Dollar is finding strength amidst an atmosphere of palpable anxiety in the financial markets, stemming from a continuation of the risk-off mood from US into Asian session. This prevailing anxiety in the markets has been heightened by the pronounced drop in US stocks overnight, coupled with a surge in long-end treasury yields. Adding to the complexity, there’s been a quick normalization in the yield curve accompanied by a notable spike in the VIX fear index. As investors brace themselves, the focus now pivots towards the forthcoming US ADP employment and ISM Services data. However, the market is caught in a conundrum, trying to decipher if positive data will quell or exacerbate the prevailing anxiety.

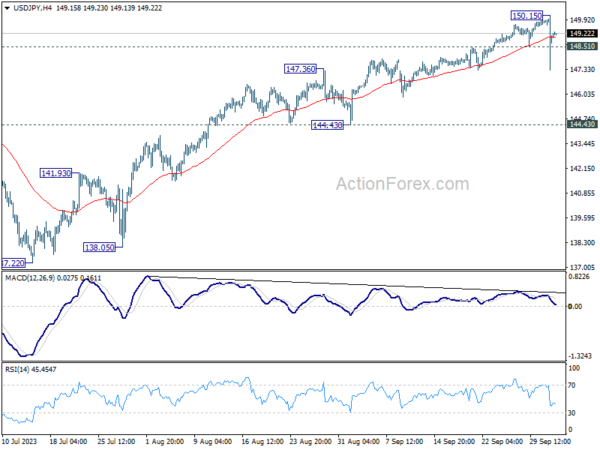

At the same time, Yen has made significant strides, an strong bounce that could be attributed to Japan’s unconfirmed intervention in the currency markets. However, this edge was short-lived, with USD/JPY experiencing a swift rebound. Current behavior suggests that speculators might have been gearing up to capitalize on Yen sales, rather than aligning with Japan’s presumed objective of buying the currency. With the financial climate teetering on unease and impending significant data releases like Friday’s US NFP, we can expect substantial fluctuations in USD/JPY in the immediate future.

Following RBNZ’s decision to keep interest rates steady, New Zealand Dollar is currently languishing near the bottom of the currency chart. Aussie, too, is underperforming, particularly after RBA’s parallel decision yesterday. For the time being, European majors display a mixed performance, though the Swiss Franc is exhibiting a slight advantage. Yet, when considering their performances against each other, Euro, Sterling, and Swiss Franc are trading within their usual bounds.

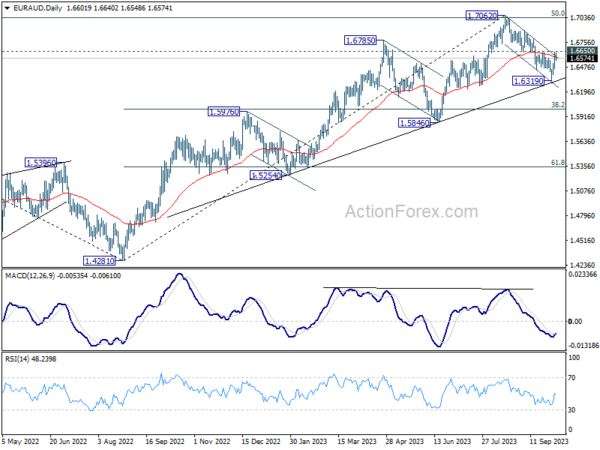

Technically, EUR/AUD is now pressing 1.6650 resistance after this week’s bounce. Firm break there will argue that correction from 1.7062 has completed after drawing support from medium term rising trend line. Stronger rally would be seen back to retest 1.7062 high next. If realized, that would be a signal of more broad based selloff in Aussie, as probably intensification of risk aversion too.

In Asia, at the time of writing, Nikkei is down -1.87%. Hong Kong HSI is down -0.99%. Singapore Strait Times is down -1.50%. Japan 10-year JGB yield is up 0.033 at 0.797, just shy of 0.8 handle. Overnight, DOW dropped -1.29%. S&P 500 dropped -1.37%. NASDAQ dropped -1.87%. 10-year yield rose 0.119 to 4.802.

Japan’s top brass remains mum on intervention claims

Market watchers were in a frenzy after Japanese Yen surged from 150 to the 147 zone against Dollar overnight , fuelling speculation that Japan’s government may have stealthily intervened to push up the struggling currency. While evidence of a Yen-buying, Dollar-selling maneuver abounds, top officials in Japan remained tight-lipped today.

Finance Minister Shunichi Suzuki, when confronted by reporters, chose the path of silence over confirmation. He held back from validating the swirl of speculations about intervention. Suzuki reiterated a standard narrative, emphasizing the desirability of market-driven, stable currency movements that mirror economic fundamentals.

“Currency rates ought to move stably driven by markets, reflecting fundamentals. Sharp moves are undesirable,” Suzuki noted. “The government is monitoring market developments very carefully with a sense of urgency. We will take appropriate steps against excessive volatility without excluding any options.”

Masato Kanda, the top currency diplomat, provided insights into the government’s assessment mechanism for currency movements. “If currencies move too much on a single day or, say, a week, that’s judged as excess volatility,” Kanda explained.

The implied volatility stands as a critical metric, among others, shaping the official perspective on whether Yen’s moves are reaching alarming amplitudes.

Kanda further outlined that even in the absence of abrupt shifts, a gradual yet one-sided build-up of significant currency movements over time is also classified as excessive volatility. However, he too refrained from offering a direct commentary on the overnight upswing of Yen.

RBNZ holds rates, hints at longer duration of restrictive policy

RBNZ has opted to keep the Official Cash Rate stable at 5.50%, aligning with broad market anticipations. The minutes of the meeting revealed a consensus among committee members that restrictive interest rate environment might be needed “for a more sustained period of time”.

