Dollar is being the standout performer this week, bolstered significantly by surging US treasury yields. Dollar index, which gauges the greenback against a basket of six major currencies, reached a high not seen since the previous November, breaking 106 mark. Contributing to the bullish momentum, EUR/USD has plunged through a pivotal support level at 1.06, and USD/JPY is inching closer to 149 mark.

Interestingly, 10-year yield has surged to an impressive 4.5%, marking the highest point since 2007. Initially, a wave of risk aversion propelled Dollar during US trading hours. However, after major stock indexes rallied to end in positive territory, the greenback’s ascent moderated. Still, as major Asian markets trended downwards, Dollar managed to hold its ground.

At present, Swiss Franc is lagging, being the week’s poorest performer, with the Euro not faring much better. British Sterling is aiming to pare back its losses from the previous week, while Yen is in a flux, with traders cautious due to potential interventions by Japanese authorities. Remarkably, despite Dollar’s strength, commodity-linked currencies have managed to showcase some resilience.

Technically an immediate focus now is on whether 10-year yield could power through the medium term channel resistance to accelerate up, and the subsequent impact on other markets. If materialized, TNX could march further to next target at 61.8% projection of 1.343 to 4.333 from 3.253 at 5.100, which is above 5% mark. On the other hand, while a retreat from the current level cannot be ruled out, near term outlook in TNX will stay bullish as long as 4.362 resistance turned support holds. The market will likely get more clarity on these movements in the upcoming days.

In Asia, at the time of writing, Nikkei is down -0.92%. Hong Kong HSI is down -0.84%. China Shanghai SSE is down -0.33%. Singapore Strait Times is down -0.08%. Japan 10-year JGB yield is up 0.013 a 0.744. Overnight, DOW rose 0.13%. S&P 500 rose 0.40%. NASDAQ rose 0.45%. 10-yea ryield rose 0.104 to 4.542.

Fed’s Kashkari: Strong economy might warrant another rate hike

Minneapolis Fed President Neel Kashkari said at an event overngiht that the strength of the economy might necessitate higher interest rates for an extended period.

Kashkari commented, “If the economy is fundamentally much stronger than we realized, on the margin, that would tell me rates probably have to go a little bit higher, and then be held higher for longer to cool things off.”

In line with last week’s updated dot plot from Fed, where 12 out of 19 members indicated a potential rate hike this year, Kashkari affirmed his position, stating, “I’m one of those folks.”

However, Kashkari also pointed out a caveat, suggesting the possibility of rate cuts if inflation undergoes a swift decline next year. He elaborated, “Depending on what is happening in all the economic data that we look at, that then might justify backing off the federal funds rate — not to ease policy but just to stop it from getting tighter from here, and that’s something obviously we’ll have to look at.”

Japanese officials weigh in on Yen’s slide as it approaches 149 against Dollar

This week’s decline of Yen against Dollar, which seems poised to breach 149 mark, has brought remarks from Japanese officials into sharp focus. Market participants are keen to decipher indications of when Japan might transition from verbal caution to active intervention, even though it’s clear that Japan wouldn’t pre-announce such a move.

Finance Minister Shunichi Suzuki, reiterating his consistent position, stated today, “Foreign exchange rates should be determined by market forces, reflecting fundamentals.”

Suzuki emphasized that “Excessive volatility is undesirable,” and assured that the government is monitoring the currency fluctuations with a “high sense of urgency”. “We will respond as appropriate to excessive volatility without ruling out any options,” he added.

Echoing Suzuki’s sentiments, the newly appointed Economy Minister, Yoshitaka Shindo, stressed the significance of stable currency movements that mirror economic realities.

Pointing out the multifaceted impact of the Yen’s position, Shindo elaborated, “Weak Yen has various effects on economy such as raising import costs for consumers, improving competitiveness of exporters.”

With these comments, the stage is set for a heightened scrutiny of Japan’s potential interventions in the currency market. Market participants will no doubt remain vigilant to further remarks and actions by Japanese officials in the coming days.

Looking ahead

The economic calendar is empty in European session. Main focus will be on US consumer confidence to be released later in the day. US house price index and new home sales will also be featured.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0616; (P) 1.0644; (R1) 1.0673; More…

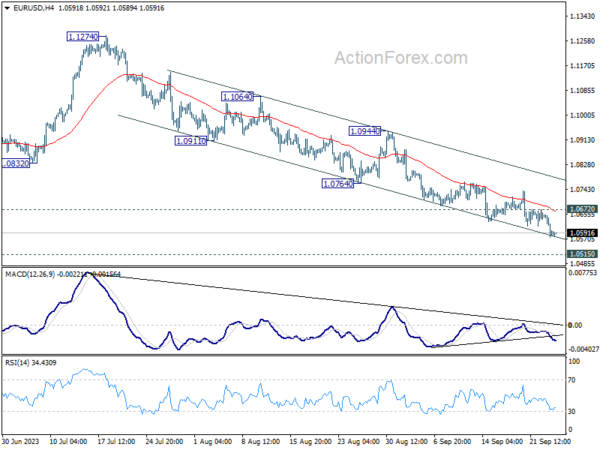

Intraday bias in EUR/USD is back on the downside as fall from 1.1274 resumed after brief consolidations. Sustained trading below 1.0609/34 cluster support will carry larger bearish implication, and target 1.0515 support next. On the upside, above 1.0672 minor resistance will turn intraday bias neutral and bring consolidations. But outlook will stay bearish as long as 1.0764 support turned resistance holds.

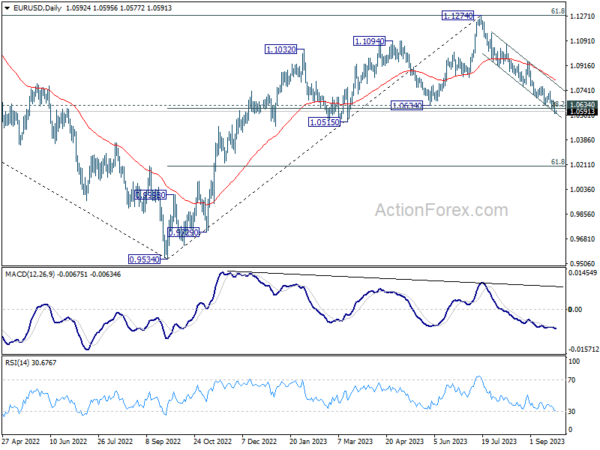

In the bigger picture, focus stays on 1.0634 cluster support (38.2% retracement of 0.9534 to 1.1274 at 1.0609). Sustained trading below there would rase the chance of bearish trend reversal. That is, fall from 1.1274 could be reversing whole rise from 0.9534 (2022 low). But even if it’s just a corrective move, deeper decline would be seen to 61.8% retracement at 1.0199. For now, risk will stay on the downside as long as 55 D EMA (now at 1.0825) holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Aug | 2.10% | 1.80% | 1.70% | |

| 13:00 | USD | S&P/CS Composite-20 HPI Y/Y Jul | -0.50% | -1.20% | ||

| 13:00 | USD | Housing Price Index M/M Jul | 0.10% | 0.30% | ||

| 14:00 | USD | Consumer Confidence Sep | 105.9 | 106.1 | ||

| 14:00 | USD | New Home Sales Aug | 700K | 714K |