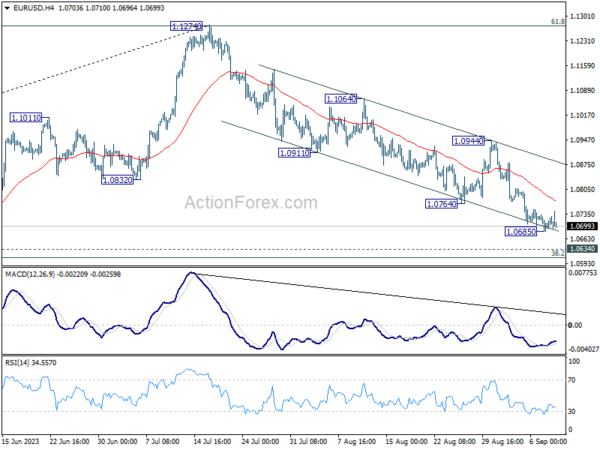

EUR/USD’s decline from 1.1274 resumed last week and hit as low as 1.0685. As a temporary low was formed, initial bias stays neutral this week for consolidations first. But outlook will remain bearish as long as 1.0944 resistance holds. Below 1.0685 will target 1.0609/34 cluster support zone next.

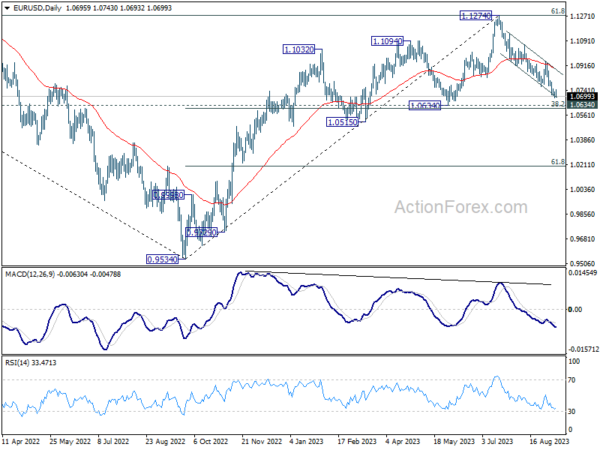

In the bigger picture, fall from 1.1274 medium term top is seen as a correction to up trend from 0.9534 (2022 low). Strong support could be seen from 1.0634 cluster support (38.2% retracement of 0.9534 to 1.1274 at 1.0609) to bring rebound, at least on first attempt. Break of 1.0944 will indicate the start of the second leg, and target retest of 1.1274. However, sustained break of 1.0609/0634 will raise the chance of bearish trend reversal, and target 61.8% retracement at 1.0199.

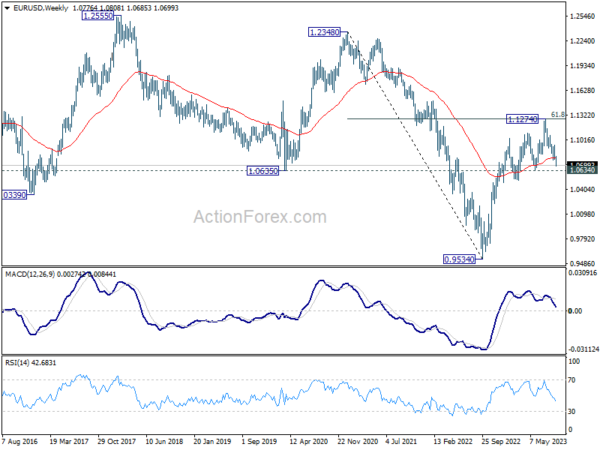

In the long term picture, focus stays on 55 M EMA (now at 1.1124). Rejection by this EMA will revive long term bearishness for resuming the down trend form 1.6039 (2008 high). However, sustained break above there will affirm the case of long term bullish reversal and target 1.2348 resistance for confirmation.