The currencies from the Southern Hemisphere, Australian and New Zealand Dollars, saw notable volatility in Asian session today. Aussie is gaining traction following release of RBA minutes, highlighting a low tolerance for inflation surprises and opening the door for another rate hike next month. In contrast, Kiwi is facing downward pressure after disappointing CPI data dampened the prospects of further RBNZ tightening. These developments have placed the two currencies at opposite ends of the daily performance spectrum.

On a wider scale, Dollar is having a mild recovery following retreat in the previous session, though its overall direction remains ambiguous. A sense of stability has returned to the risk environment, with US stock indexes and treasury yields both climbing. The Swiss Franc finds itself not far behind Dollar, positioning itself as the third strongest. Meanwhile, Canadian Dollar mirrors the downtrend of its New Zealand counterpart, emerging as the second weakest, closely followed by British Pound. Euro and Yen currently display mixed dynamics.

A slew of significant economic data is slated for release today, including UK employment figures, German ZEW economic sentiment, Canadian CPI, and US retail sales. The spotlight will be on UK wage growth and Canadian inflation data, pivotal in shaping expectations around the continuation of the tightening cycles by BoE and BoC. The volatility post these data releases might parallel the dramatic moves seen in Aussie and Kiwi during Asian session.

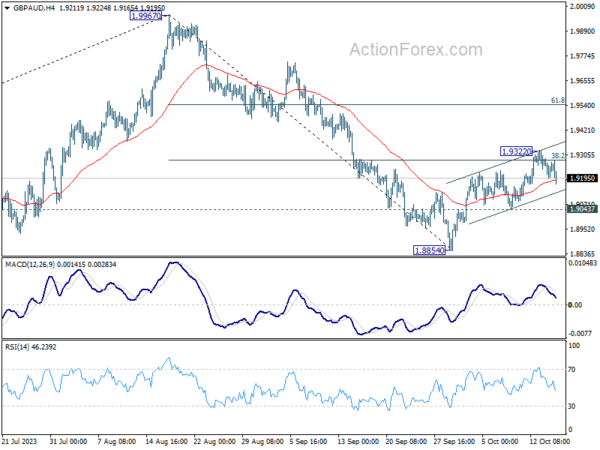

On the technical front, GBP/AUD’s retreat from 1.9322 extends lower today, but it’s trying to draw support from 55 4H EMA. For now, further rise is in favor as long as 1.9043 support holds. Break of 1.9322 will pave the way to 61.8% retracement of 1.9967 to 1.8854 at 1.9542, even as a corrective move. On the downside, break of 1.9043 will suggest that recovery from 1.8854 has completed, and bring retest of this low.

In Asia, at the time of writing, Nikkei is up 1.12%. Hong Kong HSI is up 0.70%. China Shanghai SSE is up 0.26%. Singapore Strait Times is up 0.31%. Japan 10-year JGB yield is up 0.023 at 0.778. Overnight, DOW rose 0.93%. S&P 500 rose 1.06%. NASDAQ rose 1.20%. 10-year yield rose 0.083 to 4.712.

RBA minutes reveal hawkish tilt, another hike in Nov?

Minutes of RBA’s October meeting surprised market participants with a more hawkish tone than anticipated. The board seriously contemplated a rate hike at the meeting, but opted to hold due to a lack of “sufficient new information.

Additionally, the central bank underscored its “low tolerance” for a delayed return of inflation to target. It suggested that “some further tightening” might be imminent if inflation proves to be more persistent than current expectations.

As RBA steers ahead, its forthcoming November meeting is expected to be crucial. The board will be equipped with additional economic data on factors such as inflation, labour market dynamics, and overall economic activity. Additionally, they will have at their disposal revised staff forecasts

The minutes highlighted, “members considered two options for monetary policy at this meeting: raising the cash rate target by a further 25 basis points; or holding the cash rate target steady.” However, the decision to maintain the status quo was reached as “members agreed that the case to leave the cash rate target unchanged at this meeting was the stronger one.” This consensus was influenced by the absence of “sufficient new information over the preceding month from economic data or financial markets to necessitate an adjustment in the stance of monetary policy.”

However, the upcoming November meeting might paint a different picture. The board is set to receive “additional data on economic activity, inflation and the labour market, as well as a set of revised staff forecasts.”

“In reaching their decision, members noted that some further tightening of policy may be required should inflation prove more persistent than expected. The Board has a low tolerance for a slower return of inflation to target than currently expected,” the minutes detailed.

New Zealand CPI slowed to 5.6% yoy in Q3, dimming prospects of RBNZ hike

New Zealand’s CPI recorded a decline in its annual inflation rate, dropping from 6.0% yoy to 5.6% yoy in Q3. This figure not only fell short of the anticipated 5.9% yoy but was also well below RBNZ’s own forecast of 6.0% yoy for the quarter. Such a deceleration would curb the likelihood of another interest rate hike in November.

