- Gold prices retreat from recent highs, despite sharp drop in US yields

- It seems safe-haven flows are unwinding as geopolitical nerves calm

- For gold to rally back to record highs, it might need a recession

Sinking yields unable to boost gold

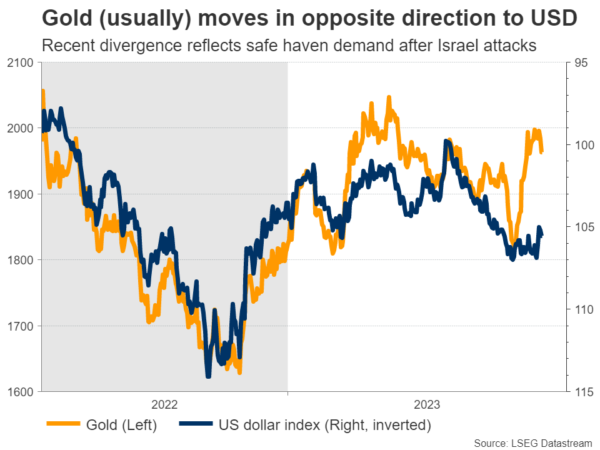

On paper, last week had all the elements to be incredibly bullish for gold. Yields on US government bonds came crashing down, which in turn inflicted heavy damage on the US dollar. Both of these developments are normally positive for gold prices, and yet the precious metal was unable to advance.

Yields are essentially the price of money, so they can be considered interest rates that are determined by market forces. Gold doesn’t pay any interest to hold, so when yields or interest rates fall, the metal becomes more attractive by comparison. In similar logic, because gold is denominated in US dollars, a weaker dollar is also beneficial for gold as it makes it cheaper to buy for foreign investors.

Hence, it is strange that gold could not rally even with such a favorable setup in bond and FX markets, and instead moved lower. It appears these positive effects were overpowered by something even stronger, and the answer might boil down to geopolitics.

No escalation in the Middle East

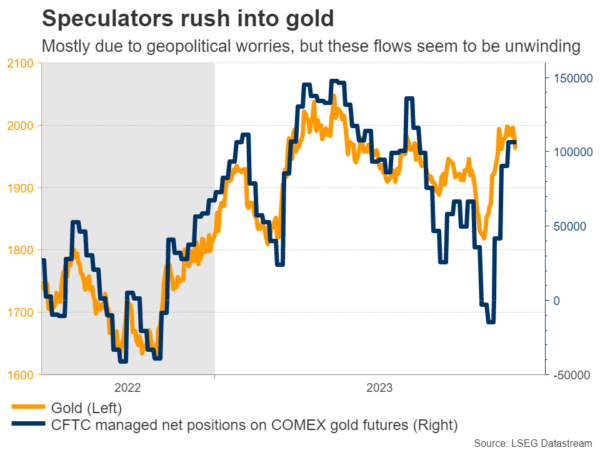

After Israel was attacked in early October, gold prices rallied more than 10% in the next few weeks as safe-haven demand went into overdrive. Investors were running scared about an escalation in the conflict that could spread to the entire region and drag Iran into the war. Gold is considered the ultimate hedge against such geopolitical risks.

But the conflict never escalated. As horrific as the situation is, it hasn’t spiraled out of control to engulf the whole Middle East. And since the threat never materialized, it appears that speculators have started to exit some of their long positions in gold that were meant to protect them from a conflagration in the war.

Therefore, fading demand for safe haven assets might be behind gold’s relative weakness. The recent decline in oil prices argues the same point. Oil has also served as a barometer for geopolitical stress over the past month amid concerns of potential disruptions to crude shipments. Hence, the selloff in oil reinforces the view that the ‘war premium’ is being priced out.

Central bank purchases

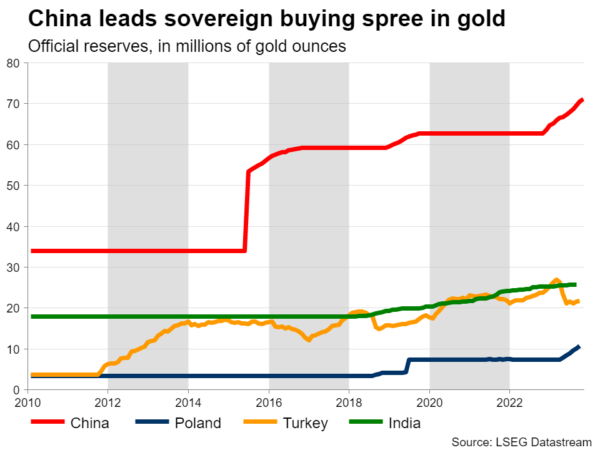

Beyond the flare up in Israel, another important factor that has supported gold prices this year have been direct purchases by central banks, led by China. Beijing is essentially trying to diversify its reserves, shifting away from dollars or euros and towards gold.

This trend started after Ukraine was invaded. The subsequent sanctions against Russia saw around half of the nation’s reserve assets getting frozen. Naturally, China is concerned about suffering the same fate should diplomatic relations with the West deteriorate. As such, Beijing is buying hard assets like gold, which cannot be frozen so easily.

Considering that the ‘new Cold War’ between the US and China continues to heat up, spreading to technology sanctions lately with America banning the export of advanced semiconductor chips to China, this strategic shift towards gold could be a multi-year process.

What would it take for new record highs?

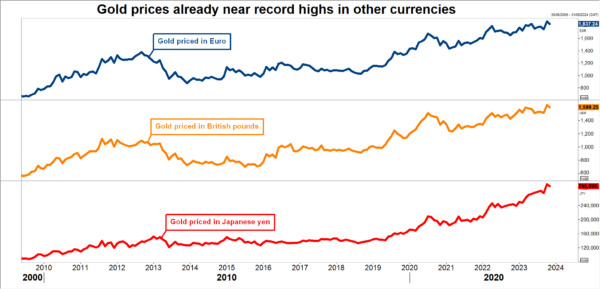

All told, despite the volatility, gold prices have been trapped in a wide sideways range for three years now, trading between the lower bound of $1,680 and the record high of $2,072. A significant catalyst will probably be required for this range to be broken.

A return of recession fears might be the most powerful trigger for a sustainable rally in gold. If market participants panic about the economic outlook, fueling bets of Fed rate cuts, that could push yields sharply lower and by extension breathe life into gold. This might be a story for next year, as the global economic data pulse has started to weaken.

A softer US dollar can also do the trick. Gold prices are already at record levels when denominated in other currencies except for the dollar, as shown on the chart above. Hence, a persistent decline in the dollar could be another blessing for gold. That said, this scenario seems unlikely considering that most economies are in worse shape than the United States.

To conclude, the performance of gold will be decided by a combination of geopolitical tensions, the path of interest rates, direct central bank purchases, and how the economic landscape evolves.

In this sense, the near-term outlook seems somewhat negative, amid fading geopolitical demand. However, the tides could turn next year as the world economy loses steam and some regions go into recession, giving gold the firepower it needs for another rally towards record highs.