In the short term, RBNZ is looking at a scenario where domestic demand could exhibit “greater resilience”, spurred by migration. This situation could “slow the pace of expected disinflation”. A related concern is wage inflation, which could take a longer time to ease than initially expected. Recent rise in oil prices could also risk “headline inflation being higher than expected”.

Looking at the medium term, the minuted noted concerns about greater slowdown in global growth. Such a downturn could lead to further reductions in non-oil import prices. Moreover, weakened global demand, with a particular emphasis on China, could exert additional pressure on commodity prices, subsequently affecting New Zealand’s export revenues.

Anxiety grips Wall Street: DOW plummets, VIX jumps, Yields soar

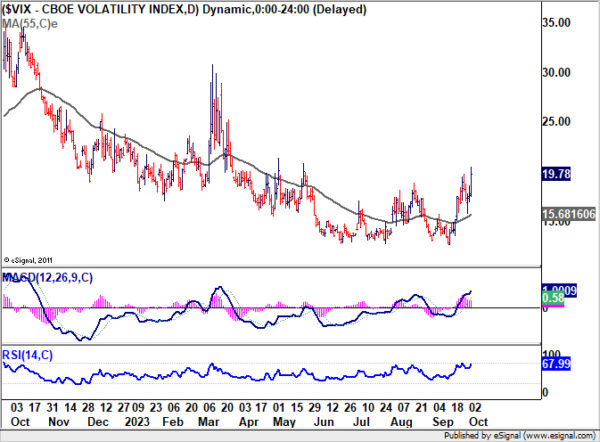

Economic storm clouds appear to be gathering on the horizon. With DOW experiencing its most significant drop since March and key Treasury yields touching multi-year highs, whispers of a potential recession are becoming more audible. This is further exacerbated by the behavior of VIX, often dubbed the “fear index”, which indicates heightened market apprehensions.

DOW plummeted by -430.97 points, or -1.29%, nudging it into negative territory for the year, now lagging by -0.4%. This downturn wasn’t isolated to stocks. The 10-year yield reached a staggering 4.8%, a pinnacle not seen in 16 years. Similarly, 30-year yield hit a peak of 4.925%, levels of which we haven’t seen since 2007.

The narrowing gap between the 2-year and 10-year Treasury yields, contracting to a mere 35 basis points from over 100 basis points a few months earlier, is especially concerning. This normalization, or “de-inverting”, of a vital part of the yield curve is often viewed as a precursor to economic downturns, igniting debates on the imminence of a recession.

Adding to the market’s jitters, VIX has climbed for three consecutive sessions, momentarily crossing the critical 20 level and finishing at a six-month high. Values below 20 on the VIX generally signify market stability, but as it surpasses this threshold, it denotes an environment fraught with investor unease and skittishness.

Back to DOW, it’s now pressing and important near fibonacci support at 38.2% retracement of 28660.94 to 35679.13 at 32998.17. Sustained break of this level will strengthen the case that fall from 35679.13 is reversing whole rise from 28660.94. This decline could be viewed as the third leg of the long term pattern from 36952.65 high. Deeper fall would be seen to 31.429.82 support, which is close to 61.8% retracement at 31341.88.

In any case, near term outlook will stay bearish as long as 34029.22 support turned resistance holds. The rest of the week, with ISM services today and non-farm payrolls release on Friday, will be crucial.

Looking ahead

Eurozone PMI services final, PPI and retail sales will be released in European session. UK will also release PMI services final. Later in the day, US ADP employment ISM services and factory orderes will take center stage.

USD/JPY Daily Outlook

Daily Pivots: (S1) 148.21; (P) 149.18; (R1) 150.03; More…

USD/JPY spiked lower to 147.28 overnight, on alleged intervention by Japan, but recovered quickly since then. As short term top should be in place at 150.15, on bearish divergence condition in 4H MACD. Intraday bias is turned neutral first and more corrective could be seen. But there is no confirmation of bearish trend reversal before firm break of 144.43 support. Another rally remains mildly in favor through 150.15 to retest 151.93 high.

In the bigger picture, while rise from 127.20 is strong, it could still be seen as the second leg of the corrective pattern from 151.93 (2022 high). Rejection by 151.93, followed by sustained break of 145.06 resistance turned support will be the first sign that the third leg of the pattern has started. However, sustained break of 151.93 will confirm resumption of long term up trend.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:00 | NZD | RBNZ Interest Rate Decision | 5.50% | 5.50% | 5.50% | |

| 07:45 | EUR | Italy Services PMI Sep | 50 | 49.8 | ||

| 07:50 | EUR | France Services PMI Sep F | 43.9 | 43.9 | ||

| 07:55 | EUR | Germany PMI Sep F | 49.8 | 49.8 | ||

| 08:00 | EUR | Eurozone Services PMI Sep F | 48.4 | 48.4 | ||

| 08:30 | GBP | Services PMI Sep F | 47.2 | 47.2 | ||

| 09:00 | EUR | Eurozone PPI M/M Aug | 0.60% | -0.50% | ||

| 09:00 | EUR | Eurozone PPI Y/Y Aug | -11.60% | -7.60% | ||

| 09:00 | EUR | Eurozone Retail Sales M/M Aug | -0.50% | -0.20% | ||

| 12:15 | USD | ADP Employment Change Sep | 155K | 177K | ||

| 13:45 | USD | Services PMI Sep F | 50.2 | 50.2 | ||

| 14:00 | USD | ISM Services PMI Sep | 53.6 | 54.5 | ||

| 14:00 | USD | Factory Orders M/M Aug | 0.20% | -2.10% | ||

| 14:30 | USD | Crude Oil Inventories | -0.1M | -2.2M |