Financial markets are once again immersed in a phase of risk aversion, a sentiment spurred by the notable ascent of benchmark treasury yields. US 10-year yield is confidently moving closer to the 5% mark. Even Japan’s 10-year JGB yield is hitting another decade high. The prevalent mood has propelled safe-haven currencies like Swiss Franc, Yen, and Dollar to be the standout performers of the day. In contrast, Aussie, Kiwi, and Loonie trail behind. Euro and Sterling find themselves in an intermediate position, though the former shows slight dominance.

All eyes are now turned to Fed Chair Jerome Powell’s upcoming policy address to the Economic Club of New York. Anticipation is rife, with markets eager to glean insights into the potential for a further rate hike in the closing months of the year. However, expectations are tempered, with Powell likely to opt for a balanced approach, letting other FOMC members lead the discussion. Nonetheless, he is expected to reiterate the “higher for longer” narrative and underscoring the importance of data in shaping future policy decisions. The bond and stock markets’ reaction to his address could play a pivotal role in steering Dollar’s course.

In another significant development, Chinese property giant Country Garden is under scrutiny. Bondholders have reportedly sought urgent discussions following the company’s failure to make a USD 15m coupon payment. This misstep puts the developer on the brink of default, thereby exacerbating the risk-averse mood permeating Asian markets.

From a technical perspective, 10-year yield resumed recent up trend by breaking through 4.887 resistance. Further rise is now expected to 61.8% projection of 1.343 to 4.333 from 3.253 at 5.100. Reaction from there would be crucial in driving overall risk sentiment. Sustained break of this 5.100 projection could spark steep selloff in stocks with contagion effects to push up Dollar. In any case, near term outlook in TNX will stay bullish as long as 4.532 support holds, in case of retreat.

In Asia, at the time of writing, Nikkei is down -1.68%. Hong Kong HSI is down -1.95%. China Shanghai SSE is down -1.21%. Singapore Strait Times is down -1.14%. 10-year JGB yield is up 0.033 at 0.841. Overnight, DOW dropped -0.98%. S&P 500 dropped -1.34%. NASDAQ dropped -1.62%. 10-year yield rose 0.057 to 4.904.

Japan’s export rose 4.3% yoy in Sep amid US and European demand

Japan saw a welcomed increase in exports in September, breaking a two-month declining trend and outpacing forecasts. Exports rose by 4.3% yoy to JPY 9198B, surpassing the anticipated growth of 3.1% yoy.

A closer examination of the trade partners reveals a contrasting scenario. Exports to China, Japan’s prominent trading partner, dipped by -6.2% yoy, marking the tenth consecutive month of decline. A staggering -58% yoy drop in food shipments contributed significantly to this contraction. Conversely, trade ties with US and Europe exhibited robustness, with exports expanding by 13.0% yoy and 12.9% yoy respectively.

On the import front, Japan reported a decline of -16.3% yoy to JPY 9136B, a steeper fall than the anticipated -12.9% yoy. Trade dynamics shifted, with Japan posting a trade surplus of JPY 62.4B.

When assessed in seasonally adjusted terms, exports went up by 7.2% mom to JPY 8910B, while imports climbed by 5.4% mom, reaching JPY 9345B. Consequently, trade deficit was reduced to JPY -434B.

Australia employment grows a mere 6.7%, unemployment rate ticks down

Australia’s job market portrayed a mixed picture in September, with a significant undershoot in employment growth countered by a lower-than-expected unemployment rate.

The country added a mere 6.7k jobs in the month, a far cry from the anticipated 20.3k. Delving deeper into the data, full-time employment took a hit, shrinking by -39.9k. However, this was partly offset by increase in part-time roles, which swelled by 46.5k.

Unemployment rate showed slight improvement, ticking down to 3.6% from previous 3.7%, despite expectations that it would remain steady. Yet, this decline could be attributed to a drop in participation rate, which receded from 67.0% to 66.7%. Meanwhile, total monthly hours worked contracted by -0.4% mom, equivalent to a reduction of 8 million hours.

Kate Lamb, ABS’s head of labour statistics, highlighted that, when considering the last two months, the average monthly employment growth stood at 35k, in line with the yearly average growth. However, Lamb also drew attention to the declining unemployment rate in September, indicating it primarily resulted from a shift of people from the unemployed category to being outside the labor force altogether.

