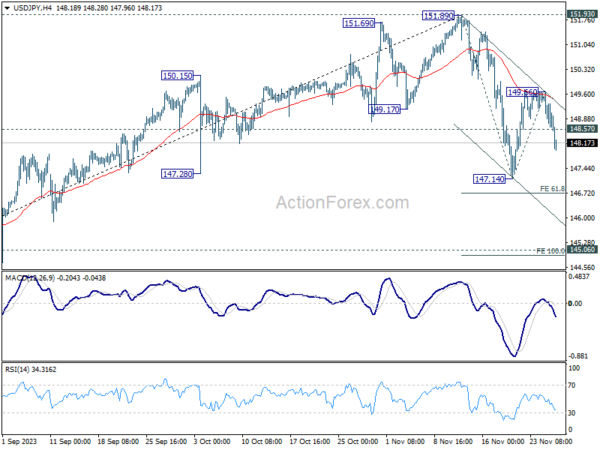

Daily Pivots: (S1) 148.26; (P) 148.97; (R1) 149.40; More…

USD/JPY’s break of 148.57 minor support indicates rejection by 55 4H EMA. Intraday bias is back on the downside to extend the decline from 151.9. Next target is 147.14 support. Further break of 61.8% projection of 151.89 to 147.14 from 149.66 at 146.72will pave the way to 100% projection at 149.91, which is close to 145.06 key resistance turned support. For now, risk will stay on the downside as long as 149.66 resistance holds, in case of recovery.

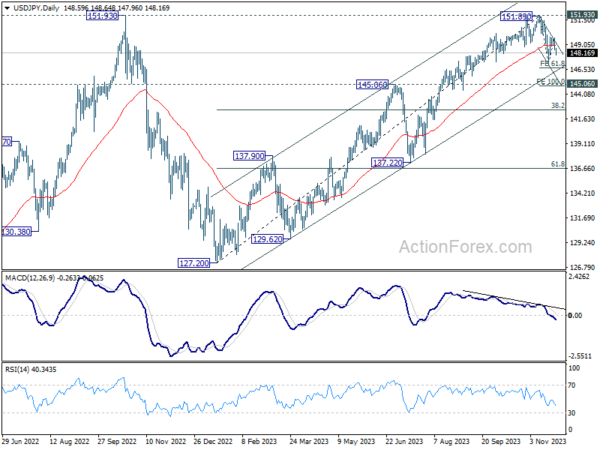

In the bigger picture, rise from 127.20 (2023 low) is seen as the second leg of the pattern from 151.93 (2022 high). Decisive break of 145.06 resistance turned support will confirm that this second leg has completed, after rejection by 151.93. Deeper fall would be seen through 38.2% retracement of 127.20 to 151.89 at 142.45 to 61.8% retracement at 136.63. Nevertheless strong bounce from 145.06 will retain medium term bullishness for another test on 151.93 at a later stage.