Summary

- At their respective monetary policy meetings this week, central banks in Australia and New Zealand remained relatively comfortably on hold.The Reserve Bank of Australia (RBA) held its Cash Rate at 4.10%, while the Reserve Bank of New Zealand (RBNZ) held its Official Cash Rate at 5.50%.

- For Australia, the RBA said that the economy is experiencing below-trend growth and that inflation is still expected to return to the 2-3 percent target range over its forecast period. While the RBA maintains a mild tightening bias, so long as growth stays sluggish and wage and price inflation keep trending in a favorable direction, we still think the current 4.10% policy rate will prove to be the peak for this cycle.

- The RBNZ said interest rates are constraining economic activity and reducing inflationary pressure. The central bank gave no clear signal of further tightening, but did hint that interest rates might have to remain at an elevated level for a more sustained period of time.

- Against a backdrop of overall resilient U.S. activity and higher U.S. yields, we view an on-hold RBA and RBNZ as consistent with some further Australian and New Zealand dollar downside in the months ahead. We target a low for AUD/USD around $0.6100, and a low for NZD/USD around $0.5700, by end Q1-2024.

Reserve Bank of Australia Still Watching, Still Waiting

The Reserve Bank of Australia (RBA) held its Cash rate at 4.10% at this week’s monetary policy announcement, an outcome that was widely expected. Notably, the RBA made very few changes in its accompanying statement which, in our view, suggests the central bank will remain on hold for the foreseeable future. Among the salient points from the RBA’s announcement, the central bank said:

- Inflation is too high and will remain so for some time yet.

- Higher interest rates are helping to establish a more sustainable balance between supply and demand in the economy, and holding rates steady provides further time to assess the impact of past monetary tightening.

- Australian growth was a little stronger than expected in the first half of the year, but the economy is still experiencing below-trend growth which is expected to continue for a while.

Recent data are consistent with inflation returning to the 2-3 percent target range over its forecast period with output and employment continuing to grow. - Significant uncertainties around the outlook include the persistence of services inflation, an uncertain outlook for Australian household consumption, and challenges for the Chinese economy, including the real estate sector.

In terms of future guidance, the RBA said “some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will continue to depend upon the data and the evolving assessment of risks. In making its decisions, the Board will continue to pay close attention to developments in the global economy, trends in household spending, and the outlook for inflation and the labor market.”

