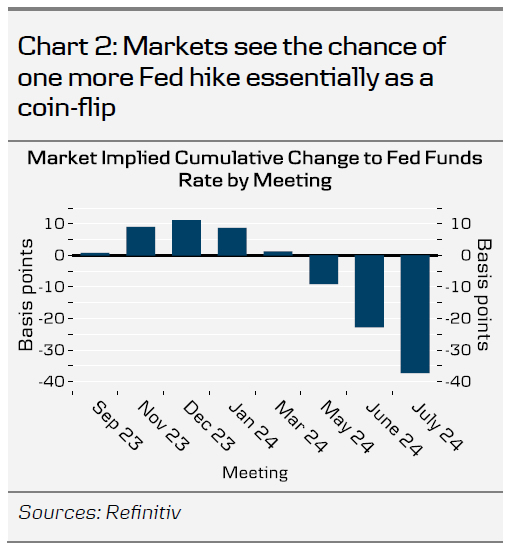

- We expect the Fed to maintain rates unchanged in the next week’s meeting, as widely anticipated in the markets.

- Markets will focus on how FOMC participants assess the need for later hikes. In June, 12 out of 18 ‘dots’ looked for one more hike, but we doubt it will materialize.

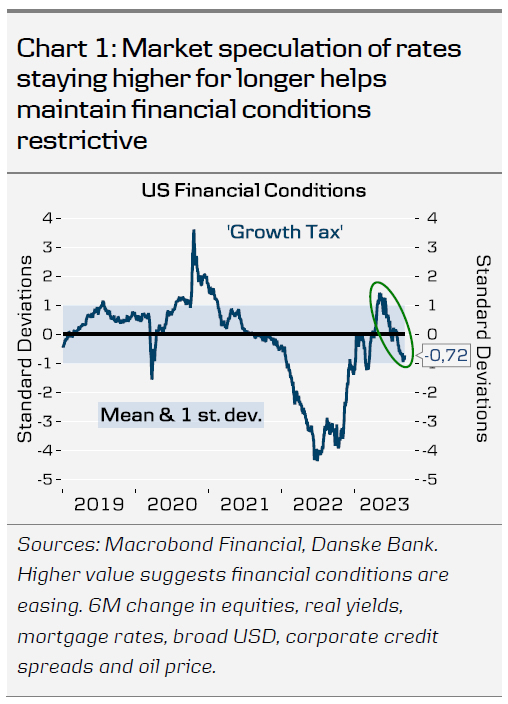

- Markets have bought into the ‘higher for longer’ narrative, and the consequent tightening in financial conditions limits the need for further hikes.

The Fed has made it clear it has the room to remain on hold for September, while keeping the door open for later hikes if needed. But the outlook beyond next week’s Wednesday is everything but clear, as Q3 GDP Nowcast estimates range from St. Louis Fed’s -0.3% all the way to Atlanta Fed’s +4.9%, with only two weeks left of the quarter. In any case, markets have bought into the Fed’s view of maintaining rates higher for longer, which is in stark contrast to the speculation seen 6M ago, when first cuts were being priced already for the next week’s meeting.

Counter-intuitively, this reduces the need for hikes going forward, as financial conditions have tightened over the summer. Our in-house ‘growth tax’ measure (Chart 1, 6M change in financial conditions), is at the most restrictive level since the collapse of SVB, not least reflecting higher mortgage rates and stronger USD, but also higher oil prices. With real yields at the highest levels since the GFC, it only makes sense that the Fed is turning more cautious on growth, even if we see no imminent signs of rapid weakening.

Market prices in around four 25bp rate cuts for 2024, which would still leave monetary policy stance fairly restrictive in real terms. And as QT continues to provide passive tightening in 2024 as well, we think the nominal policy rate has already reached a sufficiently restrictive level. Further hikes could be justified, if the underlying growth backdrop is significantly stronger than we have anticipated, for example reflecting the past fiscal support to investments (see Research US, 22 August). But for now, our baseline GDP forecasts remain on the bearish side of the spectrum, +1.9% for 2023 and +0.6% for 2024.

With little need to pre-commit to any policy action, we expect Powell to deliver a balanced message, highlighting positive development in cooling labour demand and recovering supply, but underscoring that there is still ways to go before declaring victory over inflation.

Strong realized data likely warrants an upward revision to the GDP projections, but the main focus will be on the ‘dots’, and if some of the 12 participants calling for 5.50-5.75% terminal rate have reverted their call for another hike. Leading up to the blackout, only two out of 12 voters were in favour of holding rates steady from here, while three favoured hikes at a later stage, leaving majority of the voter views still unclear.

This leaves the door open for market volatility during the meeting. We expect long treasury yields to decline gradually over the coming months as the probability of further rate hikes is being priced out, cuts (expected to start in Q1 2024) are drawing closer and weaker US inflation/growth data is dampening long term market inflation expectations. We expect the 10Y UST yield to end the year at around 4%, and see EUR/USD at 1.06/1.03 in 6/12M.