U.S. Highlights

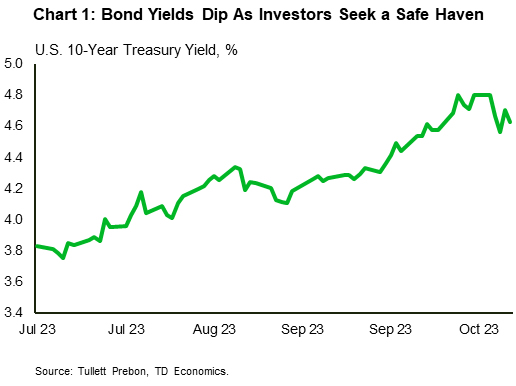

- U.S. bond yields retreated from highs reached last week, as heightened geopolitical risks in the Middle East boosted investors demand for safe haven assets.

- However, the recent overall surge in yields has prompted some Fed members to pay closer attention to tightening financial conditions as they determine the most appropriate policy path for interest rate.

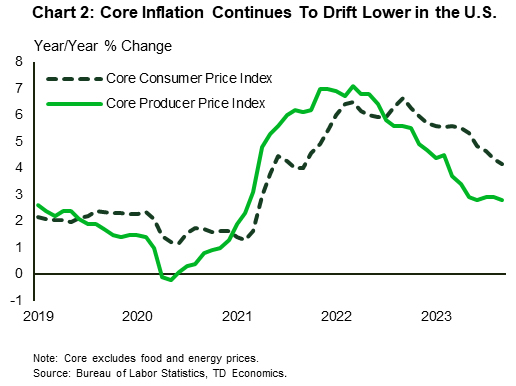

- Both producer prices and consumer prices suggest that the Fed still has some work to do to ensure inflation gets back to target, even as core prices continue to moderate.

Canadian Highlights

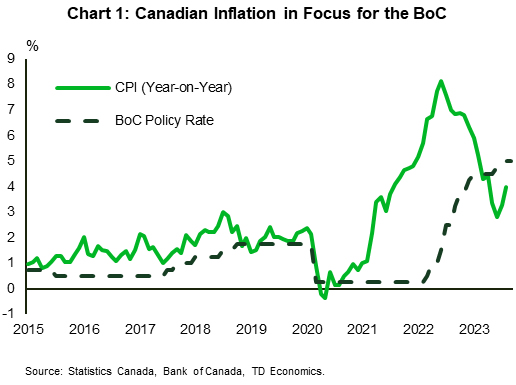

- The countdown to the Bank of Canada’s October 25th policy meeting is on, with recent data making the hike/no hike decision a close call.

- Investors are awaiting Canadian CPI data next week, which is unlikely to show much progress with the three-month rate of core inflation accelerating recently.

- The housing market continues to slide. With sales activity down and listing starting to jump, house prices continue to decline.

U.S. – Goodbye “How High”, Hello “How Long”

Last week’s tight financial conditions abated a bit this week, as conflict in the Middle East boosted demand for safe haven assets. As such, the 10-year Treasury yield took a reprieve from its upward trek and at the time of writing was down 17 basis points (bps) relative to the end of last week (Chart 1). Nonetheless, yields are still up 76 bps since July 26 when the Fed last raised the policy rate. Several factors have contributed to rising bond yields over the past few months including expectations of higher for longer interest rates and concerns about energy supply and prices.

The relatively higher yields have prompted some Fed officials to acknowledge that higher longer-term yields may be helping to achieve their policy objective. Dallas Fed President Lorie Logan remarked that “if long-term interest rates remain elevated because of higher term premiums, there may be less need to raise the fed-funds rate.” Similar sentiments were echoed by Fed governor Christopher Waller who said that “financial markets are tightening up and they are going to do some of the work for us”. Fed Vice Chair Philip Jefferson said that he would “remain cognizant of the tightening in financial conditions through higher bond yields” when assessing the path for interest rates. That sentiment was also echoed by Minneapolis Fed president Neel Kashkari.