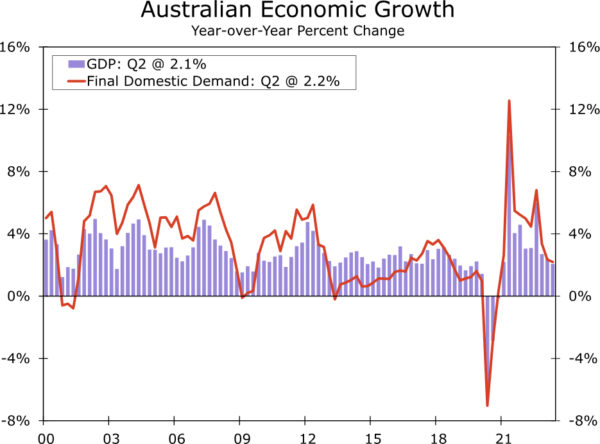

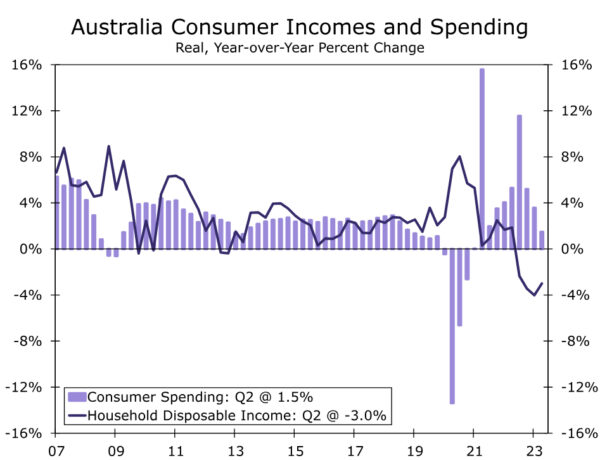

However, while the RBA maintained a mild tightening bias, at the current juncture we do not forecast any further rate hikes and believe the current policy rate of 4.10% will be the peak for this cycle. With respect to economic growth, recent indicators appear consistent with ongoing below-trend growth. Australian GDP grew just 0.4% quarter-over-quarter in both Q1 and Q2 of this year. To be sure, growth in final domestic demand was somewhat stronger at 0.7% per quarter. Over the past year, however, both overall GDP and final domestic demand have grown by just over 2%, which is subdued by historical standards. Notwithstanding a jump in August employment (driven largely by part-time jobs) and a rise in the September manufacturing and services PMIs, we still see reasons to expect slower growth in the Australian economy during the second half of this year. Household incomes have not kept up with the pace of inflation, meaning that the trend in real household disposable incomes has turned negative, a factor that should continue to weigh on consumer spending. In addition, China’s ongoing economic challenges could be a headwind for Australia’s economy.

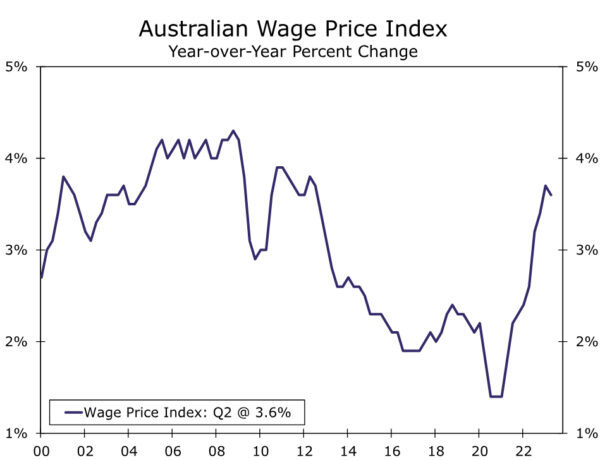

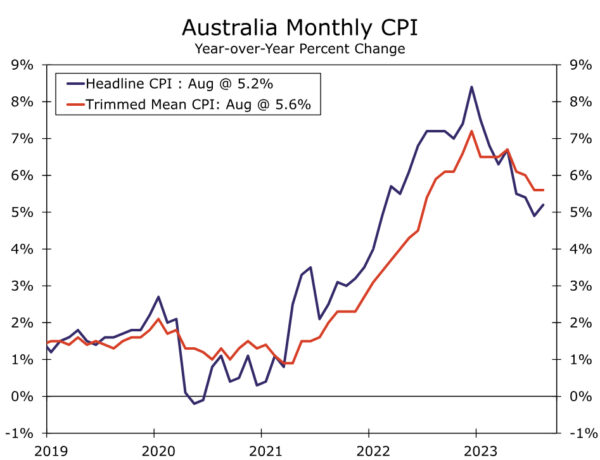

In addition to subdued economic growth, Australian wage and price inflation has started trending in a more favorable direction, albeit gradually. Even with a still relatively tight labor market, there are very early hints of an easing in wage pressures, and the Wage Price Index slowed slightly to 3.6% year-over-year in Q2. The more timely data available on price trends shows a more perceptible slowing of inflation. The August headline CPI rose 5.2% year-over-year, down from a peak of 8.4% last December. Underlying measures of inflation have also slowed, including the trimmed mean CPI, which rose 5.6% in August. So long as Australia economic growth remains subpar and inflation continues to trend in a more favorable direction, we believe the Reserve Bank of Australia will be comfortable remaining on hold. In contrast, there appears to be more debate and discussion about the possibility of a further Federal Reserve rate increase, as well as how long the Fed’s policy rate will remain at elevated levels, a factor that has contributed to rising U.S. bond yields. Considering the resilience of the U.S. economy to date, we believe this backdrop remains consistent with further U.S. dollar strength, including versus the Australian currency. For the months ahead we remain biased toward Australian dollar downside, and forecast a low for the Australian currency around $0.6100 by end Q1-2024.

