- EURCHF breaks downward sloping channel to the upside

- Price’s momentum is weak for further upward move

- MACD and RSI lose momentum

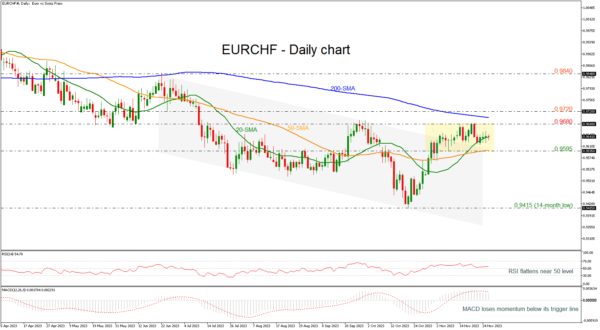

EURCHF penetrated the medium-term descending channel to the upside, but the momentum is too weak as the price is consolidating withing a tight range of 0.9595 – 0.9680.

To attract new buyers, the bulls will have to surpass the nearby resistance of 0.9680 and move beyond the 200-day simple moving average (SMA) at 0.9700. In this case, the price could pick up steam towards the important resistance area at 0.9720. Another successful battle there could see the price jumping to the 0.9840 barrier.

However, the muted technical indicators do not currently confirm the recent bullish scenario. The narrowing SMAs are indicating a potential explosive move but the direction is unclear as the flattening RSI has recently escaped a drop below its 50 neutral mark, whereas the MACD keeps lacking power below its trigger line.

Hence, a downside correction could still be possible in the coming sessions. If the pair slumps below the 50-day SMA and the 0.9595 support level, it could stabilize near the 14-month low of 0.9415.

Summing up, EURCHF has not eliminated downside risks yet, despite the upside break of the downward sloping channel. To boost buying confidence, the pair will need to crawl above 0.9680, and more importantly, strengthen its uptrend above the 200-day SMA.