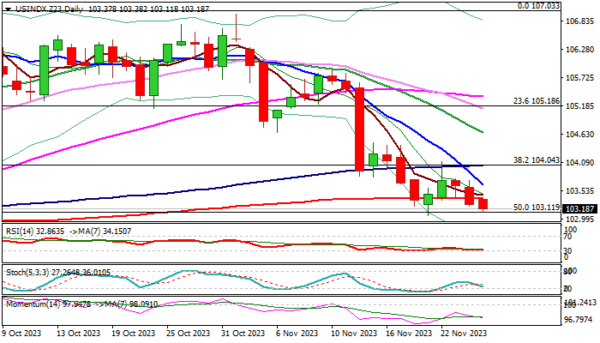

The dollar index keeps bearish stance at the beginning of the week and cracks the upper boundary of pivotal 103.11/102.84 support zone (50% retracement of 99.20/107.03 rally / Nov 21 three-month low/weekly cloud base).

Last Friday’s close below 200DMA (102.38) generated initial bearish signal which looks for confirmation on firm break of 103/11/102.84 to signal continuation of a downtrend from 107.03/106.96 double top and spark fresh acceleration towards 102.19/00 (Fibo 61.8% / round figure).

Daily studies show strong negative momentum and converging daily Tenkan/Kijun-sen pointing to increasingly bearish configuration.

Growing expectations of an end of Fed’s tightening cycle and speculations of rate cuts in mid-2024, keep the dollar under pressure, as markets await releases of US Q3 GDP and Oct PCE Price Index (Fed’s preferred inflation gauge) for more clues about the next steps of the US central bank.

Broken 200DMA reverted to initial resistance, followed by falling 10DMA (103.66), guarding upper pivot at 104.04 (broken 100DMA / Fibo 38.2%).

Res: 102.38; 103.66; 104.04; 104.66.

Sup: 102.84; 102.19; 102.00; 101.59.