Dollar is exhibiting mixed performance in today’s relatively calm trading environment. Earlier losses were swiftly counteracted, illustrating the greenback’s resilience amidst fluctuating conditions. Interestingly, the extended pullback in treasury yield has left Dollar unscathed, and it has similarly shrugged off stronger than expected PPI data. All eyes are now set on the release of the FOMC minutes, although tomorrow’s CPI data release is anticipated to be the significant market mover.

On the European front, Sterling and Swiss Franc are leading the pack, demonstrating noticeable strength. Euro is lagging behind after two ECB policymakers who expressed the belief that the tightening cycle might have reached its conclusion. The commodity currencies, alongside the Yen, are on a slight decline.

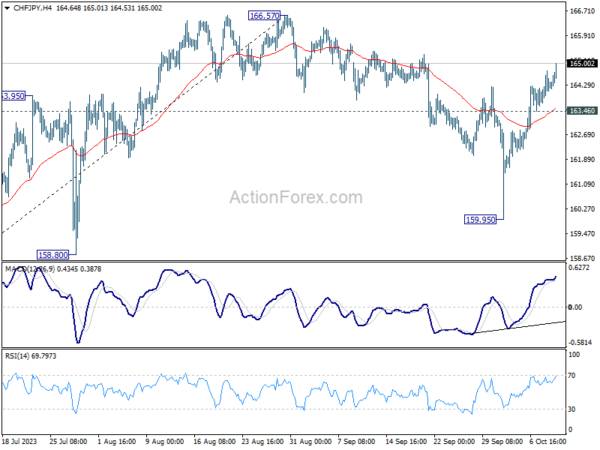

From a technical viewpoint, CHF/JPY’s rally from 159.95 extends higher today. Current development suggests that corrective pull back from 166.57 has completed already. Further rise is in favor as long as 163.46 support holds, for retesting 166.57 high. At this point, it’s unsure yet whether CHF/JPY is ready to break through 166.57 to resume the larger up trend. The development in other Yen and Franc pairs will be monitored to gauge the chance. However, it remains uncertain whether the cross is prepared to breach the 166.57 mark to resume its broader uptrend. To evaluate this possibility, analysts are keeping a close eye on the development in other Yen and Franc pairs.

In Europe, at the time of writing, FTSE is up 0.16%. DAX is up 0.11%. CAC is down -0.26%. Germany 10-year yield is down -0.0535. Earlier in Asia, Nikkei rose 0.60%. Hong Kong HSI rose 1.29%. China Shanghai SSE rose 0.12%. Singapore Strait Times dropped -0.19%. Japan 10-year JGB yield rose 0.0046 to 0.779.

US PPI up 0.5% mom, 2.2% yoy in Sep, largest annual rise since Apr

US PPI for final demand rose 0.5% mom in September, above expectation of 0.4% mom. PPI less foods, energy, and trade services increased 0.2% mom, the fourth consecutive advance. PPI goods rose 0.9% mom while PPI services rose 0.3% mom.

For the 12 months period, PPI rose 2.2% yoy, above expectation of 1.6% yoy. That’s the largest annual increase since April’s 2.3% yoy. PPI less foods, energy and trade services was up 2.8% yoy.

Fed’s Bowman: Policy rate may need to rise further

Fed Governor Michelle Bowman acknowledged in a speech the progress made in curbing inflation. However, she quickly pointed out “inflation remains well above the FOMC’s 2 percent target.”

She highlighted the robust pace of domestic spending and the prevailing tightness in the labor market. These factors indicate that “the policy rate may need to rise further and stay restrictive for some time to return inflation to the FOMC’s goal.”

Shifting her attention to the broader challenges faced by central banks, she elucidated, “As they have confronted price stability challenges, central banks have also faced new financial stability risks.”

Specifically, she cited concerns related to the substantial fluctuations in interest rates amidst an environment characterized by sustained, heightened inflation.

Moreover, Bowman emphasized the potential risks arising from geopolitical tensions, explaining how they can instigate “greater financial market volatility.” She also underscored the indirect impacts such tensions could have, including influencing economic activity and inflation.

ECB’s consumer survey reveals rising inflation expectations amid subdued growth outlook

ECB’s latest Consumer Expectations Survey for August paints a picture of an economy where consumers anticipate higher inflation rates but remain pessimistic about economic growth.

Specifically, the survey indicates that median inflation expectations for the next 12 months have risen from 3.4% to 3.5%. A similar uptrend was observed for the three-year horizon, with expectations inching up from 2.4% to 2.5%.

Household income expectations for the next year showed a slight increase, moving from 1.1% to 1.2%. However, a contrasting sentiment emerged for spending , with expectations slightly decreasing from 3.4% to 3.3%.

In terms of economic growth, the mood appears somewhat bearish. The survey revealed that median expectations for growth over the coming 12 months have declined, shifting from -0.7% to -0.8%.

ECB’s Knot: Policy is in a good place

ECB Governing Council member Klaas Knot acknowledged the recent strides the central bank has made towards achieving its inflation target, but he emphasized that there’s still “a long and winding road ahead”. Nevertheless, expressing contentment with the current policy stance, he mentioned, “I do believe that policy at this moment is in a good place.”