The minutes released from the Fed’s September meeting revealed that, prior to the most recent run-up in bond yields, a “majority” of FOMC participants believed that another rate increase might be appropriate, while only “some” viewed no further increases as necessary. The tone of the minutes, economic projections and policy guidance was hawkish with Fed members expecting rates to be kept higher for even longer. This was reflected in a shallower path of expected rate cuts (FOMC commentary). Additionally, “several” participants commented that the Fed’s focus should be transitioning to how long to maintain restrictive policy, rather than how high to raise rates. Ultimately, all participants were in favor of maintaining restrictive policy for some time to ensure that inflation remains on a sustainable path downwards.

Both headline measures of producer prices (PPI) and consumer prices (CPI) show that the inflation battle is not quite over. On a yearly basis, PPI accelerated in September, while CPI held steady. The movements largely reflected gains in food and energy prices. Stripping out these volatile segments, core prices for both measures edged lower (Chart 2). While the downward tilt to core prices is sure to be welcomed by the Fed, rates are still too high for comfort given that near-term inflation expectations have inched higher in recent months and the labor market remains resilient.

American small businesses are also feeling less optimistic as expectations regarding the economic outlook and credit conditions deteriorated in September. Several firms noted that the Fed’s aggressive hiking campaign is weighing on credit with a net 26% of borrowers reporting paying higher interest rates versus three months ago. Nonetheless, the Fed will need to see a meaningful cooling in the jobs market and a sustained reduction in inflation, before shifting policy stance. As such, higher for longer may be around for some time.

Canada – Housing Slumps, With Inflation In Focus

The countdown to the Bank of Canada’s (BoC’s) October 25th policy meeting is on. While the Bank will be weighing the recent strength in the labour market alongside still stubbornly high inflation, the cracks forming in consumer spending and further weakness emanating from the housing market make the hike/no hike decision a tougher call. This had bond markets on a rollercoaster this week, as investors try to pin down what the BoC will do next.

One report that could sway the BoC’s hand is Canadian CPI released next week (Chart 1). The trend has not been a friend of the BoC lately. Consumer price inflation hit 4.0% year-on-year (y/y) in August, up from 3.3% y/y in July. While the headline number will get a lot of the media attention, the BoC will be looking at core inflation measures, which strip out more volatile price swings to get at underlying inflation trends. In August, the average of the Bank’s trimmed mean and median inflation rates surprisingly increased to 4.0% y/y (from 3.8% y/y). The underlying trend here is also worrying. On a three-month annualized basis, the average of trimmed mean and median are clocking in at 4.5%. This signals that the annual core inflation rates might continue to show an upward bias in the coming months.

A mixture of services and goods inflation have been driving the momentum in core inflation recently. As our regular readers know, underlying services inflation (supercore) has been flying high on the back of persistently strong wage gains. Save for the discounting in airfares and travel relative services, supercore inflation has been running at an average pace of 5% for over a year now (Chart 2). With wages continuing to rise, services inflation is likely to remain elevated. More recently, we have seen core goods inflation starting to creep higher as well. Big purchase items like automobiles, sports/recreation, and household equipment, as well has personal care goods and clothing have seen prices rise once again. Combined with services, this has been a recipe for higher core inflation.

The one area of the economy that has been most responsive to the BoC’s past rate hikes has been housing. Following the spring 2023 sales surge, the BoC’s June and July rate hikes have pushed mortgage rates up by over 1 percentage point. This has not only forced many buyers to question whether to jump into the market, but has resulted in a large increase in the number of listings. Today’s data have added to the negative trend, with sales down 9% since the June 2023 peak. With listings rising 35% since the spring, the sales-to-listings ratio is now at 51.4% (from 67.8% in April). The move away from a sellers’ market has pushed house prices lower by 5.2% in the last four months.

For the BoC, the slowdown in the housing market shouldn’t come as a surprise. This is the one area where the BoC’s actions have the most impact. But as Governor Macklem said today, the BoC is “looking for clear signs that core inflation” is coming down. The issue here is that prior labour market strength will continue to push wages upwards, keeping inflation and the risk of another rate hike too high for comfort.