Gold keeps negative tone at the beginning of the week and fell to new lowest in almost seven months ($1839) in early European trading on Monday.

The metal extends steep fall into sixth straight day after registering weekly loss of 4% last week (the biggest weekly drop since mid-June 2021).

Gold was down 4.7% in September, mainly driven by stronger dollar, but recent weak US economic data signal that tight Fed monetary policy started to bite, which may result in fresh demand for safe-haven yellow metal.

Data on Friday showed that underlying US inflation eased last month (PCE index, closely watched by Fed), adding to signals that the central bank might be done with rate hikes, though percentage of expectations for another hike is still significant.

The US economic data to be released this week, are expected to provide more details, with today’s speech by Fed Chair Powell to be followed by job openings, private sector hiring and non-farm payrolls.

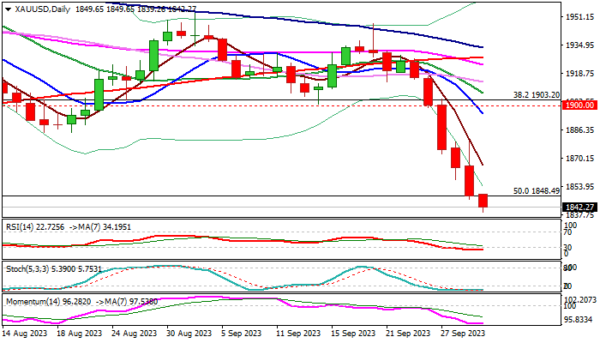

Technical picture on daily chart is bearish but deeply oversold, which suggests that bears may start to face headwinds.

Fresh weakness broke below $1848 (50% of $1616/$2080 rally) and eyeing $1823 (weekly Ichimoku cloud base) which may mark a strong obstacle and pause larger bears.

Slower pace ahead of key US labor data is likely and a partial profit taking after a steep fall could be a likely near-term scenario, with overall bearish bias to remain intact while the price stays below former low at $1885 (Aug 17).

Caution on return above $1900 zone (former strong support, now reverted to significant resistance) which would put larger bears on hold.

Res: 1848; 1866; 1885; 1895.

Sup: 1839; 1823; 1814; 1804.