The U.S. Federal Reserve will be on the lookout for signs that broader inflation trends continued to slow down in August—even as energy prices spiked. We expect headline CPI to tick up to 3.6% year-over-year in August, up from 3.2% in July. This increase is almost entirely explained by higher global energy prices. Gasoline prices rose more than 10% month-over-month (on a seasonally adjusted basis) between July in August. And energy prices as a whole likely reported their steepest month-over-month growth since mid-2022.

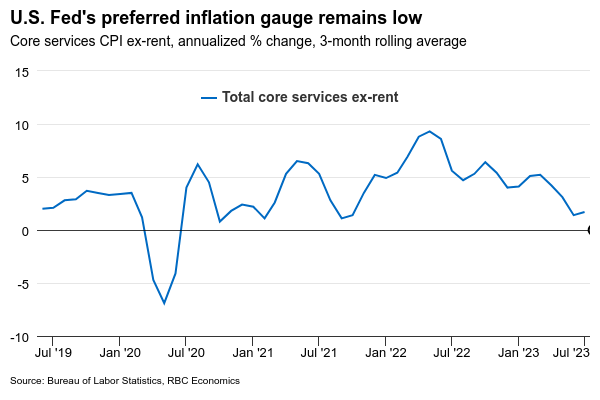

Aside from energy, U.S. price pressures have eased substantially in recent months. Food price growth has moderated sharply and we look for ‘core’ (ex-food & energy) price growth to slow to 4.3% year-over-year in August from 4.7% the month before. That will drop the measure further below a 6.6% peak in September last year. Month-over-month increases in the Fed’s preferred “supercore” measure (CPI services excluding rent) have been running below a 2% annualized rate for the last four months. But inflation pressures won’t stay that low if surging economic growth data and firm labour markets don’t show further signs of softness. But the economic backdrop abroad is slowing, job openings and quit rates continue to decline, and ‘excess’ savings that cushioned households from the blow of higher prices and interest rates are now largely depleted. We continue to look for U.S. economic growth to soften in the coming months—preventing a re-acceleration of broader inflation pressures.

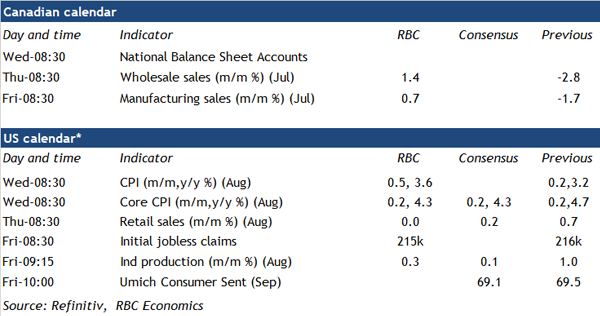

- According to StatCan’s advance estimates for July, “core” wholesale sales rose by 1.4%, higher motor vehicle and parts sales (+5.8%) contributed to this, offsetting lower sales in machinery, equipment and supplies.

- Manufacturing sales ticked up 0.7% in July according to the flash estimate, primarily driven by petroleum and coal product, food, and primary metal subsectors. Industrial prices in the manufacturing sector rose more than that (seasonally adjusted) in July, suggesting that sales declined excluding price impacts.

- U.S. retail sales likely remain unchanged in August, following a 0.7% uptick in the prior month. This expected slowdown in growth is mainly due to a 4.5% decline in unit auto sales in August. Excluding autos, we expect sales edged up by 0.3% although largely due to a price-related increase in sales at gas stations.

- We expect that U.S. industrial production inched up 0.3% in August, decelerating from a 1% increase in July. Most of this growth was drive by the manufacturing sector, where hours worked rose.

- Canadian household net wealth likely rose in Q2 with an increase in house prices and stronger equity markets pushing asset values up more than debt levels. A surge in household disposable incomes in Q2 likely pushed the debt-to-income ratio lower and left the debt servicing ratio little-changed despite further increases in debt payments. Signs that labour markets softened into Q3 mean that positive income boost is unlikely to be repeated in the near-term.