Summary

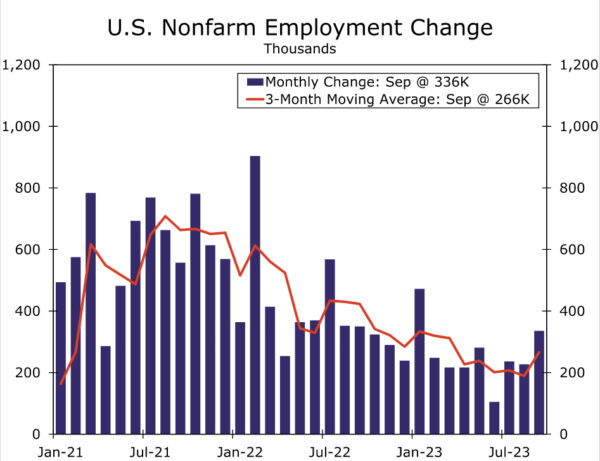

The September employment was strong across-the-board. Nonfarm payrolls grew at a robust 336K pace in the month, and upward revisions to job growth in July and August further flattered the employment figures. Job growth was driven by both public and private hiring and a diverse set of industries. The labor force continued to grow, helping to restrain wage growth. Average hourly earnings grew just 0.2% for the second month in a row, bringing the year-over-year pace down to 4.2%, the slowest pace in more than two years and about a percentage point above where it was before the pandemic.

Today’s report drove yet another increase in Treasury yields and fanned the flames that the FOMC may hike the federal funds rate one more time at one of its two remaining meetings of the year. Another rate hike before the end of the year is a possibility, but for now our base case remains that the last rate hike of the tightening cycle occurred in July. Next week’s CPI report and the Q3 Employment Cost Index to be released on October 31 will help the FOMC determine if progress is continuing in its inflation fight despite the surprising strength in employment gains in recent months.

Jobs Market Still Flying High

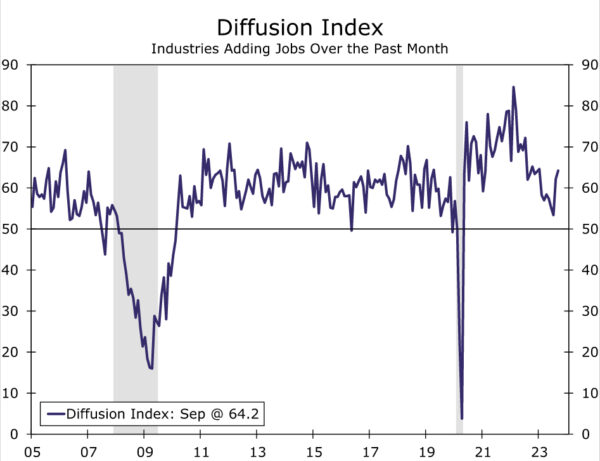

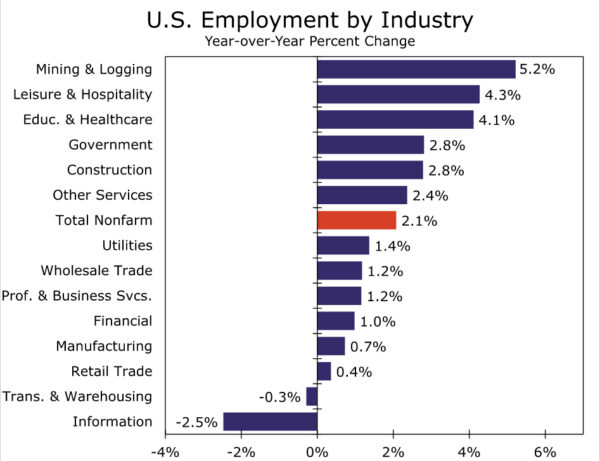

U.S. job growth blew past expectations in September, rising by 336K compared to consensus expectations for a 170K gain. Revisions to the previous two months increased employment by an additional 119K. Not only was aggregate job growth impressively strong, but employment gains were broad-based across most industries. The employment diffusion index, a measure of hiring breadth across industries, jumped to 64.2, the highest reading since January. Leading the charge were leisure & hospitality (+96K) and government (+73K), two industries where payrolls are quickly closing in on their pre-COVID levels. Health care (+41K), professional, scientific & technical services (+29K) and manufacturing (+17K) also posted notable gains.

