Markets reacted with notable positivity to the latest US. non-farm payroll report, which showed weaker-than-expected growth in jobs, a higher unemployment rate, and subdued wage inflation. Stock futures leaped as the data appeared to assuage investor concerns about further tightening by Fed. In a sharp response, 10-year Treasury yield plunged through 4.55% level, exacerbating the week’s precipitous decline and signalling a potential shift in investor expectations regarding the trajectory of interest rates. Dollar experienced a broad sell-off, intensifying its decline for the week.

While Canadian dollar was burdened by its own disappointing employment figures, it nevertheless surged against Dollar, reflecting the greenback’s broad weakness. Meanwhile, New Zealand and Australian dollars emerged as the strongest performers for the day, buoyed not only by the narrowing yield differential but also by a surge in risk appetite.

Euro and Sterling capitalized on Dollar’s weakness, with both currencies making substantial gains. Conversely, Yen and Swiss Franc were notable laggards in the currency markets, potentially due to their status as safe havens which are less attractive in an environment where risk sentiment is on the rise.

In Europe, at the time of writing, FTSE is down -0.02%. DAX is up 0.44%. CAC is up 0.15%. Germany 10-year yield is down -0.062 to 2.659. Earlier in Asia, Nikkei rose 1.10%. Hong Kong HSI rose 2.52%. China Shanghai SSE rose 0.71%. Singapore Strait Times rose 1.98%. Japan 10-year JGB yield dropped -0.0433 to 0.916.

US NFP grows 150k, unemployment rate rose to 3.9%

US non-farm payroll employment grew 150k in October, below expectation of 172k. That’s well below average monthly gain of 258k over the prior 12 months.

Unemployment rate rose from 3.8% to 3.9%, above expectation of being unchanged at 3.8%. Participation rate dropped from 62.8% to 62.7%.

Average hourly earnings rose 0.2% mom, below expectation of 0.3% mom. Over the 12 months, average hourly earnings rose 4.1% yoy.

Canada’s employment grew 17.5k, unemployment rate rose to 5.9%

Canada’s employment grew 17.5k in October, below expectation of 25.7.

Employment was up in construction (+23,000; +1.5%) and information, culture and recreation (+21,000; +2.5%) in October. This was offset by decreases in wholesale and retail trade (-22,000; -0.7%) and manufacturing (-19,000; -1.0%).

Unemployment rate rose from 5.7% to 5.9%, above expectation of 5.8%.

On a year-over-year basis, average hourly wages rose 4.8% yoy in October, following an increase of 5.0% yoy in September.

Eurozone unemployment rate rose to 6.5%, EU unchanged at 6.0%

Unemployment rate in Eurozone ticked up in September, rising to 6.5% from the previous month’s 6.4%. This uptick defied market expectations that the unemployment rate would hold steady.

Despite the month-over-month increase, the broader picture shows a labor market that has seen a significant year-over-year improvement, with Eurozone unemployment shrinking by -212k compared to September 2022. However, the monthly rise in unemployment, with 69k more individuals without work in the Eurozone, suggests that the region’s labor market might be facing new challenges as it enters the final quarter of the year.

The EU-wide unemployment rate remained constant at 6.0%, underscoring a more stable job market situation across the broader European Union. Nevertheless, the total number of unemployed persons in the EU rose by 95k month-over-month, bringing the number to approximately 13.026m, of which 11.017m are within the Eurozone.

UK PMI services finalized at 49.5, shallow downturn persists

UK PMI Services index was finalized at to 49.5 in October up fractionally from 49.3 in September, lingering in contraction territory for the third consecutive month. PMI Composite showed a minor improvement to 48.7 from an 8-month nadir of 48.5

Economics Director at S&P Global Market Intelligence, Tim Moore, highlighted, “A shallow downturn in UK service sector activity persisted in October as businesses struggled to make headway against a backdrop of worsening domestic economic conditions and stretched household budgets.”

The outlook remains cautious at best. “Forward-looking survey indicators suggested that service providers will continue to skirt with recession,” said Moore, noting that business optimism has dipped to its lowest point of the year.

On the brighter side, there was a silver lining with a slight uptick in new export sales. Furthermore, input cost inflation showed signs of easing, reaching its softest point in over two years due to reduced raw material prices and supplier discounting.

Nevertheless, this hasn’t stopped businesses from hiking prices. “Higher wages and fuel bills were still passed on to clients, which resulted in the strongest increase in average prices charged inflation for three months,” Moore explained.

China Caixin PMI services ticks to 50.4, composite fell to 50

China’s service sector showed a glimmer of resilience in October, with Caixin PMI Services edging up marginally from 50.2 to 50.4, meeting expectations. However, this slight uptick could not buoy the overall PMI Composite, which leveled at the neutral 50.0 threshold, down from 50.9 in the previous month.

