- As expected, ECB kept policy rates unchanged at today’s meeting and guided that they are done with additional rate hikes.

- Lagarde seemed to be on a mission not to rock the boat in terms of market pricing, she succeeded well and gave indications that this was a stock taking meeting only.

- Lagarde highlighted uncertainty about the economic outlook and remained confident that inflation would return to the target if rates were maintained for a sufficiently long duration at the current level, based on today’s inflation. Surprisingly, no discussion took place today on advancing the full end to PEPP reinvestments.

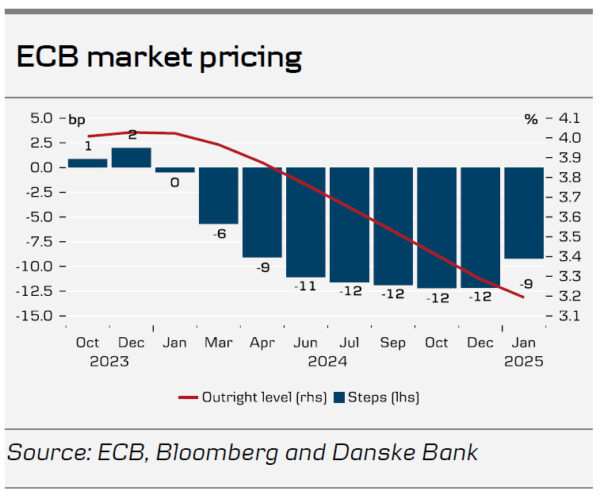

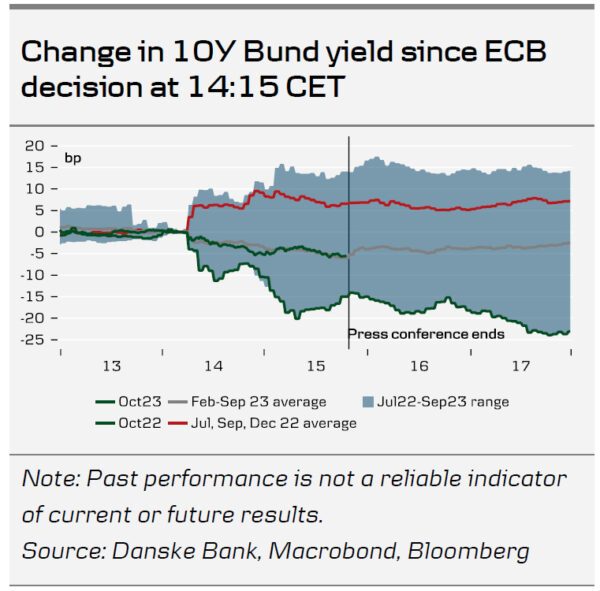

- The outcome was marginally on the dovish side of expectations and led to a minor dovish market reaction to the ECB decision and the press conference, which was supported by US data release along the way. Markets are pricing the first full rate cut in June next year.

Unchanged in uncertainty

For the first time since June last year, ECB decided to leave policy rates unchanged following their guidance in September. While ECB said that inflation is still expected to stay too high for too long and domestic price pressures remain strong, they nevertheless highlighted the inflation dropped ‘markedly’ in September due to base effects as well as underlying inflation pressures continue to ease. ECB guided that the inflation would return to target if rates were maintained at sufficiently restrictive levels. While Lagarde said that they do not rule out a further rate hike could come, she nevertheless made clear that such rate hike is not expected.

Stock taking meeting.

We conclude that today’s meeting was more about stock taking that than sending new policy signals. Highlights were made on the transmission of the monetary policy to the real economy where not least the President Lagarde and VP de Guindos said that the recent rise in yields stemmed from outside the euro area and didn’t reflect fundamentals and hence spill-overs and potential a fear of more coming needs to be taking into account.

Inflation is still expected to stay too high for too long

Lagarde acknowledged that the incoming data since the September meeting have been broadly as expected. Hence, the ECB has not changed its assessment of the economic situation and the inflation outlook since the last meeting. Lagarde characterised the current economic environment as weak especially due to the manufacturing sector. The labour market is currently supporting activity. Yet, there are signs that it is weakening also in the service sector. The service sector is weakening as industrial activity is spilling over and the higher interest rates are broadening out to the economy. The economic activity will remain weak the rest of the year and then likely recover, as household’s real income increases (also on the back of lower inflation) and rising foreign demand will give strength to activity in the coming years.

Lagarde reiterated that risks to the economic outlook are tilted to the downside due to potentially stronger monetary policy transmission, weaker external demand, and geopolitical risks. Regarding inflation, the upside risks are higher than expected energy prices, wage increases and corporate profits. Overall, the higher than usual uncertainty surrounding the outlook prevails.

Muted FX reaction as expected

EUR/USD was more or less unaffected by the ECB decision, trading in the mid 1.0500- 1.0600 range. After the move just shy ahead of 1.0700 in the beginning of the week, the past couple of days the USD has regained strength on rising US yields, still remarkably strong US data and very weak euro area PMIs.

Overall, we make no changes to our long-term EUR/USD forecast and therefore, we maintain our strategic case for a lower EUR/USD based on relative terms of trade, real rates and relative unit labour costs. We forecast the cross at 1.06/1.03 in 6/12M. In the near-term, we stick to our topside risk call in EUR/USD. We expect a turnaround in the exceptional run of positive US economic data surprises to weigh on the USD. Additionally, we believe that peak policy rates, improvements in the struggling manufacturing sector, and a bottoming out of China-pessimism will provide some support to EUR/USD in the nearterm. The risks primarily consist of an escalation in the Middle East, leading to both a riskoff sentiment and higher energy prices, resulting in a stronger USD.