As the quarter nears its end, a tangible shift towards a risk-on sentiment is sweeping through the global financial markets. Supported by lower than expected inflation data from both sides of the Atlantic, investors are regaining confidence. This renewed optimism is evident in the notable gains posted by major European stock indexes, with US futures also suggesting a robust opening. Benchmark treasury yields also continue to pare back recent gains.

The Eurozone’s less-than-anticipated inflation figures are reinforcing the consensus that ECB have reached the peak of its interest rate hikes. Concurrently, US’s modest monthly core PCE inflation reading has alleviated some urgency for Fed to implement another rate increase, further fueling the market’s positive outlook. Meanwhile, concerns about the partial government shutdown in the US seem to be taking a backseat for traders

In the currency domain, the Dollar is facing a pronounced selloff, a trend that began in the Asian trading session and has intensified throughout the day. Euro and Yen are not far behind, echoing Dollar’s dip. Contrarily, New Zealand and Australian Dollars are rallying, with Sterling joining the upward momentum. Canadian Dollar, however, is experiencing constrained vigor, attributed to disappointing GDP data that has curtailed its ascent.

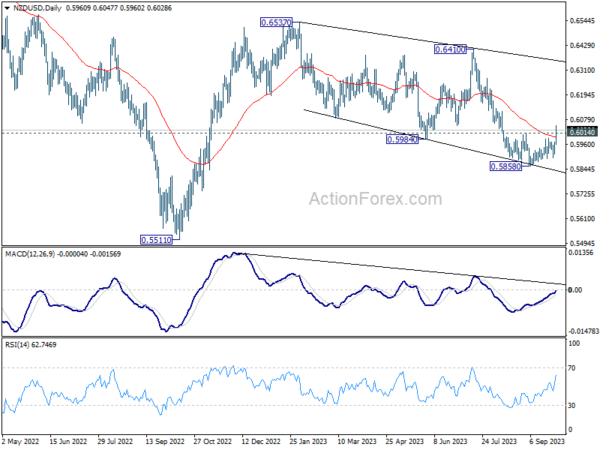

Technically, NZD/USD’s strong break of 0.6014 resistance and 55 D EMA firstly confirms short term bottoming at 0.5858. More important, that’s a sign that corrective pattern from 0.6537 has completed with three waves down to 0.5858. Further rally is now in favor in back to 0.6410 resistance next. To strengthen this bullish case, AUD/USD should also break through 0.6510 resistance and 55 D EMA soon in tandem.

In Europe, at the time of writing, FTSE is up 0.3%. DAX is up 1.17%. CAC is up 1.17%. Germany 10-year yield is down -0.0960 at 2.835. Earlier in Asia, Nikkei fell -0.05%. Hong Kong HSI rose 2.51%. Singapore Strait TImes rose 0.32%. Japan 10-year JGB yield rose 0.0097 to 0.771.

US PCE inflation rose to 3.5% yoy in Aug, core PCE down to 3.9% yoy

US personal income rose 0.4 mom or USD 87.6B in August, matched expectations. Personal spending rose 0.4% mom or USD 83.6B, below expectation of 0.5% mom. That includes USD 47.0B increase in spending for services, and USD 36.7B increase in spending for goods.

For the month, headline PCE price index rose 0.4% mom, below expectation of 0.5% mom. Core PCE price index rose 0.1% mom, below expectation of 0.2% mom. Prices for goods increased 0.8% mom and prices for services increased 0.2% mom. Food prices increased 0.2% mom and energy prices increased 6.1% mom.

From the same month one year ago, headline PCE price index rose from 3.4% yoy to 3.5% yoy, matched expectations. Core PCE price index slowed from 4.3% yoy to 3.9% yoy, matched expectations. Prices for goods increased 0.7% yoy and prices for services increased 4.9% yoy. Food prices increased 3.1% yoy and energy prices decreased -3.6% yoy.

Canada GDP flat in July, might edge up 0.1% mom in Aug

Canada GDP was essentially unchanged in July, below expectation of 0.10% mom growth. Goods-producing industries contracted -0.3% mom while services-producing industries grew 0.1% mom. Overall, 9 of 20 industrial sectors posted increases.

