Yen has a notable bounce in Asian session today, fueled by a Nikkei report suggesting that BoJ is finally near to the end its negative interest rate policy. This policy shift, which could see interest rates rise as early as the first half of next year, hinges on the outcomes of spring labor-management negotiations and consumer spending development. Such a move, if realized, would mark a major shift in monetary policy, being the first interest rate hike in 17 years.

Nikkei report indeed aligns closely with BoJ’s existing communication, where a wage-price spiral is considered a prerequisite for any rate hike. While BoJ has not specified a timeline, the timing of spring wage negotiations make the first half of 2024 a plausible period for this policy change.

In a related development, Yomiuri newspaper reported that Japan’s top business lobby, Keidanren, plans to discuss the potential negative impacts of Yen’s weakness on the economy. This is a notable shift, as Keidanren, comprising major companies in the automotive and electronics sectors, has traditionally favored a weak yen. A reevaluation of this stance could intensify calls for BoJ to end ultra-loose monetary policy, reflecting a changing perspective in Japan’s business sector regarding currency valuation and economic impact.

Globally, Dollar is underperforming, extending its near-term sell-off. Euro, continuing to struggle too, has failed to break out from its near-term range against the weak Dollar. Swiss Franc is performing marginally better than Euro, while Sterling appears firmer among European currencies. Interestingly, Australian Dollar is currently the second strongest after Yen, showing resilience despite weak retail sales data, followed by Canadian Loonie and New Zealand Kiwi.

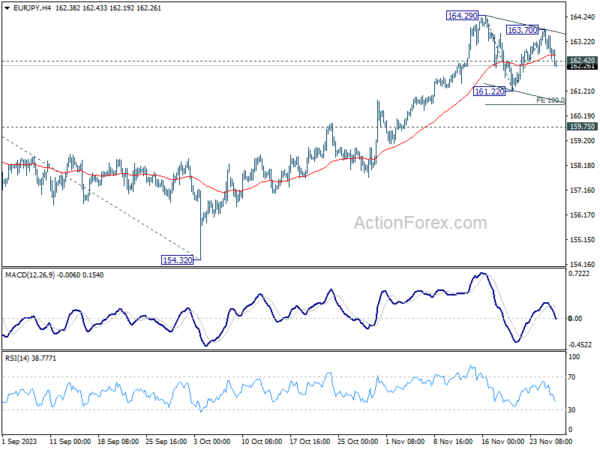

From a technical standpoint, EUR/JPY’s break of 162.42 minor support indicates the start of the third leg of the corrective pattern from 164.29. Deeper fall could reach 161.22 support and potentially lower, though strong support is expected around 159.75 resistance-turned-support to complete the correction. However, decisive fall through 159.75 would be a significant indicator of Yen’s underlying strength.

In Asia, at the time of writing, Nikkei is down -0.31%. Hong Kong HSI is down -0.60%. China Shanghai SSE is up 0.10%. Singapore Strait Times is down -0.38%. Japan 10-year JGB yield is down -0.0075 at 0.768. Overnight, DOW fell -0.16%. S&P 500 fell -0.20%. NASDAQ fell -0.07%. 10-year yield fell -0.083 to 4.389.

Australia retail sales down -0.2% mom in Oct, strategic delay for Black Friday

Australia’s retail sales turnover in October displayed an unexpected downturn, falling by -0.2% mom, contrary to the anticipated rise of 0.1% mom. This decline follows a period of growth, with 0.9% mom increase in September and 0.2% mom rise in August.

Ben Dorber, head of retail statistics at ABS, noted “Retail turnover fell in October after a short-lived boost in spending in September.” This downturn was seen across all retail categories except food retailing.

Dorber attributed this pause in consumer spending to a strategic delay by consumers, who are likely waiting to capitalize on Black Friday sales events in November. He observed that this has become a recurring pattern in recent years, with Black Friday sales gaining increasing popularity among consumers.

RBA’s Bullock: we have to be a little bit careful in this period

In a central bank conference held in Hong Kong, RBA Governor Michele Bullock said that monetary policy is currently restrictive, a necessary stance to moderate demand and anchor inflation expectations.

Bullock highlighted the need to be “a little bit careful,” in this period, aiming to control inflation and bring it back within target range of 2-3%, while also being mindful of not overly burdening the economy or causing a significant rise in unemployment rates.

