In a twist of events today, Euro takes a considerable hit following ECB’s dovish rate hike which communicated a possibly peak in the tightening cycle. The downgrading of core CPI and GDP growth forecasts for the coming years – 2024 and 2025 – further aggravates the descent. This bearish sentiment spills over to Sterling and Swiss Franc, painting a subdued picture for European majors across the board.

In a contrasting scenario, Dollar exhibits a spirited performance, leveraging off the back of a stream of encouraging economic data releases. US retail sales and PPI figures emerged strong, coupled with data pointing to a hearty employment market echoed by jobless claims report. Despite this upbeat tide, Dollar finds itself outshone slightly by Australian and Canadian dollars in the financial market space.

Aussie Dollar is seen deriving some backing from China’s decision to cut RRR, a move aiming to inject liquidity and stimulate economic activity. On another front, Canadian dollar rise on the rally observed in WTI oil, which notably surges past 90 handle.

Technically, as the greenback is rallying against European majors, the focus is on whether buying momentum could continue. In particular, EUR/USD and GBP/USD will have to sustain below 1.0685 and 1.2432 temporary lows. USD/CHF will also have to sustain above 0.8951 temporary high. Otherwise, the greenback will be back to square one.

In Europe, at the time of writing, FTSE is up 1.04%. DAX is up 0.34%. CAC is up 0.49%. Germany 10-year yield is down -0.070 at 2.584. Earlier in Asia, Nikkei rose 1.41%. Hong Kong HSI rose 0.21%. China Shanghai SSE rose 0.11%. Singapore Strait Times rose 0.95%. Japan 10-year JGB yield dropped -0.0013 to 0.709.

Dovish ECB hike, peak reached already, 2024 & 2025 core inflation and growth downgraded

ECB delivers a dovish 25bps rate hike today. The accompany statement indicated that the current tightening cycle could have reached its peak already. Also, core inflation and growth forecasts for 2024 and 2025 were revised down.

The newly set rates are as follows: main refinancing operations rate at 4.50%, marginal lending facility rate at 4.75%, and deposit facility rate at 4.00%.

ECB President cited the persistent nature of inflation being “too high for too long” as the primary motivator behind this strategy to “reinforce progress” in ushering inflation back to the target in a “timely manner”.

ECB added, “the Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target”. Future decisions will “ensure” that the interest ares are set at “sufficiently restrictive levels for as long as necessary.

In the new economic projections, inflation is forecast to be at 5.6% in 2023 (prior projection at 5.1%), 3.2% in 2024 (prior 3.0%) and 2.1% in 2025 (prior 2.3%). The upward revision for 2023 and 2024 mainly reflects a higher path for energy prices.

Core inflation is projected to average 5.1% in 2023 (unchanged), 2.9% in 2024 (prior 3.0%), and 2.2% in 2025 (prior 2.3%).

Growth is projected to be at 0.7% in 2023 (prior 0.9%), 1.0% in 2024 (prior 1.5%), and 1.5% in 2025 (prior 1.6%).

US retail sales up 0.6% mom, ex-auto sales up 0.6%, above expectations

US retail sales rose 0.6% mom to USD 697.6B in August, above expectation of 0.2% mom. Ex-auto sales rose 0.6% to USD 564.0B, above expectation of 0.4% mom. Ex-gasoline sales rose 0.2% mom to USD 642.3B. Ex-auto & gasoline sales rose 0.2% mom to USD 508.8B

In the three months through August, sales were up 2.2% yoy from the same period a year ago.

US PPI rose 0.7% mom in Aug, highest since Jun 2022

US PPI for final demand rose 0.7% mom in August, above expectation of 0.4% mom. That’s also the largest monthly increase since June 2022.

80% of the rise in PPI is attributable to the 2% mom jump in PPI goods, highest since June 2022, mostly attributable to energy prices which was up 10.5% mom. Prices for services rose 0.2% mom.

For the 12 months ended in August, PPI rose 1.6% yoy, above expectation of 1.2% yoy.

PPI less foods, energy, and trade services rose 0.3% mom. For the 12 months period, PPI less foods, energy, and trade services was up 3.0% yoy, largest annual advance since April.

Also released, initial jobless claims rose slightly from 217k to 220k in the week ending September 8, below expectation of 229k.

PBOC cuts reserve requirement ratio to release CNY 500B liquidity

People’s Bank of China slashed the Reserve Requirement Ratio for a majority of banks by 25bps today. This marks the second such reduction in this calendar year, aiming to spur liquidity in the market and support the economy. Following this adjustment, the weighted average RRR for banks will stand at 7.4%. This strategic step is slated to unleash medium to long-term liquidity exceeding CNY 500B (approximately USD 68.7B) into the financial system.

