- Important data releases coming up as the market is looking ahead to next week’s key events

- Average earnings figures are expected to remain elevated, sounding an alarm at the BoE halls

- The main part of this week’s data will be released on Tuesday (06:00 GMT)

The Bank of England prepares for next week’s meeting

Central banks have put the summer break behind them and are preparing for a frantic period ahead. The BoE is hosting its meeting next week, on September 21, a day after the Fed’s respective meeting. In the meantime, central bankers continue to evaluate Fed Chairman Powell’s message at the Jackson Hole gathering and strategize their own monetary policy actions after a very strong rate hiking cycle.

The BoE is making dovish noises again, but this looks like an attempt to control the ballooning market expectations. In particular, market participants assign a 75% probability for a 25bps rate hike at next week’s gathering and a decent 35% probability for similarly sized move at the November meeting. With inflation still elevated – the highest among the key developed economies – there is little leeway for BoE members not to react, especially considering the fact that the core inflation indicator – excluding energy, food, alcohol and tobacco – remains just 0.2% below its May 2023 peak. The market is anxious for some further comments this week, starting with Mann on Monday, just ahead of the usual blackout period.

Busy calendar; Average earnings data stand out

Ahead of the crucial BoE meeting though, we have a plethora of economic data releases scheduled. On Tuesday, we will get employment data and crucial information on average earnings for the month of July. In terms of the former, unemployment is expected to record another small increase, rising to 4.3%, the highest level since October 2011.

Since unemployment is a lagging indicator, the market is expected to be all over the average earnings data. As noted last month, the June print marked the first time that the annual rate of earnings surpassed the annual inflation rate. This means that since November 2011 the real disposable income for UK citizens has been negative, gravely affecting consumer sentiment.

Another strong print on Tuesday morning would prove helpful for consumers amidst the current cost-of-life crisis but the BoE members are unlikely to be as happy. The continued higher earnings prints substantially increase the possibility of second and third round effects manifesting as the higher inflation rate could become part of the public’s mindset. The latter was mentioned in the August 3 meeting’s minutes and will most likely be a part of the discussion at the next meeting.

Production data painting a brighter picture but the housing sector is feeling the pain

Amidst the current muted growth environment, the recent industrial and manufacturing production data have been improving. Both indicators managed to record their first annual positive prints since June 2022. On Wednesday, the July 2023 figures will be published and are expected to show further improvement, increasing the possibility for a strong GDP print for the third quarter of 2023.

On the flip side, the housing sector is feeling the impact of the higher mortgage rates. Mortgage approvals have dropped considerably with the actual lending figures tumbling. House prices are recording negative annual moves, for example the most recent Halifax house price index showed a 4.6% annual drop for the month of August. Consequently, the RICS house price index is expected to dive even further to negative territory.

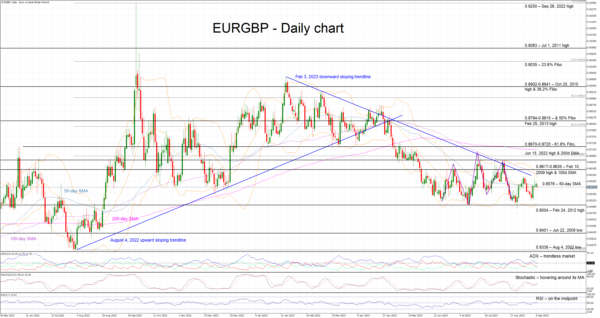

Euro-pound close to 2023 lows

Contrary to the US dollar, the pound has failed to record any gains against the euro over the past 40 days. However, this pair continues to hover at the lower end of its 2023 trading range with the market appearing to be in waiting mode. A positive set of data this week, especially strong average earnings figures, would most likely confirm the strong rate hike expectations. Consequently, the pound could get the necessary boost to record a new 2023 below the key 0.8504 level.