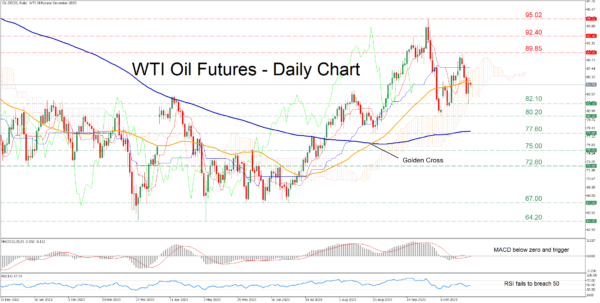

- WTI futures bounce off the lower end of the Ichimoku cloud

- But their rebound is being held down by the 50-day SMA

- Momentum indicators got rejected before entering bullish territories

WTI oil futures (December delivery) had been in a steady advance since their October bottom of 82.10 before experiencing a pullback. Although the commodity managed to halt its latest retreat and recoup some losses, the 50-day simple moving average (SMA) has been acting as a strong ceiling.

Should the price conquer the 50-day SMA, there is no prominent resistance zone before the October high of 89.85. Piercing through that wall, the price could test the September resistance of 92.40. A violation of that territory could open the door for the 2023 high of 95.02, which is also a 13-month peak.

Alternatively, if the price reverses lower, the recent support of 82.10, which overlaps with the lower boundary of the Ichimoku cloud, could act as the first line of defense. Sliding beneath that floor, WTI futures could challenge the October bottom of 80.20 ahead of the August low of 77.60. Even lower, the June resistance of 75.00 may provide downside protection.

In brief, WTI oil futures managed to pause the latest retreat, but their recovery seems to be faltering near the 50-day SMA. However, the neutral technical picture remains intact for the commodity as long as the price keeps hovering within the Ichimoku cloud.