showed notable progress, reducing from 4.2% to 3.6%. This trend aligns with the broader economic context, as Eurozone is experiencing a more severe economic slowdown compared to the US.

Despite this trend, ECB President Christine Lagarde has cautioned against premature celebration in the fight against inflation. She emphasized that it is “not the time to start declaring victory” and maintained a cautious stance. Echoing her sentiment, some ECB officials have also expressed that discussions about rate cuts are premature. Nevertheless, the market sentiment is increasingly leaning towards the possibility of ECB rate cuts, with some economists advancing their expectations for the first rate cut from the third to the second quarter of next year.

Investors in Germany cheered the development, even though stocks in France lagged behind. DAX accelerated higher to close at 16397.52 last week, within striking distance to 16528.97 historical high. For now, near term outlook will stay bullish as long as 15915.40 support holds. Decisive break of 16528.97 will pave the way to 61.8% projection of 11862.84 to 16528.97 from 14630.21 at 17513.87.

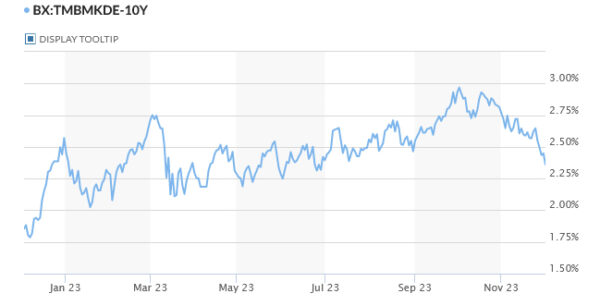

Concurrently, yield on 10-year German bund continued its down trend, closing at its lowest level since June at 2.360.

Dollar index bounces on Euro weakness, but capped below near term resistance

The net results of the above mentioned development is that Euro and Dollar ended as the worst, and second worst performers of the week, respectively. Hence, bounce seen in Dollar index was largely attributed to the weakness in Euro rather than inherent strength in the Dollar.

From a technical analysis standpoint, 61.8% retracement of 99.57 to 107.34 at 102.53 is an ideal level to provide support for DXY to form a short term bottom. However, a key condition for confirming this bottoming pattern is a break above 104.21 resistance. In this case, stronger rebound would be seen back to 55 D EMA (now at 104.69) and above.

For such a rebound to materialize, two key market movements would be necessary: Deeper selloff in EUR/USD and, ideally, a sustainable bounce in USD/JPY too. These movements would collectively support a bullish scenario for the Dollar Index.

Conversely, a firm break below the last week’s low of 102.46, coupled with sustained trading below 102.53, would indicate continuation of the decline from 107.34 high. In this bearish scenario, DXY could extend its fall to retest 99.57 low.

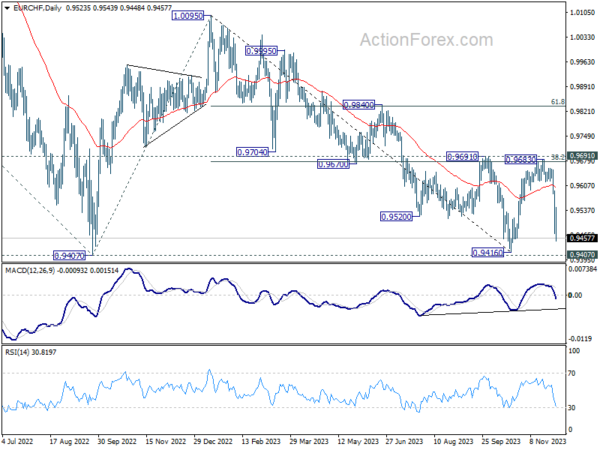

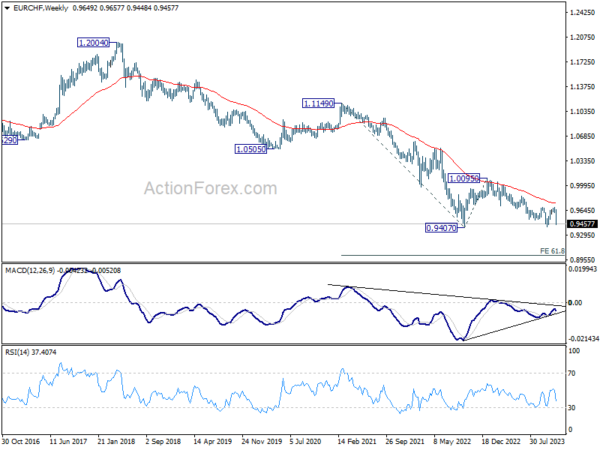

Bearish developments in EUR/CHF, EUR/GBP and EUR/AUD

Some important technical developments in Euro are worth noting. EUR/CHF’s steep decline should confirm rejection by 0.9691 cluster resistance (38.2% retracement of 1.0095 to 0.9416 at 0.9675). The fall from 1.0095 (2023 high) is still in progress. Based on the current strong momentum, EUR/CHF is possibly resuming the long term down trend too.

Retest of 0.9407 (2022 low) should be seen soon. Decisive break there will confirm the bearish case, and pave the way to 61.8% projection of 1.1149 to 0.9407 from 1.0095 at 0.9018, which is close to 0.9 psychological level.