Advance information indicates that real GDP edged up 0.1% mom in August. Increases in wholesale trade and finance and insurance sectors were partly offset by decreases in retail trade and oil and gas extraction sectors.

Eurozone CPI eases to 4.3% in Sep, core CPI down to 4.5%

Eurozone CPI slowed from 5.2% yoy to 4.3% yoy in September, below expectation of 4.5% yoy. CPI core (ex energy, food, alcohol & tobacco) also slowed from 5.3% yoy to 4.5% yoy, below expectation of 4.8% yoy.

Looking at the main components, food, alcohol & tobacco is expected to have the highest annual rate in September (8.8%, compared with 9.7% in August), followed by services (4.7%, compared with 5.5% in August), non-energy industrial goods (4.2%, compared with 4.7% in August) and energy (-4.7%, compared with -3.3% in August).

ECB’s Vasle: Probably done with rate hikes, but still many uncertainties

In a panel discussion held in Skopje today, opinions about the future of interest rates and inflation were aired by two members of ECB’s Governing Council.

Bostjan Vasle suggested that the series of interest rate hikes might have come to an end, citing a possible easing of inflation. Boris Vujcic, on the other hand, shared a more cautious perspective, highlighting potential challenges in attaining the 2% inflation target.

Vasle, Slovenia’s central bank head, was quoted saying, “It’s probably the case that we are done with interest-rate increases.” He noted that current economic indicators appear favorable, with preliminary signs of inflation tapering off.

However, Vasle also pointed out the prevailing uncertainties, stating, “We are seeing some signs of inflation going down, also some first signs of sustainability of this trends, but on the other hand, there are still many uncertainties.”

Croatian central bank chief Vujcic, acknowledged the downward movement towards the 2% goal but pointed out the statistical effects that may be influencing these figures. His words served as a reminder of the monetary policy challenges that could arise if the disinflation process stalls before reaching the target.

“You might get into a situation where the inflation rate — the disinflation process — stops at a level, which is not your target,” Vujcic expressed. “Then it’s challenging for monetary policy, because it has to do something more to bring it all the way down to 2%.”

Swiss KOF dips to 95.9, cooling economy for end of the year

Swiss KOF Economic Barometer registered a drop in September, moving from 96.2 to 95.9. Although this decline was milder than the anticipated fall to 90.5, the barometer still positions below its historical average. This suggests a deceleration in the Swiss economy as 2023 comes to a close.

KOF said: “The slight decline is primarily attributable to bundles of indicators from the manufacturing and other services sectors. Indicators from the finance and insurance sector and the construction industry are sending positive signals.”

Japan’s industrial output flat in Aug, Tokyo inflation eases in Sep

Japan’s industrial output for August surprised by remaining steady month-on-month, outpacing expectations of a -0.8% mom decline. The seasonally adjusted index of production at factories and mines held its ground at 103.8, based on 2020 base of 100. Equally, index of industrial shipments ticked up by 0.1% to 103.2. In contrast, inventory index marked a -1.7% decrease to 104.6, registering the first decline in a quadrimestrial span.

The Ministry of Economy, Trade and Industry maintained a cautious tone on the economy’s direction, indicating that industrial output “fluctuated indecisively.” However, optimism is still present; the ministry’s poll suggests that manufacturers anticipate a 5.8% uptick in production for September, followed by a 3.8% rise in October.

On the retail front, August saw a 7.0% yoy surge in retail sales, surpassing anticipated 6.4% yoy. This momentum builds upon the month’s modest growth of 0.1% mom.

The labor market remained resilient, with the unemployment rate steadfast at 2.7%. The job offers-to-applicants ratio for August persisted at 1.29, unchanged from July.

Inflationary pressures seem to be cooling down. Tokyo’s core CPI for September, excluding food, dipped more than forecasted, from 2.8% yoy to 2.5% yoy , as opposed to the predicted 2.6% yoy. Headline CPI decreased slightly from 2.9% yoy to 2.8% yoy. Additionally, core-core CPI, which excludes both food and energy, retreated from 4.0% yoy to 3.8% yoy.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2141; (P) 1.2183; (R1) 1.2246; More…

Intraday bias in GBP/USD remains neutral at this point. Recovery from 1.2109 could still extend higher. But near term risk will stay on the downside as long as 1.2420 turned resistance holds. Fall from 1.3141 is still in favor to continue. On the downside, decisive break of 1.2075 fibonacci level would carry larger bearish implication and target 1.1801 support next.