A breakdown of the inflation contributors indicates that food prices played a dominant role in driving the annual inflation rate. Following closely were the costs associated with housing and household utilities, with the inflation in this sector being attributed to escalating expenses of construction and rental services.

Nicola Growden, the senior manager of consumer prices, stated, “Prices are still increasing, but are increasing at rates lower than we have seen in the previous few quarters.”

On a quarterly perspective, Q3 CPI reflected a growth of 1.8% qoq, marking an upturn from Q2’s 1.1% qoq. However, it missed the estimated rise of 1.9% qoq. An analysis of sector-wise performance shows that the transport sector experienced significant inflationary pressures. Specifically, the costs of petrol and new motor vehicles surged by 16.5% and 4.6%, respectively.

AUD/NZD soars amidst diverging predictions for RBA and RBNZ moves

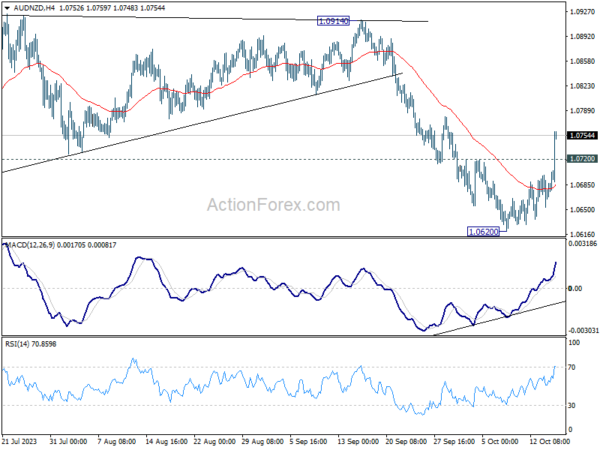

AUD/NZD surges sharply in Asian session, buoyed by the combined effects of more hawkish RBA minutes and the disappointing New Zealand inflation numbers. This series of events has led to heightened speculation of another interest rate hike by RBA come November, while RBNZ is more likely opt to hold their stance.

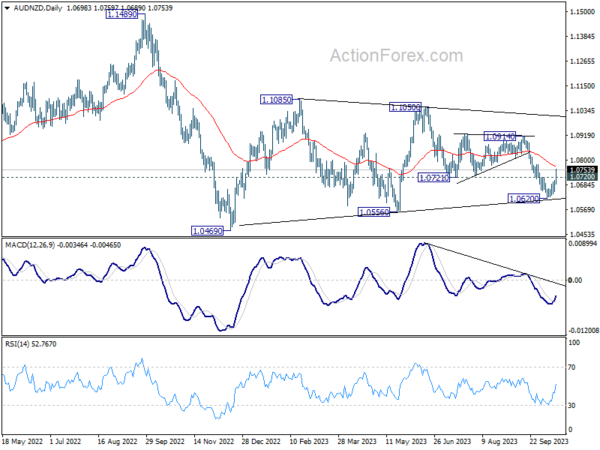

The strong break of 1.0720 resistance confirms short term bottoming in AUD/NZD . More importantly, fall from 1.1050 could have completed with three waves down to 1.0620 too. Immediate focus is on 55 D EMA (now at 1.0773). Sustained trading above there will strengthen this case and target 1.0914 resistance and above. In case of retreat, risk will now stay on the upside as long as 1.0620 support holds.

In the bigger picture, price actions from 1.0469 (2022 low) could still be interpreted as consolidation to the down trend from 1.1489 (2022 high). Thus, strong resistance could be seen in AUD/NZD as it enters into resistance zone of 1.0914/1.1050.

ECB’s Lane emphasizes long road ahead before rate cuts

In an interview with Het Financieele Dagblad, ECB Chief Economist Philip Lane stressed the European Central Bank’s stance on the prevailing inflationary conditions. Highlighting the central bank’s efforts, Lane remarked, “Because inflation is too high, we’re trying to deliver interest rates that are significantly above the neutral range.” He affirmed the bank’s commitment to maintaining this position, stating, “We will keep interest rates high for as long as necessary.”

Lane also opened the door to potential policy adjustments, emphasizing that, “If we have inflation shocks that are sufficiently large or sufficiently persistent, we have to be open to doing more.”

He projected that inflation would return to ECB’s target of 2% by 2025. However, he also signaled that the journey to this target is not short-term. “Only when we are sufficiently confident of reaching that target, we can normalize policy,” he said, adding, “But this is quite some distance from where we are now.”

Delving into what he perceives as necessary to gain more clarity, Lane expressed a personal need for “more information about the wage settlements for 2024.” He highlighted that a considerable amount of time would elapse before gaining confidence in the inflation trajectory, noting, “we will have to wait until spring next year before many countries release that information.”

He said, “So it’s going to be some time before we can have a high degree of confidence that inflation is on its way back to 2%.”