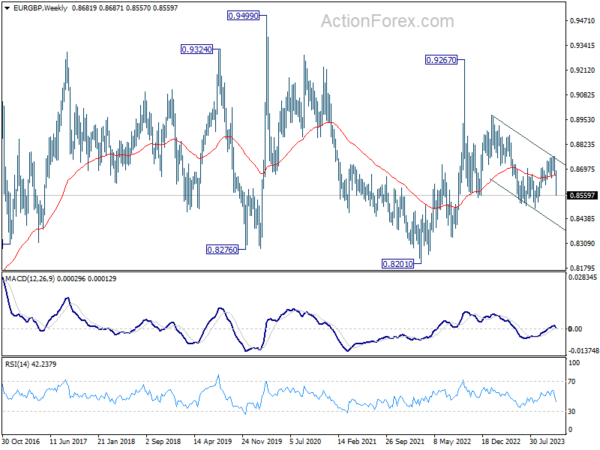

EUR/GBP’s sharp fall also suggests that rebound from 0.8491 has completed as a corrective move to 0.8764. Down trend from 0.9267 is likely still in progress. Retest of 0.8491 support should be seen next. Decisive break there will confirm this bearish case and target medium term channel support at around 0.8413.

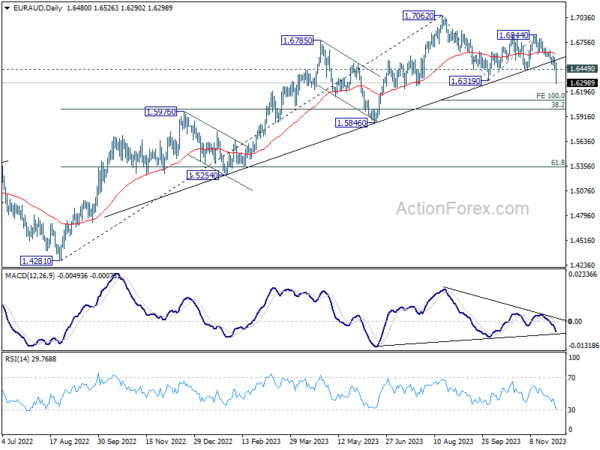

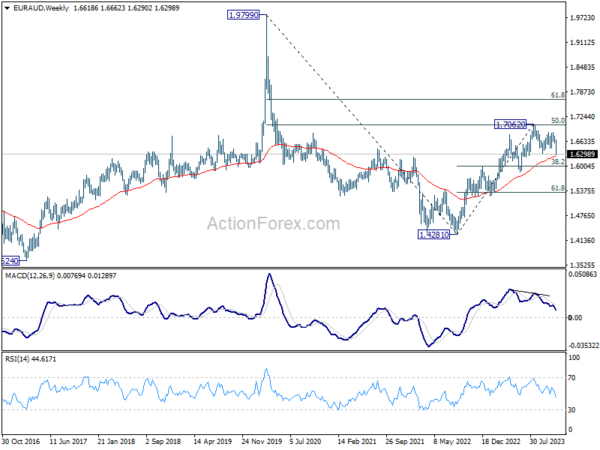

EUR/AUD’s strong break of the medium term trend line support argues that’s fall from 1.7062 is already correcting the whole up trend from 1.4281 (2022 low). Deeper fall should be seen to 38.2% retracement of 1.4281 to 1.7062 at 1.6000 in the near term. Strong support could be seen there to bring rebound. But firm break of this fibonacci level would pave the way to 61.8% retracement at 1.5343.

EUR/USD Weekly Outlook

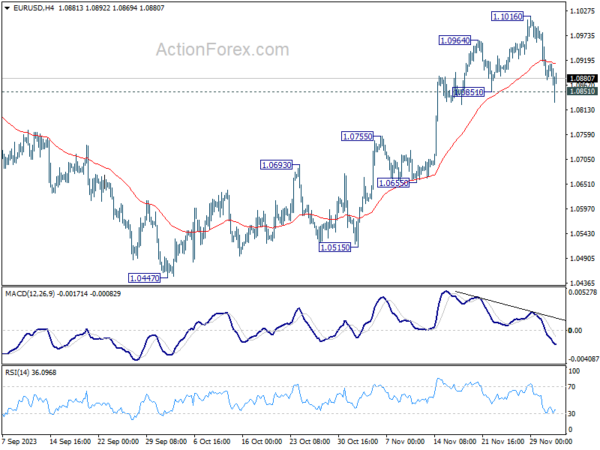

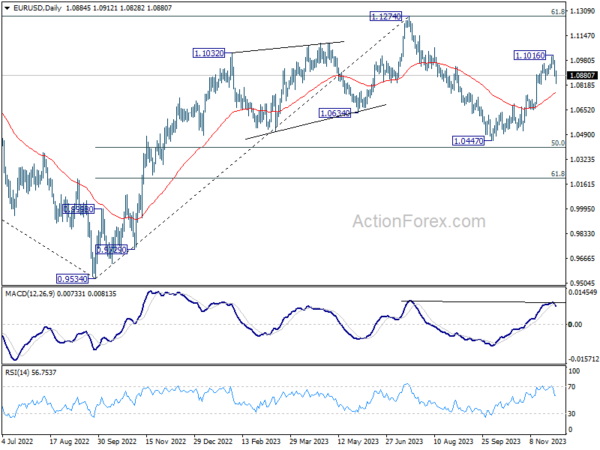

EUR/USD reversed after edging higher to 1.1016. With breach of 1.0851 support, a short term top should be in place on bearish divergence condition in 4H MACD. Initial bias is mildly on the downside this week for 55 D EMA (now at 1.0766). On the upside, however, break of 1.1016 will resume the rise from 1.0447 to retest 1.1274 high instead.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is tentatively seen as the second leg. Hence while further rally could be seen, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 55 D EMA will argue that the third leg has already started for 1.0447 and below.

In the long term picture, a long term bottom is in place at 0.9534 on bullish convergence condition in M MACD. It’s still early to call for bullish trend reversal with the pair staying inside falling channel. Nevertheless, sustained trading above 55 M EMA (now at 1.1081) and break of 1.1274 resistance will raise the chance of reversal and target 1.2348 resistance for confirmation.