Knot did not shy away from underscoring ECB’s readiness to take further action if needed, affirming, “we will remain vigilant and we stand ready to adjust interest rates even more if the disinflation process were to stall.” He emphasized that ECB has a “credible prospect” of achieving its inflation target by 2025.

Highlighting challenges in the short term, Knot pointed out that the eurozone is currently grappling with economic stagnation. While the manufacturing sector is already in a recession, the services sector is also beginning to feel the pressure.

Nevertheless, Knot views this slowdown as “desirable in a way.” Despite the immediate hurdles, Knot remains optimistic about the medium-term outlook, suggesting that growth is poised for a rebound in the foreseeable future.

ECB’s De Cos: Market confidence reflects in rate expectations

ECB Governing Council member Pablo Hernandez de Cos noted that market pricing indicated a clear understanding of the central bank’s communication, finding its intended policy path to be credible.

“They are interpreting well that there might be a need for the current rate to remain in the current (setting) for sufficiently long,” he mentioned”

“They are also expecting that rates will decline, which for me is a kind of a confidence of the market that we will fulfil our mandate,” he added.

However, De Cos voiced concerns about unforeseen challenges that might arise, emphasizing the high level of uncertainty surrounding economic prospects. New shocks could dictate different policy decisions by the ECB.

Offering insight into the economy, de Cos observed a potential dip in the near-term, hinting at a possible negative outcome for the third quarter. Despite this near-term pessimism, he expressed a lack of alarm, reassuring that a recovery is on the horizon for next year, driven by rejuvenating real incomes.

RBA’s Kent: Some further tightening may be required

In a speech, RBA Assistant Governor, Chris Kent, indicated that while the effects of previous monetary tightening have not yet been fully realized, “some further tightening ” might be on the horizon to keep inflation in check.

Kent asserted that the policies currently in place are beginning to stymie demand growth, a crucial step towards mitigating inflation.

“The lags of transmission mean that some further effects of rate increases to date are still to be felt through the economy, which will provide further impetus to lower inflation in the period ahead,” he added.

However, with inflation persisting at elevated levels, Kent hinted at the necessity for additional measures. “The Board is paying close attention to economic developments here and overseas, and some further tightening of monetary policy may be required to ensure that inflation, which is still too high, returns to target in a reasonable timeframe.”

GBP/USD Mid-Day Outlook

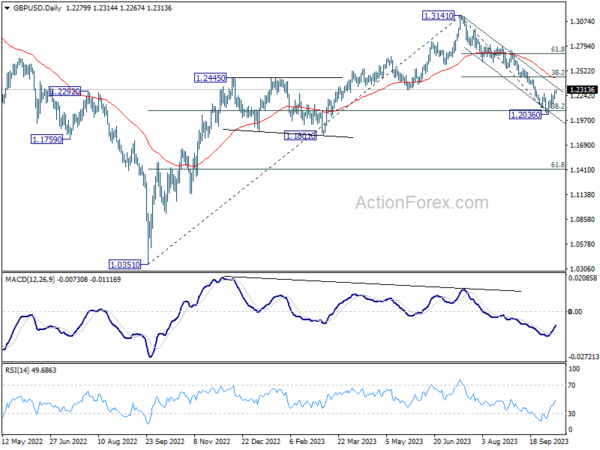

Daily Pivots: (S1) 1.2235; (P) 1.2263; (R1) 1.2314; More

Intraday bias in GBP/USD stays on the upside at this point. Rebound from 1.2036 short term bottom is in progress for near term channel resistance (now at 1.2338). Firm break there will target 38.2% retracement of 1.3141 to 1.2036 at 1.2458 next. Nevertheless, break of 1.2161 minor support will revive near term bearishness and bring retest of 1.2036 low.

In the bigger picture, fall from 1.3141 medium term top could still be a correction to up trend from 1.0351 (2022 low) only. But risk of complete trend reversal is rising. Sustained break of 38.2% retracement of 1.0351 to 1.3141 at 1.2075 will pave the way to 61.8% retracement at 1.1417. For now, risk will stay on the downside as long as 55 D EMA (now at 1.2440) holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 06:00 | EUR | Germany CPI M/M Sep F | 0.30% | 0.30% | 0.30% | |

| 06:00 | EUR | Germany CPI Y/Y Sep F | 4.50% | 4.50% | 4.50% | |

| 06:00 | JPY | Machine Tool Orders Y/Y Sep F | -11.20% | -17.60% | ||

| 12:30 | CAD | Building Permits M/M Aug | 3.40% | 0.50% | -1.50% | -3.80% |

| 12:30 | USD | PPI M/M Sep | 0.50% | 0.40% | 0.70% | |

| 12:30 | USD | PPI Y/Y Sep | 2.20% | 1.60% | 1.60% | 2.00% |

| 12:30 | USD | PPI Core M/M Sep | 0.30% | 0.20% | 0.20% | |

| 12:30 | USD | PPI Core Y/Y Sep | 2.70% | 2.30% | 2.20% | |

| 18:00 | USD | FOMC Minutes |