Reserve Bank of New Zealand Joins The Higher For Longer Club

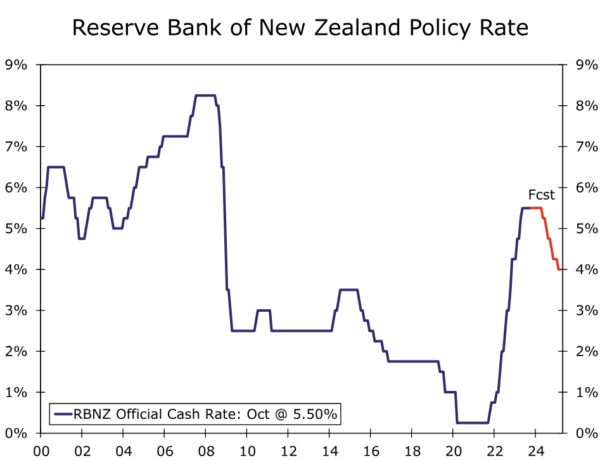

The Reserve Bank of New Zealand (RBNZ) held its Official Cash Rate at 5.50% at this week’s announcement, an outcome that was also widely expected. While the central bank reiterated its determination to return inflation towards target, its accompanying comments were not as hawkish as might have been anticipated, especially in the context of rising expectation for further interest rate hikes at upcoming meetings that had emerged in recent weeks. Among the RBNZ’s main points:

- Higher interest rates are constraining economic activity and reducing inflationary pressure as required.

- While Q2 GDP growth was stronger than expected, demand growth continues to ease overall.

- A prolonged period of subdued activity is required to reduce inflation pressure.

- The Official Cash Rate needs to stay at a restrictive level to ensure that inflation returns to target.

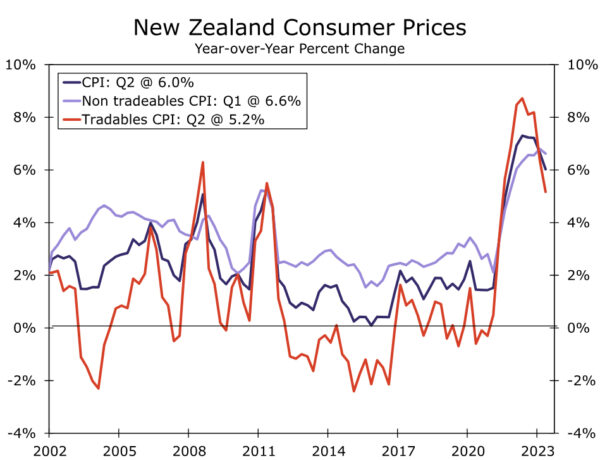

Of particular note, the summary record of the meeting noted that policymakers “agreed that interest rates may need to remain at a restrictive level for a more sustained period of time, to ensure annual consumer price inflation returns to the 1 to 3% target range and to support maximum sustainable employment.” The desire to keep interest rates at current levels for an extended period is perhaps not surprising given that domestically-oriented non-tradeables inflation is still running at an elevated pace for the time being.

Overall, there was no clear indication of further tightening from the RBNZ, and our view remains that the policy rate peak for the current cycle has already been reached at 5.50%. However, it also appears that interest rates could remain at an elevated level for a longer period of time, suggesting the risk is that RBNZ rate cuts could begin later than the Q2-2024 easing we currently forecast. Against a backdrop of overall resilient U.S. activity trends and higher U.S. yields, that suggests some further downside for the NZ dollar, although the RBNZ’s “higher for longer” mantra might limit the extent of the NZ currency’s decline. We target a low for the New Zealand dollar around $0.5700 by end Q1-2024.