US stocks underwent a marked decline overnight, with NASDAQ at the forefront, shedding -1.76% of its value. This follows closely on the heels of Wednesday’s downturn, where the tech-driven index recorded its most significant single-day loss in eight months, plummeting by -2.5%. Notably, several pivotal technical support have been violated, hinting that we might be witnessing the onset of a medium-term downtrend in NASDAQ.

Interestingly, the strong US Q3 GDP figures released overnight did little to lift investor spirits. Paradoxically, these robust economic indicators are fueling concerns about Fed maintaining higher interest rates for an extended period, rather than providing reassurance to the markets.

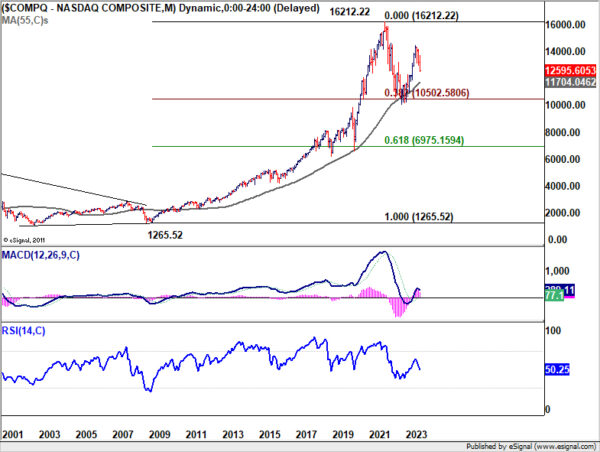

On the technical front, NASDAQ has taken out both 38.2% retracement of 10088.82 to 14446.55 at 12781.89 and 55 W EMA (now at 12826.98). These developments lend notion to the hypothesis that the entire rally from 10088.82 has concluded. Additionally, the break of channel support suggests that the index may be entering a phase of downside acceleration. For the near term, outlook will stay bearish as long as 13170.39 resistance holds. Next target is 61.8% retracement at 11753.47.

In a broader context, rise from 10088.82 (2022 low) is seen as the second leg of the corrective pattern from 16212.22 (2021 high). In a less bearish scenario, the fall from 14446.55 could merely be a correction to rise from 10088.82. In this case, significant support might emerge around the 55 M EMA (now at 11704.04), close to the aforementioned fibonacci level, triggering a substantial bounce.

However, in a gloomier perspective, the decline from 14446.55 might represent the third leg of the corrective pattern from 16212.22. This would suggest a more significant and persistent decline, plummeting below 10088.82. While it’s premature to definitively conclude, market’s reaction around 11700 level should provide valuable insights into future trends.