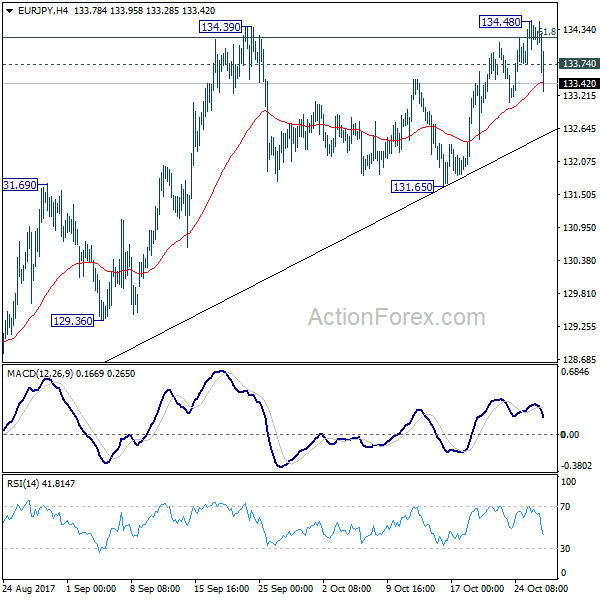

Daily Pivots: (S1) 133.90; (P) 134.20; (R1) 134.64; More…

EUR/JPY’s sharp fall suggests rejection from 134.39 key resistance. That is, rise from 131.65 could have completed. Intraday bias is turned back to the downside for 131.65. Overall outlook will remain bullish as long as 131.65 holds and another rise is still in favor. But firm break of 131.65 will suggest reversal and turn focus to 127.55 key support. On the upside, sustained trading above 134.39 will confirm up trend resumption and and target 141.04 long term resistance.

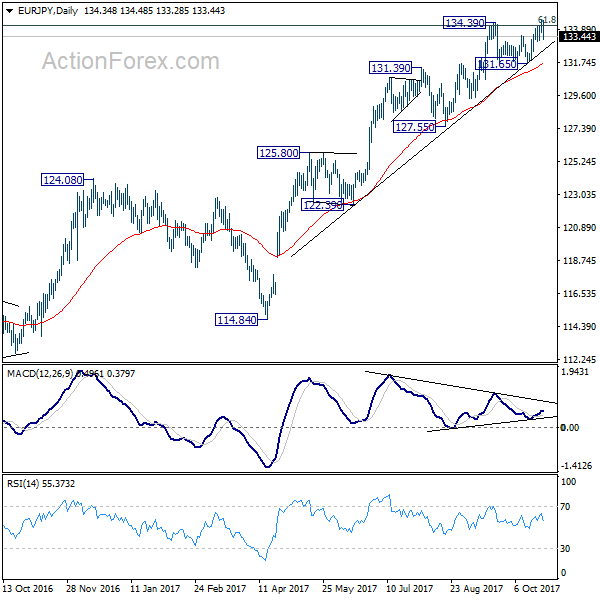

In the bigger picture, medium term rise from 109.03 (2016 low) is seen as at the same degree as the down trend from 149.76 (2014 high) to 109.03 (2016 low). 61.8% retracement of 149.76 to 109.03 at 134.20 is already met. Sustained break there will pave the way to key long term resistance zone at 141.04/149.76. However, break of 127.55 support will argue that the medium term trend has reversed and will turn outlook bearish for deeper fall.