Euro recovers overnight against Dollar and remains generally firm this week. It’s just overpowered by Sterling which was shot up by strong Q3 GDP data. ECB policy decision and press conference will be the main highlight for today. The central bank is widely expected to announce recalibration of its EUR 60B a month asset purchase program, after it expires by the end of this year. The general consensus is that ECB will half the program to EUR 30B per month, but give it a 9-month extension till end of September 2018.

One important thing to note is recent repeated comments of ECB chief economist Peter Praet. He noted that calmness in the markets makes it more appropriate for smaller monthly purchases with longer duration, because investors are more patient. This could be a yardstick in gauging how comfortable ECB policy makers are regarding economic and inflation outlook. That is:

- = EUR 30B, = 9 months – base case

- = EUR 30B, > 9 months – dovish

- = EUR 30B, < 9 months – hawkish

- > EUR 30B, = 9 months – dovish

- > EUR 30B, > 9 months – very dovish

- > EUR 30B, < 9 months – still dovish

- < EUR 30B, = 9 months – hawkish

- < EUR 30B, < 9 months – very hawkish

- < EUR 30B, > 9 months – cautiously hawkish

BoC turned cautious, Loonie dives

Canadian Dollar tumbles sharply overnight after BoC rate decision. Showing genuine concerns over the downside risks to inflation, BoC indicated it would be more ‘cautious’ over future rate hike decisions. In the concluding statement, policymakers stressed that ‘while less monetary policy stimulus will likely be required over time, Governing Council will be cautious in making future adjustments to the policy rate’. The tone in this October appears more dovish than previous ones, likely resulting from recent developments of disappointing progress in NAFTA negotiations, household debt levels and appreciation of Canadian dollar. More in BOC Pledges Cautiousness In Future Rate Hike

Yen and Franc rebounded strongly

Yen and Swiss Franc staged strong rebound overnight. Pull back in equities is still as a contributing factor. DOW lost -0.48%, S&P 500 lost -0.47%, NASDAQ lost -0.52%. But the rally in 10 year yield indicates that it’s likely just a temporary pull back after record runs. TNX indeed closed higher by 0.038, at 2.444, and is still on course for 2.621 high later this year. The more likely factor for yesterday’s rebound in Yen and Franc is probably receding expectation for aggressive global rate hikes. That followed after disappointing Australia CPI and then dovish BoC statement. But it should still be noted that the trend of monetary stimulus exit is still there, probably just not as fast as prior BoC hikes implied.

Yesterday’s sharp fall in AUD/JPY now puts 87.24 near term support in focus. Firm break there will be an early sign of medium term topping, on bearish divergence condition in daily MACD. Further break of 85.44 support will bring deeper fall to 81.48 cluster (50% retracement of 72.39 to 90.29 at 81.34) before drawing enough support for sustainable rebound.

On the data front

New Zealand trade deficit narrowed slightly to NZD 1143M in September. Australia import price index dropped -1.6% qoq in Q3. Japan corporate service price index rose 0.9% yoy in September. German Gfk consumer sentiment, Eurozone M3 and UK CBI reported sales will be released in European session. US will release jobless claims, wholesale inventories, trade balance and pending home sales.

USD/CAD Daily Outlook

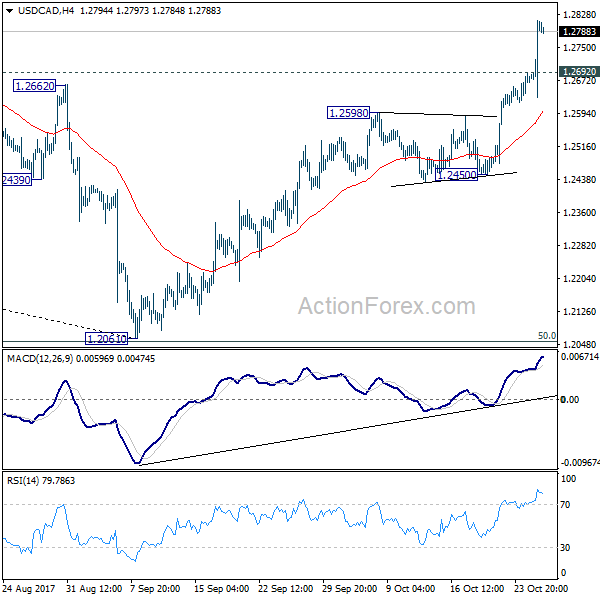

Daily Pivots: (S1) 1.2679; (P) 1.2748; (R1) 1.2864; More….

