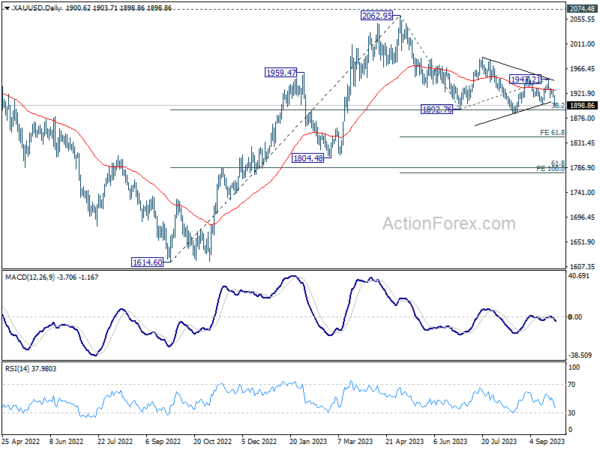

Gold is under intensifying selling pressure this week. The prominent drivers behind this selloff are strengthening Dollar and, crucially, surging treasury yields. As a result, the yellow metal finds itself back at a crucial support zone around 1900 mark.

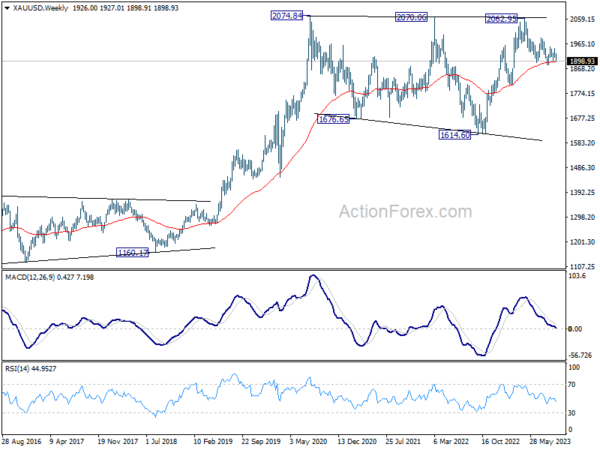

Within this critical support region lies 38.2% retracement of 1614.60 (2022 low) to 2062.95 at 1891.68, as well as 55 W EMA (now at 1896.68). A clear break below this pivotal range would underscore the notion that whole rally originating from 1614.60 has completed at 2062.95 already, stopping short of 2020 high of 2074.84. This descent from 2062.95 could then be interpreted as a medium-term fall trend, as one of the falling legs inside the long term consolidation pattern from 2074.84.

For now, risk will stay on the downside as long as 1947.21 resistance holds. Sustained break of 1884.83 support will pave the way to 61.8% projection of 2062.95 to 1892.76 from 1947.21 at 1842.03 in the near term. 100% projection at 1777.02 and below will be the medium term target.

Drawing parallels with other markets, the extended decline in Gold, if realized, would be consistent with Dollar Index surging towards 108/110 zone.