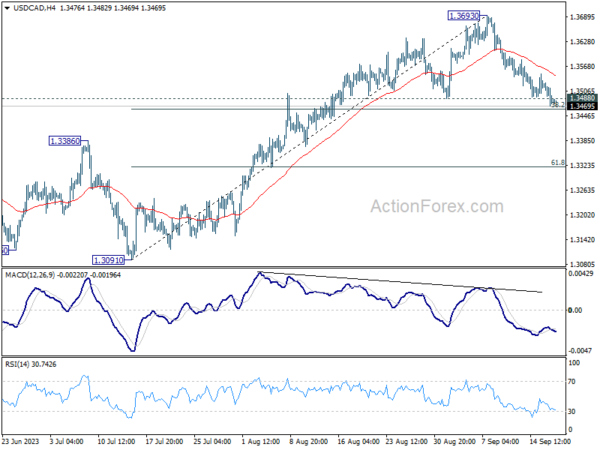

Daily Pivots: (S1) 1.3462; (P) 1.3496; (R1) 1.3519; More….

USD/CAD’s break of 1.3488 support argues that rise from 1.3091 might have completed at 1.3693. Intraday bias is mildly on the downside at this point. Sustained trading below 55 D EMA (now at 1.3467) will target 61.8% retracement of 1.3091 to 1.3693 at 1.3321, as another leg of the corrective pattern from 1.3976. Nevertheless, break of 1.3693 will revive near term bullishness for 1.3860/3876 resistance zone.

In the bigger picture, price actions from 1.3976 are viewed as a corrective pattern. Strong support from 55 D EMA (now at 1.3467) will solidify the case that it has completed with three waves down to 1.3091 already. Break of 1.3976 will target 61.8% projection of 1.2005 to 1.3976 from 1.3091 at 1.4309. However, sustained break of 55 D EMA will indicate that the pattern is extending with another falling leg before completion.