As geopolitical tensions escalate, markets are swiftly reacting, with notable rises observed in Gold, Oil, and Swiss Franc at the beginning of the week. The eruption of hostilities between Israel and Hamas following a sweeping incursion by the Palestinian group into Israeli towns has sounded alarms worldwide, drawing unequivocal condemnation from Western nations, introducing a fresh element of uncertainty into the global financial markets.

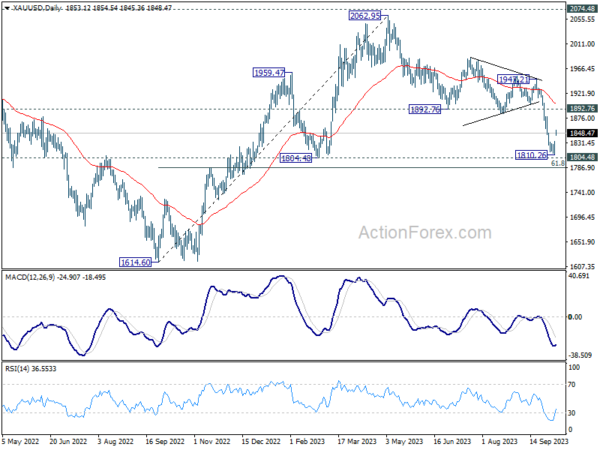

The immediate impact of these developments is most palpable in Gold. The precious metal’s resurgence marks short-term bottoming at 1810.26, just above 1804.48 medium-term support. If the ongoing geopolitical crises further deteriorate, we might see a continued upswing in the precious metal’s price. However, a significant barrier awaits at the 1900 handle, slightly above the 1892.76 support turned resistance. Return to normalized sentiment will inevitably refocus market attention on the anticipation of persistently high Fed interest rates and towering benchmark treasury yields, potentially exerting downward pressure on gold again.

In tandem with gold, WTI crude oil has also responded to the geopolitical shockwaves, posting robust gains. With 77.95 support remains unbreached, there’s an absence of concrete confirmation pointing towards reversal of the rally initiating at 63.67. However, it’s worth noting a marked attenuation in upside momentum recently, as seen in D MACD. Even though a more substantial rise isn’t off the table in the short term, the ceiling is likely to be established below 95.50 resistance, for an extended phase of range trading.

The currency markets are not immune to these developments either. EUR/CHF pair is emblematic of the shifts underway, with a decisive break of 55 D EMA arguing that that recovery from 0.9513 has completed at 0.9691. This comes on the heels a rejection by medium-term falling trend line resistance. If the pair fails to recapture ground above 55 D EMA in the coming days, deeper descent is likely on the cards, potentially surpassing the 0.9513 low to resume the broader downtrend originating from 1.0095.