Furthermore, she noted, “The recent softening in hours worked, relative to employment growth, may suggest an easing in labour market strength.”

Australia’s business confidence shows uptick, but inflationary concerns persist

Australian businesses are displaying signs of renewed optimism, as revealed by NAB Quarterly Business Confidence index for Q3. The index improved, moving up from -4 in the second quarter to -1 in the third. Moreover, the gauge for Current Business Conditions also indicated better sentiment, rising from 11 to 13.

However, an undercurrent of concern persisted regarding cost dynamics. Labour cost growth experienced an increase, shifting up to 1.8% from the 1.3% witnessed in Q2. On the other hand, purchase costs growth showed a modest climb, reaching 1.4% from the 1.3% seen in the previous quarter. In a positive sign, fewer businesses highlighted materials as a limiting factor, with the percentage dropping to 32% from the 36% reported in Q2.

NAB’s Chief Economist Alan Oster noted, “Price growth remained elevated in Q3. This is in line with our expectation for a reasonably strong inflation print of 1.1% for the quarter when the full Q3 CPI is released next week.”

However, he tempered the immediate inflationary concerns with a longer-term view, adding, “Still, we do expect inflation to moderate gradually as the economy slows.”

Looking ahead

Swiss trade balance and Eurozone current account will be released in Euroepan session. Later in the day, US will publish jobless claims, Philly Fed survey and existing home sales. Canada will release IPPI and RMPI.

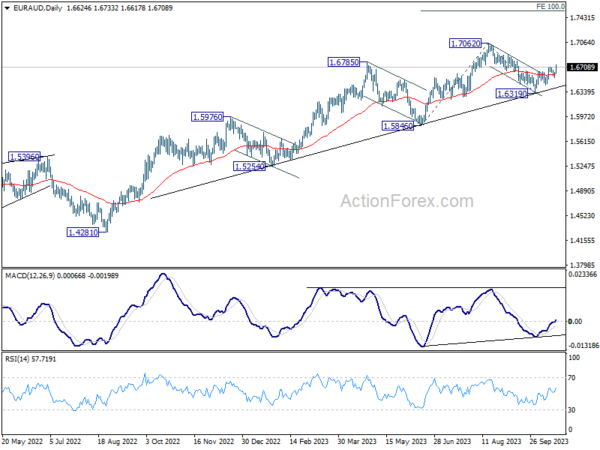

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.6574; (P) 1.6609; (R1) 1.6663; More…

EUR/AUD’s rally from 1.6319 resumed by taking out 1.6704 and intraday bias is back on the upside. Outlook is unchanged that correction from 1.7062 should have completed at 1.6319. Further rally is expected to retest 1.7062 high next. On the downside, however, break of 1.6550 support will dampen this view and turn bias back to the downside for 1.6319 instead.

In the bigger picture, the strong support from medium term rising trend line indicates that rise from 1.4281 (2022 low) is still in progress. On resumption, next target is 100% projection of 1.5846 to 1.7062 from 1.6319 at 1.7353. In any case, outlook will stay bullish as long as 1.6319 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Trade Balance (JPY) Sep | -0.43T | -0.50T | -0.56T | -0.55T |

| 00:30 | AUD | NAB Business Confidence Q3 | -1 | -3 | -4 | |

| 00:30 | AUD | Employment Change Sep | 6.7K | 20.3K | 64.9K | 63.3K |

| 00:30 | AUD | Unemployment Rate Sep | 3.60% | 3.70% | 3.70% | |

| 06:00 | CHF | Trade Balance (CHF) Sep | 3.77B | 4.05B | ||

| 08:00 | EUR | Eurozone Current Account (EUR) Aug | 20.9B | |||

| 12:30 | CAD | Industrial Product Price M/M Sep | 0.30% | 1.30% | ||

| 12:30 | CAD | Raw Material Price Index Sep | 1.80% | 3.00% | ||

| 12:30 | USD | Initial Jobless Claims (Oct 13) | 210K | 209K | ||

| 12:30 | USD | Philadelphia Fed Manufacturing Survey Oct | -6.5 | -13.5 | ||

| 14:00 | USD | Existing Home Sales Sep | 3.90M | 4.04M | ||

| 14:30 | USD | Natural Gas Storage | 82B | 84B |