- Gold prices have remained stable lately, even as interest rates shot higher

- Central bank purchases have boosted demand, offsetting impact from rates

- Downside risks dominate for now, but longer-term outlook seems bright

Gold stable, despite ‘bad news’

Gold continues to trade with impressive resilience. Even though conditions in financial markets have turned against the precious metal in recent months, gold prices have not absorbed much damage, defying the negative pressure exerted by soaring interest rates and an appreciating US dollar.

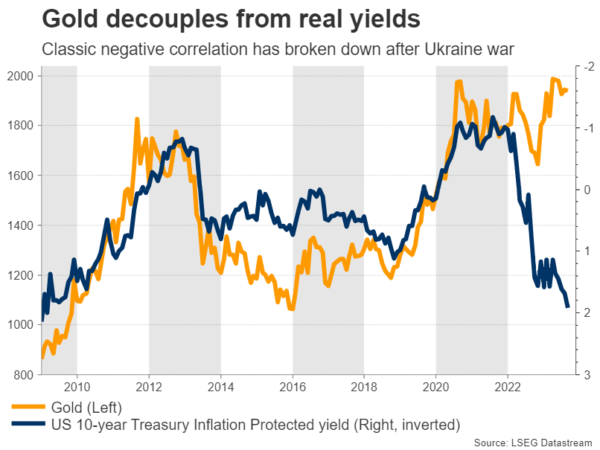

In normal times, gold and interest rates have a negative relationship. When rates rise and yields on government bonds race higher, gold becomes less attractive, as it pays no interest to hold. If investors can buy a US government bond that pays them a yield of 4.5% per year, like they can today, they are less likely to buy the non-yielding precious metal. That’s what theory suggests, at least.

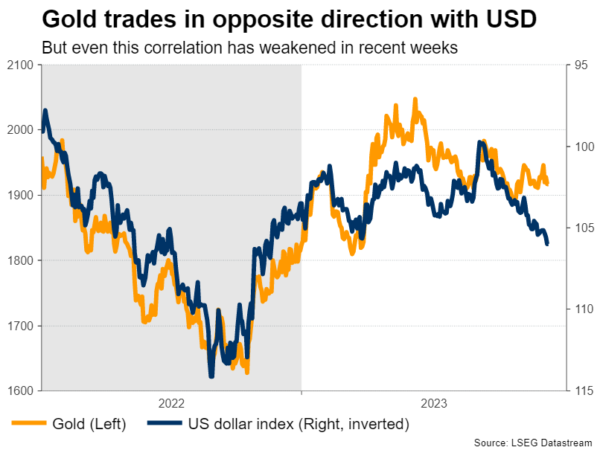

Similarly, a stronger US dollar is bad news for gold because the metal is mostly priced in US dollars. This means that when the dollar appreciates, it becomes more expensive for investors outside of the United States to buy gold, which inevitably dampens demand.

But these classic correlations have broken down lately. Yields on inflation-protected bonds went through the roof in September to reach their highest levels in almost 15 years and the dollar has staged a phenomenal recovery. Going purely by the historical relationships, this combination should have smashed gold down.

Yet, the yellow metal has remained relatively flat, and continues to trade 8% away from record highs. Therefore, some new element has come into play to change gold’s trading dynamics.

Central bank demand

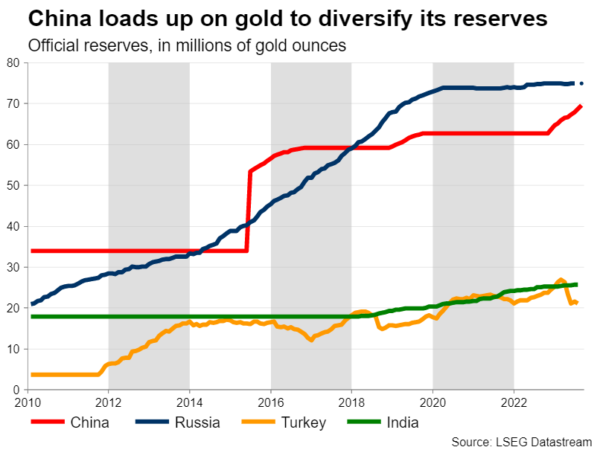

This new element has been the direct buying of gold by central banks in an effort to raise their reserves. Central bank gold purchases reached a new record in the first half of this year, a pattern that likely persisted in the third quarter, spearheaded by China.

Geopolitics lie behind this boom in central bank demand. The invasion of Ukraine resulted in the immediate freezing of Russia’s reserves held abroad in dollars and euros – around half of the assets held by the Bank of Russia were frozen under Americans and European sanctions. That was the beginning of a paradigm shift for how central banks manage their reserves.

The People’s Bank of China started loading up on gold to diversify the nation’s reserves away from dollars and euros, concerned about suffering the same fate in case diplomatic relations with the West turn colder in the future. This diversification strategy has seen China consistently buy gold for ten consecutive months through August, in what could be a multi-year trend.

Sovereign purchases have fueled underlying demand for gold, almost establishing a floor under prices. When there are such massive buyer whales active in the market, which are not sensitive to prices because their motives are mostly political, it helps to prevent any massive selloffs. Hence the resilience of gold prices in the face of sky-high rates.

The central bank buying spree has also suppressed volatility. Gold options contracts have seen their implied volatility fall to pre-pandemic levels over the summer, which essentially means investors are not hedging as much for any massive movements in gold, expecting the boost in demand to translate into smoother trading conditions moving forward.

New record highs possible, but not imminent

In the near term, downside risks for gold will probably continue to dominate. The negative forces of rising real yields and a roaring US dollar could continue to dampen the appeal of the precious metal, keeping a lid on any rallies.

It is difficult to say exactly how much further the rally in the dollar and yields can go. The US economy is superior to its competitors at this stage from a growth perspective, the Fed has shifted to a stance of higher-for-longer interest rates, and the Treasury will continue to flood the markets with newly issued debt next quarter, maintaining the upward pressure on yields.

Therefore, it seems premature to call for a trend reversal in gold. Most likely, these factors will keep the precious metal under selling interest in the coming weeks. That said, any losses could also be relatively limited considering the purchases from central banks, so gold prices might only bleed lower in a slow manner.

Looking at the charts, the most crucial regions to watch on the downside are $1,900, and beyond that the August low near $1,885. If that zone is violated too, the spotlight would turn to $1,860, a level marked by the inside swing high in March.

In the bigger picture, though, it seems quite plausible that gold can eventually rally to new records. If the highest bond yields in a generation could only knock gold 8% down from record highs, the precious metal can likely take out those highs once yields cool off again.

For that to happen, it might require some panic event in global markets or signs of an imminent US recession that fuel speculation of Fed rate cuts. That’s not on the horizon for now, but the economic cycle does seem to be in its final stages, so it might simply be a matter of time.