Fed’s Harker advocates for rate pause amid struggles of small businesses

As Fed grapples with the consequences of its tightening monetary policy, Philadelphia Fed President Patrick Harker voiced concerns regarding the implications for small businesses. In a virtual event, Harker underscored the challenges small firms are facing due to limited access to capital, and suggested Fed should refrain from contemplating additional interest rate hikes

“Small firms are really struggling with access to capital,” Harker pointed out, echoing the sentiments of bankers who are wary that their business models may not withstand further hikes.

“Some of the bankers I’ve talked to are concerned that their business plans just aren’t going to be able to make it at the higher rates. I heard that warning a lot over the summer,” Harker elaborated.

In light of these concerns, Harker advocated for a pause in rate adjustments to evaluate the full impact of the existing policy on small businesses. By holding rates steady, Fed can provide a reprieve for struggling firms and assess the broader economy before making further moves.

“This is why we should hold rates steady, we should not at this point be thinking about any increases, because if that’s true — and it is true — then we should let that ride out,” Harker asserted.

Looking ahead

UK employment and Germany ZEW economic sentiment will be release in European session. Later in the day, Canada CPI and US retail sales will take center stage.

USD/CAD Daily Outlook

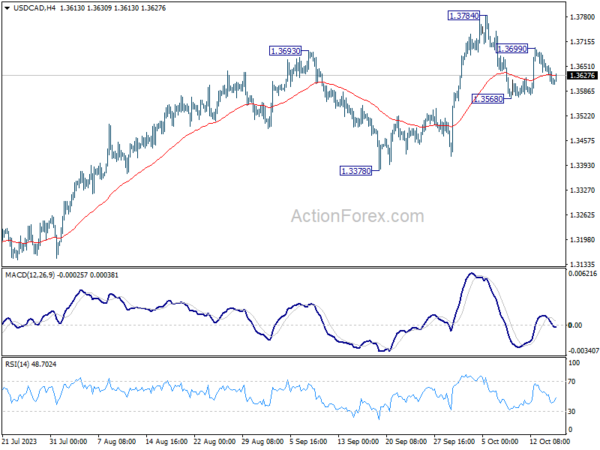

Daily Pivots: (S1) 1.3589; (P) 1.3627; (R1) 1.3648; More….

Intraday bias in USD/CAD remains neutral at this point as range trading continues. On the upside, above 1.43699 will target 1.3784 first. Break there will will resume larger rise from 1.3091 to retest 1.3976 high. On the downside, below 1.3568 will bring another falling leg to extend the near term corrective pattern from 1.3784 instead.

In the bigger picture, current development revives the case that corrective pattern from 1.3976 (2022 high) has completed with three waves down to 1.3091. Decisive break of 1.3976 high will confirm resumption of up trend from 1.2005 (2021 low). Next target will be 61.8% projection of 1.2401 to 1.3976 from 1.3091 at 1.4064. This will now remain the favored case as long as 1.3378 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | CPI Q/Q Q3 | 1.80% | 1.90% | 1.10% | |

| 00:30 | AUD | RBA Minutes | ||||

| 06:00 | GBP | Claimant Count Change Sep | 2.3K | 0.9K | ||

| 06:00 | GBP | ILO Unemployment Rate (3M) Aug | 4.30% | 4.30% | ||

| 06:00 | GBP | Average Earnings Including Bonus 3M/Y Aug | 8.30% | 8.50% | ||

| 06:00 | GBP | Average Earnings Excluding Bonus 3M/Y Aug | 7.80% | 7.80% | ||

| 09:00 | EUR | Germany ZEW Economic Sentiment Oct | -9.5 | -11.4 | ||

| 09:00 | EUR | Germany ZEW Current Situation Oct | -80.5 | -79.4 | ||

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Oct | -8 | -8.9 | ||

| 12:15 | CAD | Housing Starts Sep | 250K | 253K | ||

| 12:30 | CAD | CPI M/M Sep | 0.10% | 0.40% | ||

| 12:30 | CAD | CPI Y/Y Sep | 4.00% | 4.00% | ||

| 12:30 | CAD | CPI Median Y/Y Sep | 4.00% | 4.10% | ||

| 12:30 | CAD | CPI Common Y/Y Sep | 3.80% | 3.90% | ||

| 12:30 | CAD | CPI Trimmed Y/Y Sep | 4.70% | 4.80% | ||

| 12:30 | USD | Retail Sales M/M Sep | 0.30% | 0.60% | ||

| 12:30 | USD | Retail Sales ex Autos M/M Sep | 0.20% | 0.60% | ||

| 13:15 | USD | Industrial Production M/M Sep | -0.10% | 0.40% | ||

| 13:15 | USD | Capacity Utilization Sep | 79.60% | 79.70% | ||

| 14:00 | USD | Business Inventories Aug | 0.30% | 0.00% | ||

| 14:00 | USD | NAHB Housing Market Index Oct | 45 | 45 |