- NZDUSD hovers near 10-month low

- A close above 20-day SMA needed

- Hopes for upside reversal remain

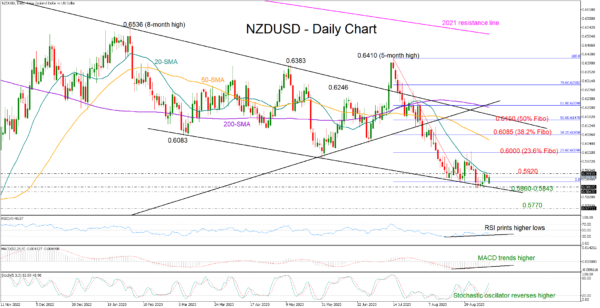

NZDUSD is unable to go beyond its 20-day simple moving average (SMA) even after persistently attempting to rebound around the falling support line from March 2023.

The pair registered a ten-month low of 0.5884 last week, but there is some growing optimism that the bulls may take the lead soon. The RSI seems to be trending against the market, creating higher lows below its 50 neutral mark. Likewise, the stochastic oscillator has changed course to the upside, while the MACD is recovering within the negative zone and above its red signal line.

Nevertheless, buyers would like to see a close above the 20-day SMA at 0.5920 before lifting the price straight up to the 0.6000 psychological mark. This is where the 23.6% Fibonacci retracement of the ongoing downtrend is placed. Hence, a clear move higher could add more fuel to the price, bringing the 50-day SMA next into view at 0.6060. If the 38.2% Fibonacci mark of 0.6085 gives way too, the rally could pick up steam towards the 50% Fibonacci of 0.6150, where the descending trendline stretched from the 2022 top is placed.

If the bears step below the support line and the 0.5860-0.5840 area, the downtrend could gain another leg to 0.5770. A move lower could retest the November 2022 low of 0.5739 ahead of the crucial 2020 base of 0.5670.

All in all, despite its negative trajectory, NZDUSD keeps trading around an important support trendline, maintaining hopes for an upside reversal.