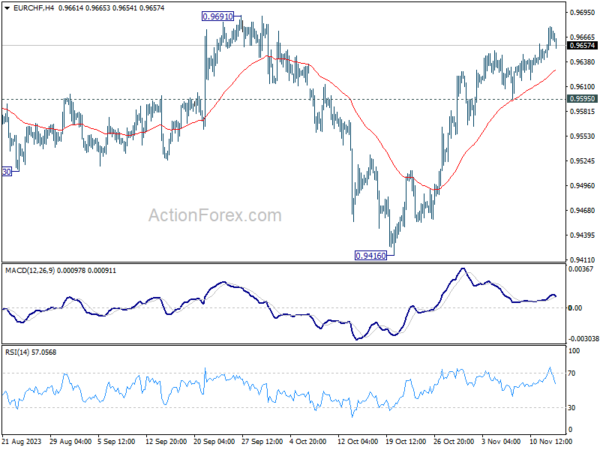

Daily Pivots: (S1) 0.9652; (P) 0.9666; (R1) 0.9688; More…

EUR/CHF’s rally from 0.9416 is still in progress and intraday bias stays on the upside for 0.9691 resistance. Firm break there will argue that whole decline from 1.0095 has completed, just ahead of 0.9407 support (2022 low). Nevertheless, break of 0.9595 support will indicate short term topping, and turn bias back to the downside for deeper pull back.

In the bigger picture, fall from 1.0095 (2023 high) might have completed at 0.9416, just ahead of 0.9407 support (2022 low). Sustained break of 0.9691 cluster resistance (38.2% retracement of 1.0095 to 0.9416 at 0.9675) will pave the way to 61.8% retracement at 0.9836 and above. However, rejection by 0.9691 will maintain medium term bearishness for another test on 0.9407 at least.