Chinese Shanghai SSE Composite continue its descent below the psychological 3000 handle today, Copper has been dragged along in the downward spiral. The string of arrests and the investigation, over the weekend, into Foxconn Technology Group , Apple Inc.’s primary collaborator and one of China’s largest employers, have further dampened foreign investors’ confidence in the Chinese market.

Interestingly, this pessimistic trend emerged against the backdrop of optimistic economic data. Last week’s releases paint a rather favorable economic portrait for China, boasting GDP growth in Q3 that exceeded expectations, accompanied by robust performances in retail sales and industrial production for September. However, these optimistic numbers have not translated into positive momentum for the SSE, which plummeted by -2.89% over the week, underscoring a pervasive bearish sentiment.

Copper, not immune to these developments, now teeters precariously, with its immediate future hanging in the balance. The metal’s price is homing in on last week’s low at 3.5129. Decisive break of this support could unleash a torrent of selling pressure, igniting resumption of the downtrend from 4.3556. Under this scenario, the next stop for Copper would be 100% projection of 4.3556 to 3.5387 from 4.0145 at 3.1976, which is close to 3.1314 support (2022 low).

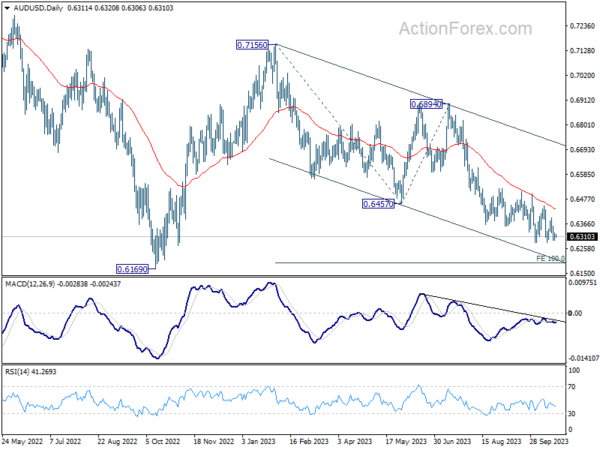

The trajectory of copper is closely entwined with that of AUD/USD, and a continued selloff in the former, spurred by dimming optimism about China, could unleash a cascade of selling pressure on the currency pair. Break of this month’s low at 0.6284 will resume AUD/USD’s down trend from 0.7156 to 100% projection of 0.7156 to 0.6457 from 0.6894 at 0.6195, which is close to 0.6169 support (2022 low).