In the bigger picture, fall from 1.3141 medium term top could still be a correction to up trend from 1.0351 (2022 low) only. But risk of complete trend reversal is rising. Sustained break of 38.2% retracement of 1.0351 to 1.3141 at 1.2075 will pave the way to 61.8% retracement at 1.1417. For now, risk will stay on the downside as long as 55 D EMA (now at 1.2526) holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Y/Y Sep | 2.80% | 2.90% | ||

| 23:30 | JPY | Tokyo CPI ex Fresh Food Y/Y Sep | 2.50% | 2.60% | 2.80% | |

| 23:30 | JPY | Tokyo CPI ex Food Energy Y/Y Sep | 3.80% | 4.00% | ||

| 23:30 | JPY | Unemployment Rate Aug | 2.70% | 2.60% | 2.70% | |

| 23:50 | JPY | Industrial Production M/M Aug P | 0.00% | -0.80% | -1.80% | |

| 23:50 | JPY | Retail Trade Y/Y Aug | 7.00% | 6.40% | 6.80% | 7.00% |

| 01:30 | AUD | Private Sector Credit M/M Aug | 0.40% | 0.30% | 0.30% | |

| 05:00 | JPY | Housing Starts Y/Y Aug | -9.40% | -8.90% | -6.70% | |

| 05:00 | JPY | Consumer Confidence Index Sep | 35.2 | 36.2 | 36.2 | |

| 06:00 | GBP | GDP Q/Q Q2 F | 0.20% | 0.20% | 0.20% | |

| 06:00 | GBP | Current Account (GBP) Q2 | -25.3B | -14.0B | -10.8B | |

| 06:00 | EUR | Germany Import Price Index M/M Aug | 0.40% | 0.50% | -0.60% | |

| 06:00 | EUR | Germany Retail Sales M/M Aug | -1.20% | 0.50% | -0.80% | |

| 06:45 | EUR | France Consumer Spending M/M Aug | -0.50% | -0.40% | 0.30% | |

| 07:00 | CHF | KOF Economic Barometer Sep | 95.9 | 90.5 | 91.1 | 96.2 |

| 07:55 | EUR | Germany Unemployment Change Aug | 10K | 14K | 18K | |

| 07:55 | EUR | Germany Unemployment Rate Aug | 5.70% | 5.70% | 5.70% | |

| 08:30 | GBP | Mortgage Approvals Aug | 45K | 48K | 49K | 50K |

| 08:30 | GBP | M4 Money Supply M/M Aug | 0.20% | 0.20% | -0.50% | -0.60% |

| 09:00 | EUR | Eurozone CPI Y/Y Sep P | 4.30% | 4.50% | 5.20% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Sep P | 4.50% | 4.80% | 5.30% | |

| 12:30 | CAD | Canada GDP M/M Jul | 0.00% | 0.10% | -0.20% | |

| 12:30 | USD | Personal Income M/M Aug | 0.40% | 0.40% | 0.20% | |

| 12:30 | USD | Personal Spending Aug | 0.40% | 0.50% | 0.80% | |

| 12:30 | USD | PCE Price Index M/M Aug | 0.40% | 0.50% | 0.20% | |

| 12:30 | USD | PCE Price Index Y/Y Aug | 3.50% | 3.50% | 3.30% | 3.40% |

| 12:30 | USD | Core PCE Price Index M/M Aug | 0.10% | 0.20% | 0.20% | |

| 12:30 | USD | Core PCE Price Index Y/Y Aug | 3.90% | 3.90% | 4.20% | 4.30% |

| 12:30 | USD | Goods Trade Balance (USD) Aug P | -84.3B | -91.2B | -90.9B | -90.9B |

| 13:45 | USD | Chicago PMI Sep | 47.6 | 48.7 | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Sep F | 67.7 | 67.7 |