Market picture

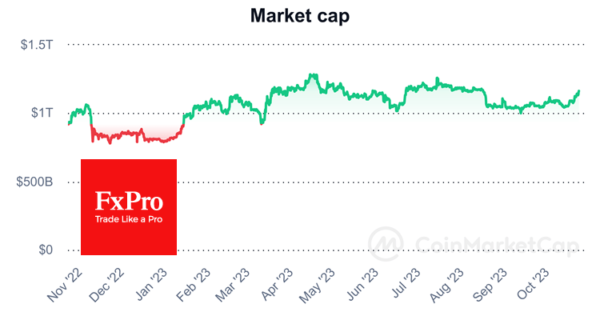

Over the past seven days, the crypto market has gained over 8.3%, bringing its capitalisation to $1.17 trillion, the highest since mid-August.

The market has reached a plateau where it stabilised from late June to mid-August. The dive back then was due to the spike in government bond yields, which suppressed global risk appetite.

This factor is no longer an obstacle and may even be playing into crypto’s hands. But we must warn that such a link can only work while the stock market’s retreat is relatively organised. A solid risk-off momentum will almost inevitably trigger institutional selling in crypto.

Bitcoin has gained over 10% in the last seven days, making the previous week the best in four months. On Monday morning, the price climbed to nearly $31K, close to highs not seen since July. This is a significant turning point. Bitcoin reversed from here in April and June, accelerating the sell-off in June 2022, but Bitcoin was actively bought back from these levels from January to July 2021. A consolidation above $31K could force the bears to capitulate and quickly send the price into the $40K area.

News Background

The crypto winter will soon be over, according to Morgan Stanley. The bull market could start as early as next year. The April halving should drive the new rally. However, there are also potential risks that could disrupt historical cycles, the bank warns.

It is doubtful that the crypto industry will flourish as long as there is a lack of liquidity in the market due to the high cost of money. The crypto spring will come, but only after a soft landing in the US, YouHodler believes.

According to Bloomberg, Grayscale and BlackRock have filed updated applications to launch a spot Bitcoin ETF.

The SEC has voluntarily dropped charges against Ripple CEO Brad Garlinghouse and co-founder Chris Larsen. Ripple Labs’ general counsel called the SEC’s action a capitulation.