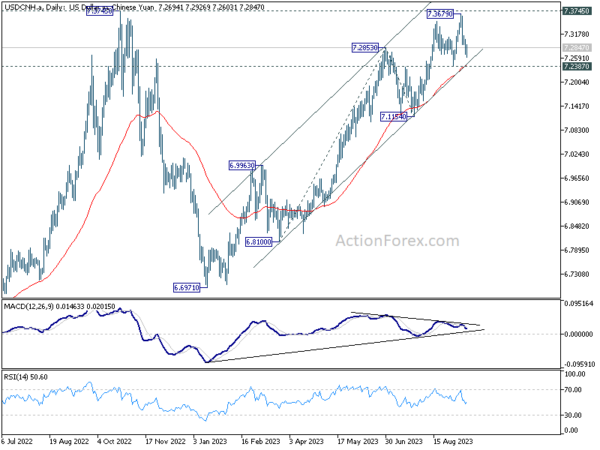

In the aftermath of this announcement, the offshore Yuan experienced a mild depreciation, fueling a recovery in the USD/CNH from its day low at 7.2603. While fall from 7.3679 could extend lower, strong support is likely at around 7.2387 to contain downside to bring rebound. Break of 7.3145 resistance will bring stronger rise back to 7.3679. But for the near term, some more range trading is likely because USD/CNH would have enough momentum to take on 7.3745 high.

UK RICS house price balance fell to 14-year low, deepening slump

In the latest sign of mounting pressures in the UK property market, RICS house price balance deteriorated notably, plummeting to -68 in August, down from -55 in the previous month. This development has surpassed the grim expectation set at -56 and marks the most unfavorable reading since February 2009.

Dissecting the UK reveals that almost every region is grappling with “relatively steep fall in house prices,” as noted by RICS.

Looking ahead, surveyors anticipate that the upcoming months will not bring any reprieve. Short-term projections illustrate a more pronounced dip, with net balance drifting deeper into negative terrain at -67%, a decline from prior figure of -60%.

Furthermore, long-term outlook remains relatively unchanged but still under a cloud, with expectations cementing around a net balance of -48%, mirroring the sentiment recorded in both June and July.

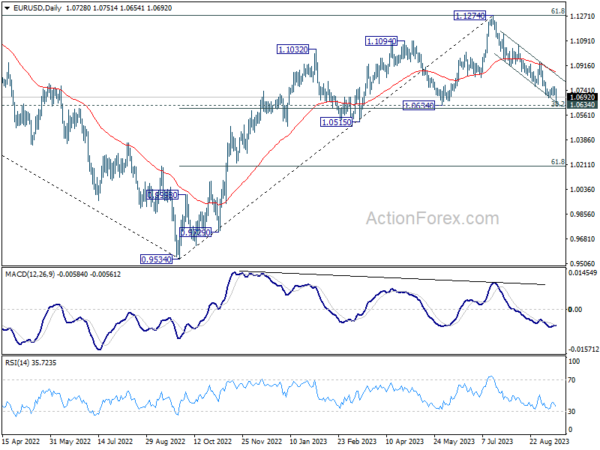

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0706; (P) 1.0735; (R1) 1.0760; More…

EUR/USD’s fall from 1.1274 resumed by breaking through 1.0685 temporary low today. Intraday bias is back on the downside for 1.0609/34 cluster support zone next. On the upside, break of 1.0767 resistance will now indicate short term bottoming, and turn bias back to the upside for stronger rebound to 1.0944 resistance next.

In the bigger picture, fall from 1.1274 medium term top is seen as a correction to up trend from 0.9534 (2022 low). Strong support could be seen from 1.0634 cluster support (38.2% retracement of 0.9534 to 1.1274 at 1.0609) to bring rebound, at least on first attempt. Break of 1.0944 will indicate the start of the second leg, and target retest of 1.1274. However, sustained break of 1.0609/0634 will raise the chance of bearish trend reversal, and target 61.8% retracement at 1.0199.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Machinery Orders M/M Jul | -1.10% | -0.70% | 2.70% | |

| 01:00 | AUD | Consumer Inflation Expectations Sep | 4.60% | 4.90% | ||

| 01:30 | AUD | Employment Change Aug | 64.9K | 24.3K | -14.6K | |

| 01:30 | AUD | Unemployment Rate Aug | 3.70% | 3.70% | 3.70% | |

| 04:30 | JPY | Industrial Production M/M Jul F | -1.80% | -2.00% | -2.00% | |

| 06:30 | CHF | Producer and Import Prices M/M Aug | -0.20% | 0.10% | -0.10% | |

| 06:30 | CHF | Producer and Import Prices Y/Y Aug | -0.80% | -0.60% | ||

| 12:15 | EUR | ECB Main Refinancing Rate | 4.50% | 4.25% | 4.25% | |

| 12:30 | CAD | Wholesale Sales M/M Jul | 0.20% | -2.00% | -2.80% | -2.10% |

| 12:30 | USD | Retail Sales M/M Aug | 0.60% | 0.20% | 0.70% | 0.50% |

| 12:30 | USD | Retail Sales ex Autos M/M Aug | 0.60% | 0.40% | 1.00% | 0.70% |

| 12:30 | USD | PPI M/M Aug | 0.70% | 0.40% | 0.30% | 0.40% |

| 12:30 | USD | PPI Y/Y Aug | 1.60% | 1.20% | 0.80% | |

| 12:30 | USD | PPI Core M/M Aug | 0.60% | 0.20% | 0.30% | 0.50% |

| 12:30 | USD | PPI Core Y/Y Aug | 2.20% | 2.20% | 2.40% | |

| 12:30 | USD | Initial Jobless Claims (Sep 8) | 220K | 229K | 216K | 217K |

| 12:45 | EUR | ECB Press Conference | ||||

| 14:00 | USD | Business Inventories Jul | 0.10% | 0.00% | ||

| 14:30 | USD | Natural Gas Storage | 51B | 33B |