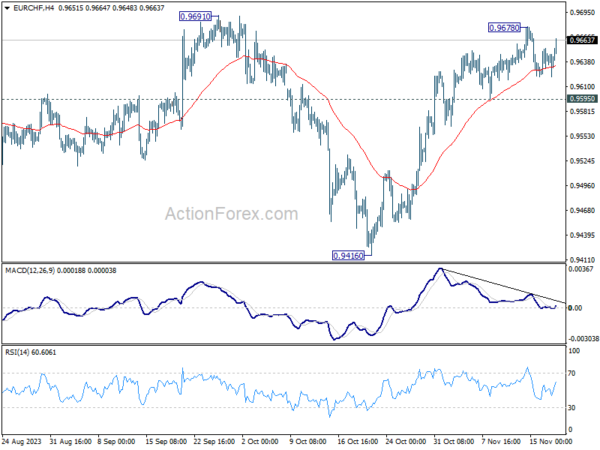

EUR/CHF edged higher to 0.9678 last week but turned retreated since then. Initial bias stays neutral this week for consolidations first. Further rally is expected as long as 0.9595 support holds. Firm break of 0.9678/91 resistance zone will carry larger bullish implication. Nevertheless, break of 0.9595 support will indicate short term topping, and turn bias back to the downside for deeper pull back.

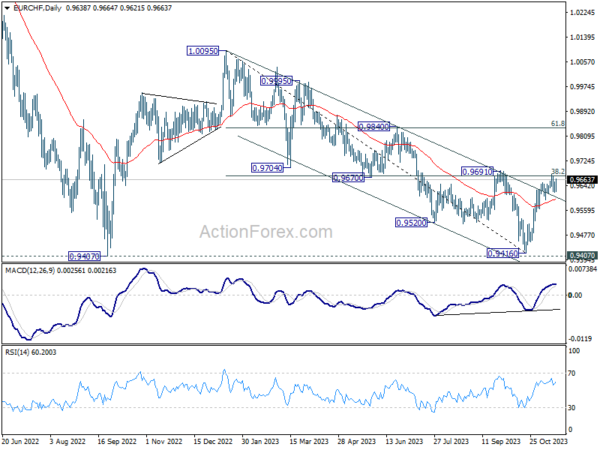

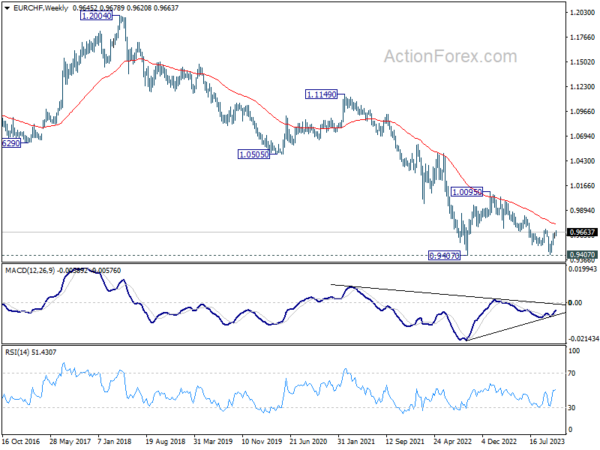

In the bigger picture, fall from 1.0095 (2023 high) might have completed at 0.9416, just ahead of 0.9407 support (2022 low). Sustained break of 0.9691 cluster resistance (38.2% retracement of 1.0095 to 0.9416 at 0.9675) will pave the way to 61.8% retracement at 0.9836 and above. However, rejection by 0.9691 will maintain medium term bearishness for another test on 0.9407 at least.

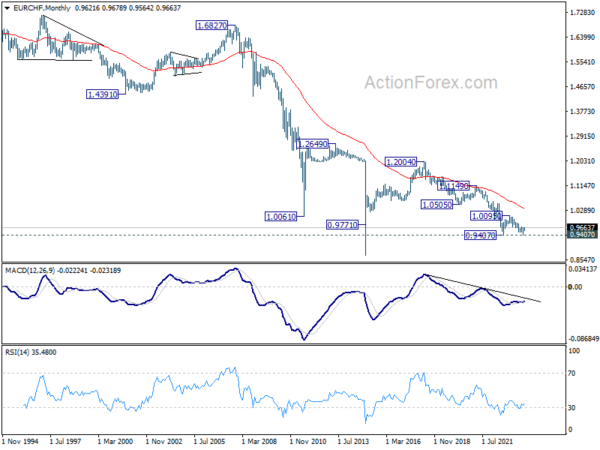

In the long term picture, outlook remains bearish as it’s staying well below 55 M EMA (now at 1.0341). Price actions from 0.9407 are viewed as a three-wave consolidation pattern first. Larger down trend from 1.2004 (2018 high) might still resume through 0.9407 at a later stage. Break of 1.0095 resistance is needed to be the first sign of bottoming, or the multi-decade down trend is expected to continue.