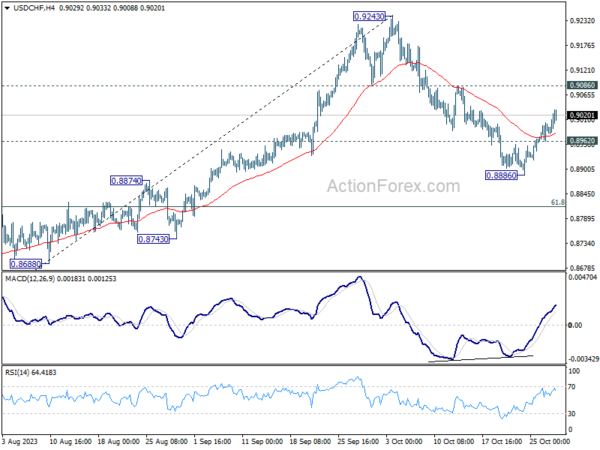

USD/CHF’s extended rebound last week suggests that a short term bottom was formed at 0.8886 already. Initial bias stays on the upside this week for 0.9086 resistance first. Sustained break there will pave the way back to 0.9342 resistance next. On the downside, however, below 0.8962 minor support will turn bias back to the downside for 0.8886 and possibly below.

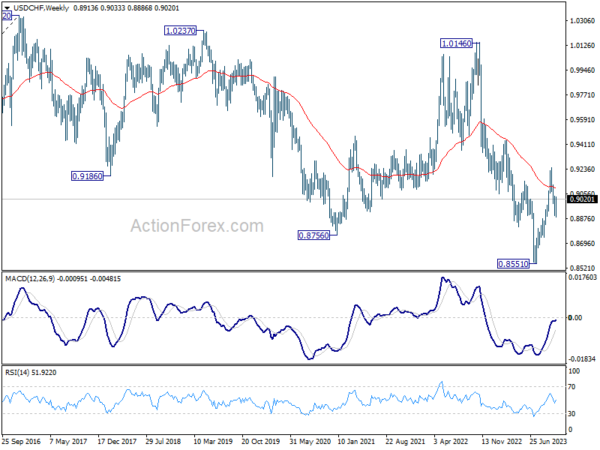

In the bigger picture, outlook is mixed up by the deeper than expected pull back from 0.9243. Yet there was no follow through selling after hitting 0.8886. On the upside, break of 0.9243 resistance will revive the case of medium term bottoming at 0.8851, and turn outlook bullish. However, sustained break of 61.8% retracement of 0.8551 to 0.9243 at 0.8815 will argue that larger decline from 1.0146 is ready to resume through 0.8551 low.

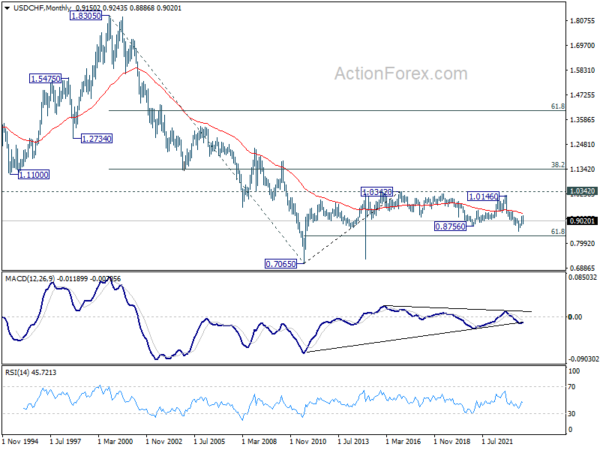

In the long term picture, there is no clear sign that down trend from 1.8305 (2000 high) has completed. With 38.2% retracement of 1.8305 to 0.7065 at 1.1359 intact, outlook is neutral at best.