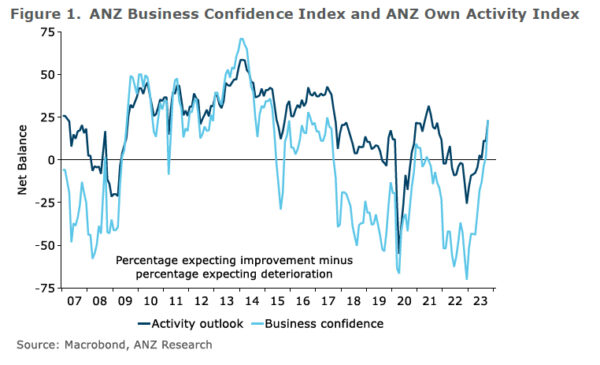

New Zealand’s ANZ Business Confidence for October showcased a significant rise, moving from 1.5 to a robust 23.4. This upbeat sentiment was mirrored in the Own Activity outlook, which climbed from 10.9 to 23.1.

A broader analysis of the report’s details reveals positive shifts across multiple components: Export intentions rose from -0.4 to 6.1, Investment intentions moved from a negative -4.1 to a positive 3.8, and Employment intentions took a jump from 1.2 to 5.6.

However, while these figures indicate growing optimism in business activities and prospects, inflation front remains a concern. Cost expectations reduced slightly from 78.6 to 76.0. Similarly, Pricing intentions saw a minor drop, moving from 47.1 to 46.3. Inflation expectations also experienced a negligible downtick, adjusting from 4.95% to 4.94%.

Reacting to these numbers, ANZ remarked, “Just as we thought that the rebound in activity indicators in the ANZ Business Outlook survey might be running out of steam, we’ve seen a marked jump across most.”

The bank also cautioned against hasty conclusions based on the current data, especially considering the potential disruptions from the election, suggesting a wait-and-watch approach: “we’ll see whether the newfound (relative) optimism persists over the next few months.”

On the inflation front, ANZ noted that, “inflation pressures are gradually waning in the big picture.” Despite this, the bank emphasized that significant progress in curbing inflation has been missing over recent months. The journey back to the inflation target remains substantial. “We continue to expect it’ll take at least one more OCR hike to get us there.”