Swiss Franc weakens broadly today, influenced predominantly by rally in benchmark European yields. Specifically, Germany 10-year yield breached 2.8% mark, reaching an 11-year peak. Euro managed to bounce back against the Australian and New Zealand dollars, which were burdened by concerns surrounding China’s property sector. However, Euro’s ability to gain against other currencies seems limited at present. While the recent Germany Ifo business climate suggests potential stabilization in the Eurozone’s leading economy, a genuine recovery might be some way off.

On another front, Dollar is seeking to extend its recent bullish run against Yen, helped by remarks from BoJ Governor Kazuo Ueda emphasizing a cautious approach. However, a pivotal challenge for the US currency will be breaking past 1.06 key resistance level when pitted against Euro. Also, Dollar remains stagnant against commodity-linked currencies, suggesting that further evidence is required to validate its buying momentum.

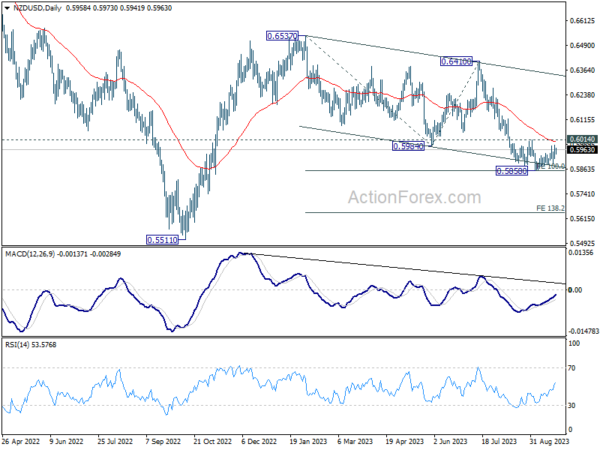

Technically, NZD/USD’s choppy recovery from 0.5858 is still extending. Near term outlook remains bearish for now, with 0.6014 resistance, as well as 55 EMA (now at 0.6004) intact. Break of 0.5858 will extend the whole fall from 0.6537 to 138.2% projection of 0.6537 to 0.5984 from 0.6410 at 0.5646. However, sustained break of 0.6014 will raise the chance that the pattern from 0.6537 has completed with three waves down to 0.5858, and bring near term reversal.

In Europe, at the time of writing, FTSE is down -0.89%. DAX is down -0.93%. CAC is down -0.85%. Germany 10-year yield is up 0.0592 at 2.801. Earlier in Asia, Nikkei rose 0.85%. Hong Kong HSI dropped -1.82%. China Shanghai SSE dropped -0.54%. Singapore Strait Times rose 0.33%. Japan 10-year JGB yield fell -0.0182 to 0.731.

Germany Ifo ticked down, but economy appears to have bottomed out

Germany’s Ifo Business Climate Index for September recorded a slight dip, moving from 85.8 to 85.7, though it outperformed expectation of 85.2. Current Assessment Index recorded a fall from 89.0 to 88.7, still surpassing forecasted 88.0. Contrastingly, Expectations Index noted an increment, shifting from 82.7 to 82.9, a touch above projected 82.8.

A sectoral breakdown revealed that manufacturing experienced a downturn from -13.8 to -16.6. Services sector witnessed a decline from a positive 1.0 to a negative score of -4.1. Additionally, trade and construction sectors marked declines, moving from -23.7 to -25.6 and from -24.6 to -29.8, respectively.

A statement from Ifo encapsulated the sentiment by saying, “pessimism regarding the coming months dissipated slightly. The German economy appears to have bottomed out.”

ECB’s de Cos and Villeroy emphasize patience and consistency

In today’s conference in Madrid, Pablo Hernandez de Cos, a member of the ECB Governing Council, emphasized the need for patience in the bank’s approach to interest rates.

De Cos pointed out, “If we keep rates at these levels long enough, there are very good chances that we will be able to reach our 2% target in a timely manner.”

De Cos added that a balanced approach was crucial “to avoid both insufficient tightening, which would impede the achievement of our inflation target, and excessive tightening, which would unnecessarily damage economic activity and employment.”

Echoing a similar sentiment, fellow Governing Council member Francois Villeroy de Galhau warned against an aggressive tightening stance. He said, “If the ECB tightens too much, the central bank could run the risk of having to rapidly reverse course.”

