Japanese Yen’s rally continued in today’s Asian session, breaking through 148 mark against Dollar. This rise raises questions about the reaction of Japanese Finance Minister Shunichi Suzuki, particularly in light of his previous comments during Yen’s decline this year. Suzuki had described the decline as “one-sided” and driven by “speculations.” The current volatility, contrasting the steady depreciation since August, could be seen as “excessive,” but it remains to be seen if Suzuki will comment similarly on this rapid ascent.

A key question for market analysts is the extent and nature of the Yen’s rise. It’s unclear whether this represents a mere correction to the year’s downtrend or signals a more fundamental reversal. Chinese Yuan’s movements could provide clues here, as USD/JPY and USD/CNH have mirrored each other for two years. With USD/CNH falling to its lowest level since July and approaching key 7.154 cluster support level, a decisive break could indicate a bearish trend reversal, potentially serving as a leading indicator for USD/JPY.

In the broader currency markets, New Zealand and Australian Dollars emerged as strong performers, followed Yen. Australian Dollar, in particular, is finding support from hawkish minutes released by RBA. These minutes highlighted the central bank’s prioritization of inflation control, aligning with its latest rate hike decision. The emphasis on fighting inflation keeps the odds of another hike in Q1 alive.

Dollar, on the other hand, is currently the weakest performer as the market shifts its focus to the upcoming FOMC minutes. Substantial hints about future moves might not be forthcoming. Fed is expected to maintain its narrative of keeping rates high for as long as necessary. The December FOMC meeting, featuring new economic forecasts and dot plots, is anticipated to be more impactful in shaping expectations.

Canadian Dollar trails as the second weakest, with markets awaiting Canada’s CPI data. This report is crucial as it is the last before BoC decision on December 6. Expectations are for further progress in disinflation, with core measures slowing. Any downside surprises in today’s CPI data could solidify expectations of a BoC rate hold in the upcoming meeting.

In Asia, at the time of writing, Nikkei is down -0.02%. Hong Kong HSI is up 1.00%. China Shanghai SSE is up 0.46%. Singapore Strait Times is down -0.28%. Japan 10-year JGB yield is down -0.0415 at 0.702. Overnight DOW rose 0.58%. S&P 500 rose 0.74%. NASDAQ rose 1.13%. 10-year yield dropped -0.019 to 4.422.

Fed’s Barkin: Inflation settling but job not done

Richmond Fed President Thomas Barkin, in an interview with Fox Business overnight, noted the positive aspects of the current economic situation, stating, the economy is “still growing” while unemployment is “still 3.9%”, and “inflation does to be settling”. “he added, “all that’s good”.

Despite these encouraging signs, Barkin emphasized that Fed’s work on bringing inflation down is far from complete. “But the job’s not done, and so you have to keep on until you get the job done, and we’ll see where we land,” he remarked.

Central to Barkin’s focus, and by extension, Fed’s, is the objective of returning inflation to the central bank’s target. “Inflation convincingly coming back to target — that’s my marker. And you can get there a lot of different ways,” Barkin elaborated.

He also expressed a desire to see a return to the pre-pandemic economic environment, where excessive price increases were not commonly used as a management strategy. “But I’m still looking to be convinced that price-setters in this economy have gotten back to where they were three or four years ago, which was an understanding that above-normal price increases just weren’t a management lever.”

BoE’s Bailey cautions against premature rate cut expectations

BoE Governor Andrew Bailey, in his remarks at an event overnight, has strongly indicated that the central bank is not yet in a position to consider reducing interest rates, stating it was “far too early to be thinking about rate cuts”.

He warned about the persistently high services inflation and noted that wage growth remains “elevated.” He added, when inflation is high, we take no chances.”

In his remarks, Bailey pointed out that the Monetary Policy Committee’s latest projections suggest that restrictive monetary policy stance will likely be necessary for “quite some time yet”.

Bailey also stressed the need for vigilance regarding inflation trends, indicating that BoE remains open to further interest rate increases if necessary. “We must watch for further signs of inflation persistence that may require interest rates to rise again,” he cautioned.

RBA’s Bullock: Australian economy faces prolonged inflation challenge

RBA Governor Michele Bullock, speaking at the Australian Securities and Investments Commission Annual Forum, emphasized the persistent challenge of inflation for the Australian economy. Bullock forecasted that inflation would remain a “crucial challenge” for the next “one or two years,” highlighting the complexity and longevity of the problem.

Bullock addressed a common misconception about the current inflationary environment, stating, “There is a bit of a perception around that the inflation at the moment really is all a supply driven thing – petrol prices, rents, these sorts of things, energy.” However, she clarified that there is also a significant “demand component” contributing to inflation, which central banks globally are striving to manage.

Governor Bullock also touched upon global issues, noting, “In a world of fragmentation and conflicts … We’re going to see more potential for supply shocks.” She explained the dilemma central banks face regarding such shocks: while the typical approach is to look through temporary supply shocks, a continuous stream of them can lead to entrenched inflation expectations. Bullock warned, “If inflation expectations adjust, then that’s a problem.”

RBA minutes indicate inflation control at forefront

RBA meeting minutes from November 7 reveal a decisive step in monetary policy adjustment, with a 25bps increase in cash rate to 4.35%. This move reflects the RBA’s heightened focus on managing inflationary pressures and aligning with its long-term targets.

