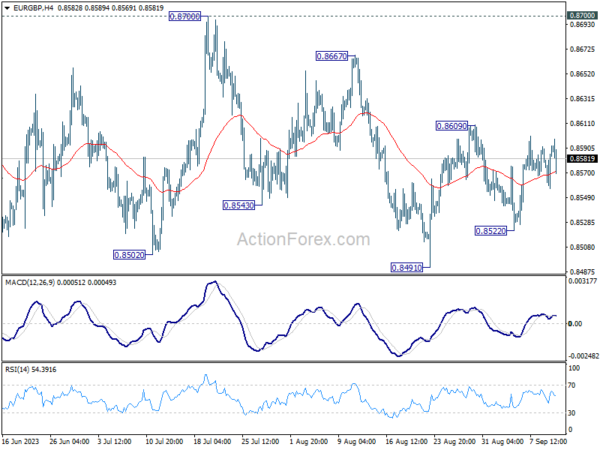

Daily Pivots: (S1) 0.8570; (P) 0.8582; (R1) 0.8606; More…

Sideway trading continues in EUR/GBP and intraday bias remains neutral. Current rise from 0.8941 could be the third leg of the corrective pattern from 0.8502. On the upside, above 0.8609 would resume the rebound and target 0.8667 resistance, possibly further to 0.8700. On the downside, however, break of 0.8522 will bring retest of 0.8491 low.

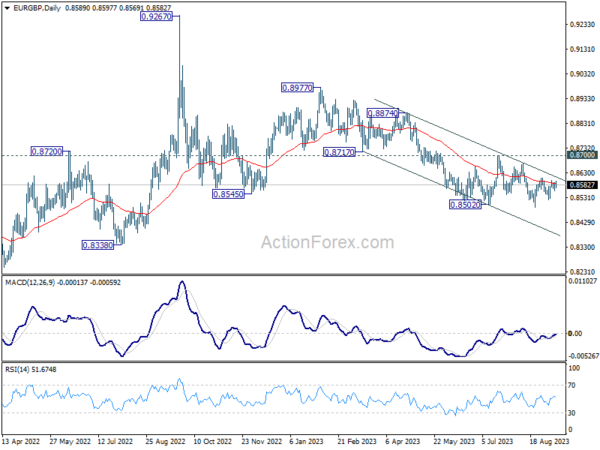

In the bigger picture, the down trend from 0.9267 (2022 high) is seen as part of the long term range pattern from 0.9499 (2020 high). Fall from 0.8977 is seen as the third leg. As long as 0.8700 resistance holds, further decline is still expected. Break of 0.8491 will resume the fall towards 0.8201 (2022 low). Nevertheless, firm break of 0.8700 will now be a sign of bullish reversal.