Villeroy de Galhau further advised against a reckless calibration of monetary policy, asserting, “‘testing until it breaks’ is not a sensible way.” Instead, he recommended a shift in focus from constantly elevating rates to maintaining a consistent policy. In his words, the emphasis should be on “duration rather than level.”

BoJ Ueda highlights shifting dynamics in Japan’s inflation drivers

BoJ Governor Kazuo Ueda, in a speech today, delineated the two forces in play regarding Japan’s inflationary pressures: “The first force, led by import prices, has seen its year-on-year rate of increase decelerate,” and he anticipates this force will “gradually wane.”

As for the second force, Ueda suggested it is tied to changes in firms’ wage and price-setting behaviors, with the potential to strengthen as “wage growth accelerates owing to economic improvement, leading to moderate inflation.”

However, he cautioned that the spread and permanence of these behaviors are uncertain, adding, “Changes have started to be seen in some aspects of firms’ wage- and price-setting behavior, but there are extremely high uncertainties as to whether these changes will become widespread.”

Addressing Japan’s broader economic outlook, Ueda described the nation as being in a “critical phase” concerning the interplay between wages and prices. Stressing the importance of fostering nascent economic shifts, he emphasized the need “to carefully nurture the buds of change in the economy.”

Ueda reiterated BoJ’s stance on monetary policy, stating the need “to patiently continue with monetary easing under the framework of yield curve control.”

USD/CHF Mid-Day Outlook

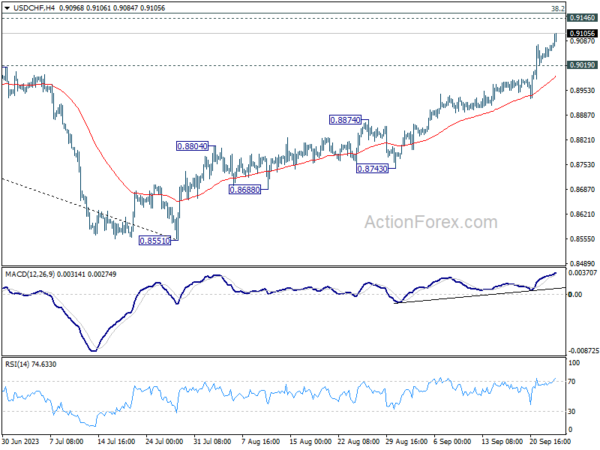

Daily Pivots: (S1) 0.9044; (P) 0.9060; (R1) 0.9086; More….

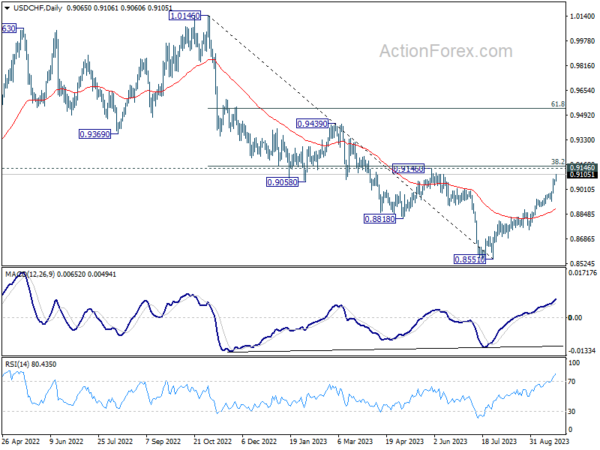

USD/CHF’s rally continues today and intraday bias stays on the upside. Current rise from 0.8551 is in progress for 0.9146/60 cluster resistance. On the downside, break of 0.9019 minor support will turn intraday bias neutral first. But further rally will remain in favor as long as 0.8874 resistance turned support holds, in case of retreat.

In the bigger picture, rebound from 0.8551 medium term bottom is currently seen as a correction to the downtrend from 1.0146 (2022 high). Further rally would be seen to 0.9146 cluster resistance (38.2% retracement of 1.0146 to 0.8551 at 0.9160). Strong resistance could be seen there to limit upside, at least on first attempt. However, decisive break of 0.9146/60 will indicate trend reversal, and target 61.8% retracement at 0.9537.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 08:00 | EUR | Germany IFO Business Climate Sep | 85.7 | 85.2 | 85.7 | 85.8 |

| 08:00 | EUR | Germany IFO Current Assessment Sep | 88.7 | 88 | 89 | |

| 08:00 | EUR | Germany IFO Expectations Sep | 82.9 | 82.8 | 82.6 | 82.7 |