The members’ discussion was centered around two options: raising the cash rate or maintaining it at its current level. The decision to increase the rate was influenced by the consensus that this was the “stronger” course of action.

Achieving inflation targets by the end of 2025 played a significant role in the decision-making process. RBA members acknowledged an increased risk of not meeting these targets, suggesting the necessity of a prompt policy response.

The minutes also reveal a strategic consideration of future scenarios. Delaying the rate adjustment was seen as potentially necessitating a “larger” policy response in the future, especially if inflation pressures intensify.

Preventing a significant rise in inflation expectations was another critical concern. The RBA aimed to avoid any shift in market sentiment that could destabilize inflationary trends. This is particularly relevant given the Board’s emphasis on “low tolerance” for delayed inflation target achievement.

Also, staff’s inflation forecasts, which anticipated one or two rate rises, further underscored the necessity of the rate hike.

New Zealand’s trade deficit narrows, led by reduced exports and imports to China

New Zealand’s trade figures for October have shown significant decrease in both goods exports and imports, leading to a narrowed monthly trade deficit. Exports fell by NZD -552m, or 9.3% yoy decline, totaling NZD 5.4B. Imports also saw a substantial drop of NZD -1.2B, or -14% yoy, to NZD 7.1B. Trade deficit consequently narrowed from NZD -2425m to NZD -1709m, which is larger than expected deficit of NZD -1150m.

A significant aspect of these shifts was the marked decrease in both exports and imports to and from China. China, being New Zealand’s top trading partner, saw the highest monthly fall in exports with a decrease of NZD -308m, amounting to – 19% reduction. This decline was echoed in imports from China, which fell by NZD -353m, a decrease of -18%.

Other key trading partners also showed varied trends. Exports to Australia decreased by NZD -128m (-15%), and to EU by NZD -84m (-24%). In contrast, exports to US slightly increased by NZD 2.9m (0.5%), and to Japan by NZD 25m (9.3%).

In terms of imports, apart from China, EU and US also registered significant drops, with decreases of NZD -138m (-11%) and NZD -146m (-20%), respectively. Imports from Australia and South Korea saw reductions of NZD -35m (-4.4%) and NZD -133m (-23%), respectively.

Looking ahead

Swiss trade balance and UK public sector borrowing will be released in European session. Later in the day, Canada CPI and FOMC minutes are the main focuses.

AUD/USD Daily Report

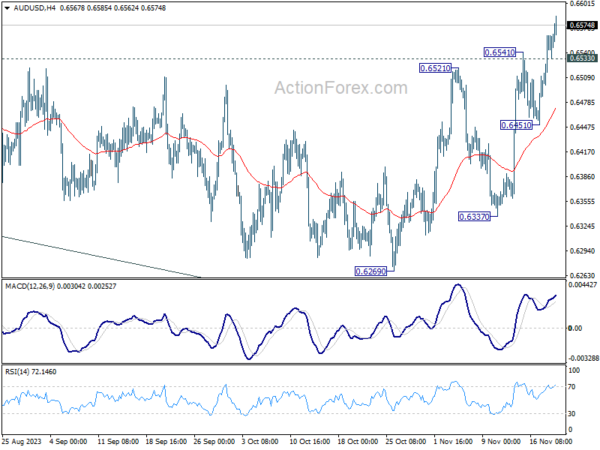

Daily Pivots: (S1) 0.6517; (P) 0.6541; (R1) 0.6581; More…

AUD/USD rises further to 0.6585 so far as rally from 0.6269 continues today. Intraday bias stays on the upside at this point. Current development argues that whole decline from 0.7156 has completed with three waves down to 0.6269. Further rally should be seen to falling channel resistance (now at 0.6676) next. On the downside, below 0.6533 minor support will turn intraday bias neutral first. But risk will stay on the upside as long as 0.6451 support holds.

In the bigger picture, there is no confirmation that down trend from 0.8006 (2021 high) has completed. While current rebound from 0.6269 might extend higher, it could be the third leg of the corrective pattern from 0.6169 (2022 low) only. For now, medium term bearishness will remain as long as 0.6894 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Oct | -1709M | -1150M | -2329M | -2425M |

| 00:30 | AUD | RBA Meeting Minutes | ||||

| 07:00 | CHF | Trade Balance (CHF) Oct | 5.87B | 6.32B | ||

| 07:00 | GBP | Public Sector Net Borrowing (GBP) Oct | 21.0B | 13.5B | ||

| 13:30 | CAD | New Housing Price Index M/M Oct | 0.00% | -0.20% | ||

| 13:30 | CAD | CPI M/M Oct | 0.20% | -0.10% | ||

| 13:30 | CAD | CPI Y/Y Oct | 3.20% | 3.80% | ||

| 13:30 | CAD | CPI Core M/M Oct | -0.10% | |||

| 13:30 | CAD | CPI Median Y/Y Oct | 3.60% | 3.80% | ||

| 13:30 | CAD | CPI Trimmed Y/Y Oct | 3.60% | 3.70% | ||

| 13:30 | CAD | CPI Common Y/Y Oct | 4.30% | 4.40% | ||

| 15:00 | USD | Existing Home Sales Oct | 3.91M | 3.96M | ||

| 19:00 | USD | FOMC Minutes |