Despite all the headlines about strikes in recent weeks, labor disputes had little bearing on the change in nonfarm payrolls in September. The UAW walkouts and Hollywood writers’ deal both occurred too late in the month to be reflected, although the net conclusion of a handful of smaller strikes gave a small (~4K) boost to payrolls.

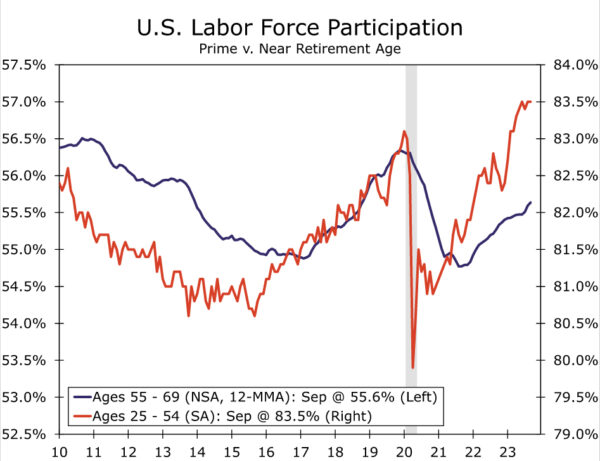

A marked increase in labor supply over the past year has helped to support overall hiring. An additional 90K workers entered the labor force in September on the heels of what was already a major swell in August. The labor force participation rate was unchanged at 62.8%, continuing its now 11-month streak of avoiding a decline despite the headwinds caused by an aging population. Prime-age women have led the charge, although men ages 25-54 have also seen participation rebound strongly. Participation among older workers also has edged higher over the past year (chart). We see scope for labor force growth to remain solid in the near-term as the still-strong jobs market pulls in workers and deteriorating finances give other workers a push. September’s moderate rise in the labor force roughly matched the increase in the household survey’s measure of employment (86K). As a result, the unemployment rate was unchanged at 3.8%.

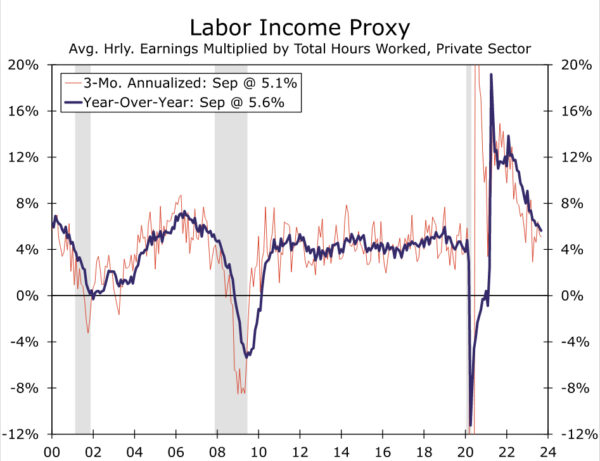

The more abundant supply of workers along with a less frenzied pace of hiring is helping to dampen wage pressures. Average hourly earnings came in a touch softer than expected, up 0.2% in September. On a year-ago basis, average hourly earnings have risen 4.2%—the slowest pace in more than two years—while the 3.4% annualized growth in AHE the past three months suggests a further drop in the year-over-year number is coming. While labor cost growth still needs to subside somewhat further to be consistent with 2% inflation over time, the moderation is a welcome step in the right direction for the inflation-fighting Fed. While the typical worker may be experiencing a slower pace of wage growth, the still-solid rate of hiring suggests growth in aggregate income derived from the labor market continues on at a decent clip, which should support overall consumer spending (chart).

After Employment, FOMC Watching CPI, ECI Closely

Today’s resoundingly strong employment report will likely keep the FOMC on guard as it watches for signs that a tight labor market could prevent inflation from returning to 2% on a sustained basis. Another rate hike before the end of the year is a possibility, but for now our base case remains that the last rate hike of the tightening cycle occurred in July. Core inflation continues to grind lower, and we expect another relatively tame reading in next week’s CPI report. In addition, robust labor supply growth has helped restrain labor cost growth, as indicated by the softness in average hourly earnings. The earnings data from the employment report are a somewhat crude measure of wages, so the Employment Cost Index (ECI) to be released on October 31 will be critical to confirming that labor costs are indeed decelerating. If the CPI and ECI data cooperate, we would expect the FOMC to remain on hold at its upcoming November 1 meeting.