USD/CAD surges to as high as 1.2816 so far. The breach of 1.2777 resistance affirms our view of medium term reversal. Intraday bias remains on the upside. Sustained break of 1.2777 will pave the way to 38.2% retracement of 1.4689 to 1.2061 at 1.3065 next. On the downside, below 1.2692 minor support will turn intraday bias neutral and bring consolidations. But outlook will remain bullish as long as 1.2450 support holds.

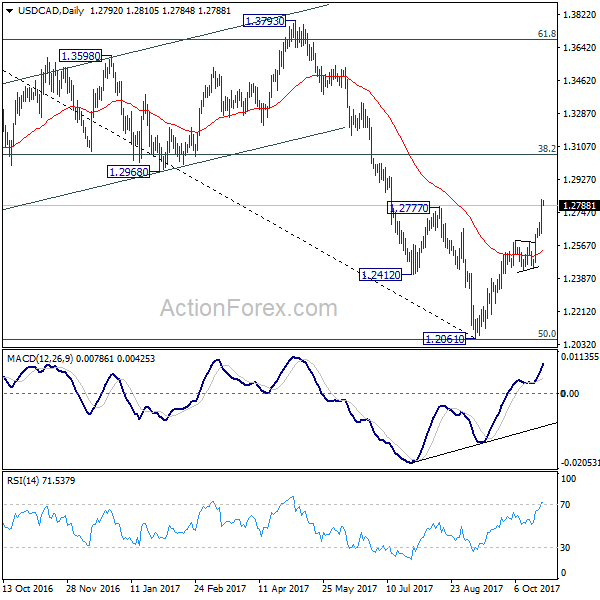

In the bigger picture, USD/CAD should have defended 50% retracement of 0.9406 (2011 low) to 1.4869 (2016 high) at 1.2048. And with 1.2048 intact, we’d favor the case that fall from 1.4689 is a correction. Break of 1.2777 will further affirm this bullish case. That is, larger up trend from 0.9406 is not completed. And in that case, USD/CAD should target 1.3793 key resistance next. However, on the other hand, firm break of 1.2048 will indicate that fall from 1.4689 is at least a medium term down trend and should target 61.8% retracement at 1.1424 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Sep | -1143M | -900M | -1235M | -1179M |

| 23:50 | JPY | Corporate Service Price Y/Y Sep | 0.90% | 0.80% | 0.80% | |

| 0:30 | AUD | Import Price Index Q/Q Q3 | -1.60% | -1.50% | -0.10% | |

| 6:00 | EUR | German GfK Consumer Confidence Nov | 10.8 | 10.8 | ||

| 8:00 | EUR | Eurozone M3 Y/Y Sep | 5.00% | 5.00% | ||

| 10:00 | GBP | CBI Realized Sales Oct | 14 | 42 | ||

| 11:45 | EUR | ECB Rate Decision | 0.00% | 0.00% | ||

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | USD | Wholesale Inventories Sep P | 0.90% | |||

| 12:30 | USD | Initial Jobless Claims (OCT 21) | 236K | 222K | ||

| 12:30 | USD | Advance Goods Trade Balance (USD) Sep | -63.8B | -62.9B | ||

| 12:30 | USD | Retail Inventories M/M Sep | 1.00% | 0.90% | ||

| 14:00 | USD | Pending Home Sales M/M Sep | 0.60% | -2.60% | ||

| 14:30 | USD | Natural Gas Storage | 51B |