The slight uptick in the services sector was overshadowed by a dip in manufacturing (which fell from 50.6 to 49.5). The details reveal a mixed scenario: composite new business inched forward at its weakest pace in ten months. Service providers and goods producers alike witnessed decelerated growth in sales.

Employment trends also painted a picture of caution. There was a small overall decline in jobs, with manufacturing bearing the brunt through more pronounced job losses, while employment in the service sector hit a plateau.

On the pricing front, inflationary pressures were somewhat contained. Input costs across the combined sectors rose modestly, maintaining a muted pattern of cost escalation. Despite this, firms nudged their selling prices upwards, continuing a trend that could suggest confidence in passing on costs, albeit the rate of charge inflation was just marginally lower than the 18-month peak seen in September.

EUR/USD Mid-Day Outlook

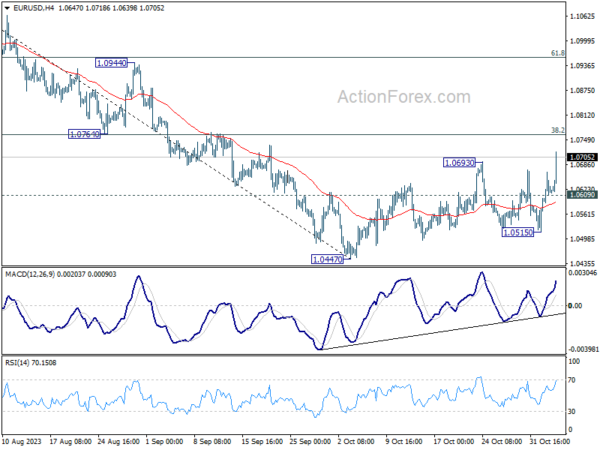

Daily Pivots: (S1) 1.0570; (P) 1.0619; (R1) 1.0672; More…

EUR/USD’s rebound from 1.0447 resumed by breaking through 1.0693 resistance. Intraday bias is back on the upside for 1.0764 cluster resistance (38.2% retracement of 1.1274 to 1.0447 at 1.0763). Decisive break there will pave the way to 61.8% retracement at 1.0958 next On the downside, below 1.0609 minor support will turn intraday bias neutral first.

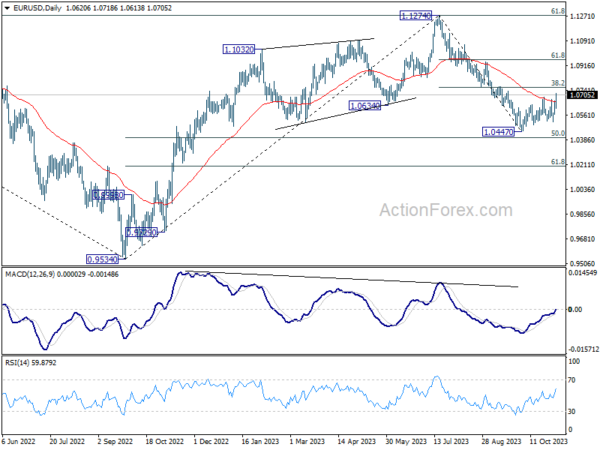

In the bigger picture, fall from 1.1274 medium term top could be viewed part of a correction to rise from 0.9534 (2022 low). An interim bounce from current level, as the second leg of the pattern, cannot be ruled out. But upside should be limited well below 1.1274 resistance to start the third leg. The pattern would likely at least have a take on 61.8% retracement of 0.9534 to 1.1274 at 1.0199 before completion.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:45 | CNY | Caixin Services PMI Oct | 50.4 | 50.4 | 50.2 | |

| 07:00 | EUR | Germany Trade Balance (EUR) Sep | 16.5B | 16.3B | 16.6B | 17.7B |

| 07:45 | EUR | France Industrial Output M/M Sep | -0.50% | 0.00% | -0.30% | -0.10% |

| 09:30 | GBP | Services PMI Oct F | 49.5 | 49.2 | 49.2 | |

| 10:00 | EUR | Eurozone Unemployment Rate Sep | 6.50% | 6.40% | 6.40% | |

| 12:30 | USD | Nonfarm Payrolls Oct | 150K | 172K | 336K | 297K |

| 12:30 | USD | Unemployment Rate Oct | 3.90% | 3.80% | 3.80% | |

| 12:30 | USD | Average Hourly Earnings M/M Oct | 0.20% | 0.30% | 0.20% | 0.30% |

| 12:30 | CAD | Net Change in Employment Oct | 17.5K | 25.7K | 63.8K | |

| 12:30 | CAD | Unemployment Rate Oct | 5.70% | 5.60% | 5.50% | |

| 13:45 | USD | Services PMI Oct F | 50.9 | 50.9 | ||

| 14:00 | USD | ISM Services PMI Oct | 53.2 | 53.6 |