Bullock also pointed out the emergence of “second-round effects” in areas like wages, observing that businesses are currently able to pass on increased costs to maintain profit margins, a trend reflecting sufficient demand.

At the same panel, BoE Deputy Governor Dave Ramsden stated that monetary policy in UK would likely need to remain “restrictive for an extended period” to effectively bring inflation back to 2% target.

Additionally, Pablo Hernández de Cos, Governor of Bank of Spain, noted that tight monetary policy is necessary in the short term. However, he also mentioned the possibility of easing should inflation slow as forecasted.

Looking ahead

Germany Gfk consumer confidence and Eurozone M3 will be release in European session. Later in the day, US will release house price index and consumer confidence.

USD/JPY Daily Outlook

Daily Pivots: (S1) 148.26; (P) 148.97; (R1) 149.40; More…

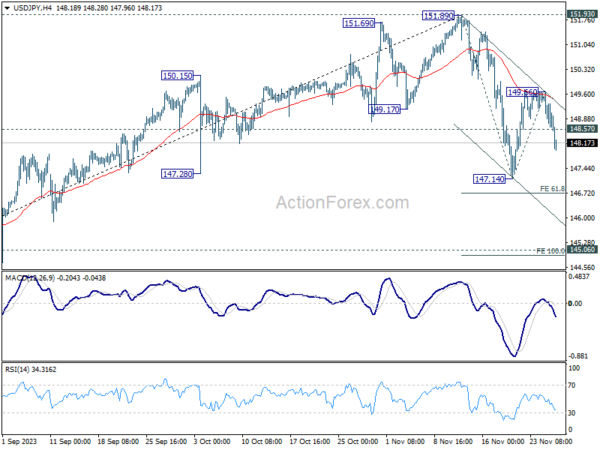

USD/JPY’s break of 148.57 minor support indicates rejection by 55 4H EMA. Intraday bias is back on the downside to extend the decline from 151.9. Next target is 147.14 support. Further break of 61.8% projection of 151.89 to 147.14 from 149.66 at 146.72will pave the way to 100% projection at 149.91, which is close to 145.06 key resistance turned support. For now, risk will stay on the downside as long as 149.66 resistance holds, in case of recovery.

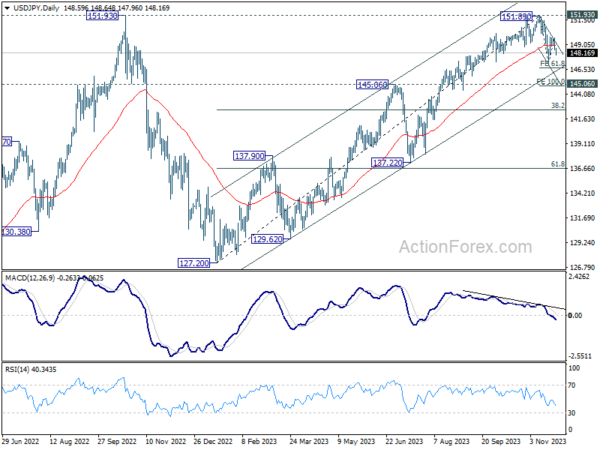

In the bigger picture, rise from 127.20 (2023 low) is seen as the second leg of the pattern from 151.93 (2022 high). Decisive break of 145.06 resistance turned support will confirm that this second leg has completed, after rejection by 151.93. Deeper fall would be seen through 38.2% retracement of 127.20 to 151.89 at 142.45 to 61.8% retracement at 136.63. Nevertheless strong bounce from 145.06 will retain medium term bullishness for another test on 151.93 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:01 | GBP | BRC Shop Price Index Y/Y Oct | 4.30% | 5.20% | ||

| 00:30 | AUD | Retail Sales M/M Oct | -0.20% | 0.10% | 0.90% | |

| 07:00 | EUR | Germany Gfk Consumer Confidence Dec | -28.5 | -28.1 | ||

| 09:00 | EUR | Eurozone M3 Money Supply Y/Y Oct | -0.90% | -1.20% | ||

| 14:00 | USD | S&P/Case-Shiller Home Price Indices Y/Y Sep | 4.20% | 2.20% | ||

| 14:00 | USD | Housing Price Index M/M Sep | 0.40% | 0.60% | ||

| 15:00 | USD | Consumer Confidence Nov | 101 | 102.6 |